Post Holdings' (POST) Acquisition & Pricing Strategy Aids

Post Holdings, Inc. POST is expanding its business through strategic acquisitions. One such acquisition was the purchase of select pet food brands from The J.M. Smucker Co. This acquisition will provide Post Holdings with a compelling entry point into the attractive and growing pet food category. This move is expected to diversify the company's product portfolio and create opportunities for growth in the pet food industry, which is known for its dynamism and growth potential.

Additionally, the company has undertaken various acquisitions over time that have strengthened its product base and have been accretive to its performance. Some of the notable acquisitions in the past few years are Lacka Foods Limited, Almark, Conagra’s Peter Pan peanut butter brand, Hungry Planet, Henningsen Foods Inc. and Bob Evans.

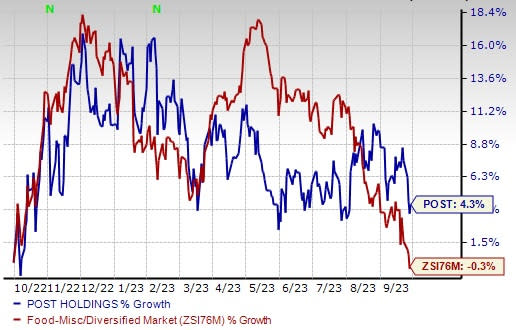

Image Source: Zacks Investment Research

What Else Should You Know?

Post Holdings has been using pricing actions effectively to combat rising input and freight costs. This pricing strategy has contributed to the company's positive third-quarter fiscal 2023 results. Adjusted earnings from continuing operations per share significantly increased year over year, from 69 cents to $1.52 per share. Total sales reached $1,859.4 million, reflecting a substantial 21.9% year-over-year rise.

Post Holdings has experienced sales growth across various segments, including Post Consumer Brands, Weetabix, and Foodservice, in the fiscal third quarter. Notably, the Post Consumer Brands segment demonstrated substantial sales growth, driven in part by its Pet Food division.

The Post Consumer Brands segment achieved remarkable sales growth of 51.6% year-over-year in the fiscal third quarter, reaching $871.3 million, including contributions from its Pet Food division. The Foodservice segment witnessed 7.5% year-over-year sales growth, driven by higher demand for away-from-home egg and potato products. The Weetabix segment's sales rose 7.4% year over year.

High SG&A Cost Hurdles

While the company is experiencing growth in various aspects of its business, it is facing challenges related to rising selling, general, and administrative (SG&A) expenses. SG&A costs increased 33.7% year over year in the third quarter of fiscal 2023. As a percentage of sales, SG&A costs increased 140 bps to 16.2%. The higher SG&A expense trend is a potential concern as it may impact the company's profitability and overall financial performance if not managed effectively.

Share Price Movement & Estimates

Shares of this Zacks Rank #3 (Hold) company have gained 4.3% in the past year against the industry’s decline of 0.3%.

The Zacks Consensus Estimate for the current and next fiscal years’s earnings has been unchanged at $4.86 and $5.05, respectively, over the past 30 days, indicating respective year-over-year increases of 189.3% and 3.8%.

Stocks to Consider

We have highlighted three better-ranked stocks, namely MGP Ingredients, Inc. MGPI, Celsius Holdings CELH and Flowers Foods FLO.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and EPS suggests growth of 5.8% and 10.4%, respectively, from the year-ago reported figures. MGPI has a trailing four-quarter earnings surprise of around 18%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently flaunts a Zacks Rank #1. CELH delivered an earnings surprise of 100% in the second quarter of 2023.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 170.7%, respectively, from the year-ago reported numbers.

Flowers Foods emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Flowers Foods’s current financial-year sales suggests growth of 6.7% from the year-ago reported figure. FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report