Post Holdings (POST) Ups Adjusted EBITDA View on Latest Buyout

Post Holdings, Inc.’s POST acquisitions have been contributing positively to the company’s results. This consumer-packaged goods holding company has updated its adjusted EBITDA guidance for fiscal 2024, which includes 10 months of contribution from its recently concluded buyout of Perfection Pet Foods, LLC.

Management expects adjusted EBITDA in the range of $1,220-$1,280 million for fiscal 2024 compared with the $1,200-$1,260 million range guided on the fourth quarter of fiscal 2023 earnings release. In fiscal 2023, the company’s adjusted EBITDA came in at $1,233.4 million.

Perfection Foods Fuels Acquisition Spree

Post Holdings concluded the acquisition of Perfection Pet Foods on Dec 1, 2023. Perfection Pet Foods is a major producer and packager of private-label and co-manufactured pet food and baked treat products. This acquisition includes two manufacturing facilities in Visalia, CA, which will most likely enhance POST's manufacturing capacity, enabling it to insource a portion of its current pet food business. It also provides the company with an entry point into the private label and co-manufacturing pet food category.

This strategic move aligns with Post Holdings' wider objectives in the pet food industry. This was also demonstrated by the company’s previous acquisition of various pet food brands and the private-label pet food business from The J.M. Smucker Co. in April 2023. These acquisitions help diversify the company's product portfolio and create growth opportunities in the pet food industry. Notably, the company’s fourth-quarter sales included $404.5 million from its latest Pet Food acquisition.

Image Source: Zacks Investment Research

Post Holdings has undertaken various acquisitions over time that have strengthened its product base and have been accretive to its performance. Some notable acquisitions in the past few years include Lacka Foods Limited (April 2022), which is a U.K.-based marketer of UFIT high-protein shakes. In June 2021 and February 2021, the company acquired TreeHouse Foods' RTE Cereal Business and Almark Foods, respectively. In the same year, it purchased the Peter Pan peanut butter brand and partnered with plant-based meat company Hungry Planet.

What’s More?

The Zacks Rank #3 (Hold) company has been benefiting from effective pricing actions, as seen in the fourth quarter of fiscal 2023. Quarterly sales and earnings improved year over year, and the bottom line surpassed the Zacks Consensus Estimate. Results reflected gains from pricing actions in most segments to counter inflation. However, cost inflation has been moderating.

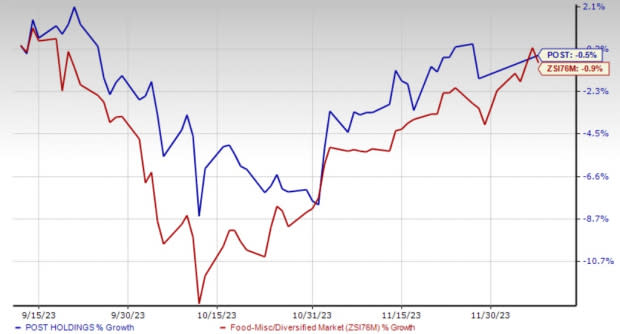

Shares of the company have lost 0.5% in the past three months compared with the industry’s decline of 0.9%.

3 Appetizing Picks

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 9.9%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and earnings suggests growth of 1.1% and 6.5%, respectively, from the year-ago reported numbers.

Celsius Holdings, Inc. CELH, which develops, processes, markets, distributes and sells functional drinks and liquid supplements, presently holds a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 110.9%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 98.5% and 184.1%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report