Posthaste: How Canada's auto theft crisis is costing you big money

Auto theft has become such a problem in Canada that Ottawa has called a national summit to find solutions.

According to the Insurance Bureau of Canada, more than 80,000 vehicles were stolen in this country over the past year. In Ontario, one of the nation’s hotspots for the crime, auto theft claims were up 329 per cent in the first half of 2023, adding up to more than $700 million in losses.

Meanwhile, the cost of insurance just keeps going up.

Auto insurance premiums rose nearly 6 per cent in 2023 and are set to rise again in 2024, says a report by online comparison site Ratesdotca. The Financial Services Authority of Ontario recently posted approved rate increases for insurers ranging up to 25 per cent to take effect in the first quarter of this year.

The federal government believes transnational organized crime is involved in the export of stolen vehicles from Canada, most of which are destined for Africa and the Middle East. Street gangs often carry out the thefts, and police in the Greater Toronto Area have seen a massive surge in carjackings.

The crime wave has driven up comprehensive insurance premiums for commonly stolen vehicles between 25 per cent and 50 per cent over the past two years, said Ratesdotca, which calls auto theft a “national crisis.”

Furthermore, Ontarians are paying more than $1.9 billion to cover the costs of these thefts, according to the insurance bureau. It estimates auto theft costs every driver in Ontario an average of $130 a year.

Insurance companies have also put a $500 surcharge on high-risk vehicles which include Honda CR-V, Ford F-Series, and Dodge Ram 1500 Series, but customers can avoid this by installing an anti-theft device, such as a Tag anti-theft system or wheel lock, said the report.

Équité Association, a non-profit organization, publishes a list of the top 10 most stolen vehicles in Canada, if you care to check it out before you buy. If you are looking for a car that hardly anyone steals try the Chevrolet Volt or Kia Niro.

Auto theft, however, isn’t the only thing driving up insurance costs. Inflation and continuing parts shortages have also contributed, says Ratesdotca.

Global supply chains have improved since the pandemic, but two years later disruptions are still delaying shipments of auto parts. Attacks on freight ships in the Red Sea recently halted production at Volvo Group and Tesla Inc factories in Europe.

Inflation has also played its part, pushing up the costs of parts, maintenance and repairs by almost 6 per cent over the past year, said Ratesdotca. Technological advances such as rearview cameras and sensors are also making repairs more expensive.

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

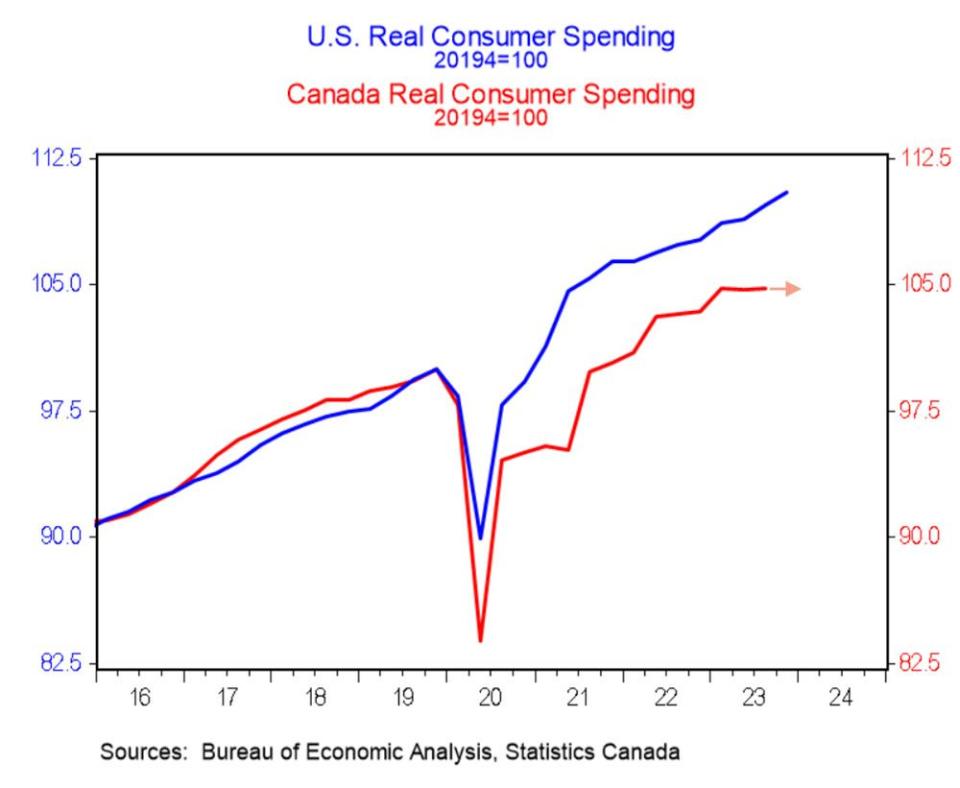

For an idea of the diverging fortunes of Canadians and our neighbours to the south look no further than this chart, from BMO senior economist Priscilla Thiagamoorthy.

Last week we learned that the American economy expanded by 3.3 per cent annualized in the fourth quarter, making six quarters in a row when growth was 2 per cent or better.

Normally, when America is doing well, Canada follows suit. Yet as the chart shows consumer spending in the United States rose 2.8 per cent in the last quarter, while Canadians “remain under severe pressure.”

One key reason for this is 30-year fixed-rate mortgages in the U.S. Locked into low rates, many homeowners are not facing the daunting mortgage renewal cliff Canadians are.

With more mortgage renewals to come and record-high household debt, consumer spending in Canada will continue to sink this year and weigh on growth, said Thiagamoorthy.

Federal Reserve begins its meeting on interest rates today. The Fed has kept its target rate between 5.25 and 5.5 per cent since July and economists expect it will continue to hold the rate when its decision is announced Wednesday.

Today’s Data: S&P/Case-Shiller Home Price Index for November, United States Conference Board consumer confidence Index and U.S. job openings and labour turnover study

Earnings: Algoma Steel Group Inc, CAE Inc, Metro Inc, Canadian Pacific Kansas City Ltd., Electronic Arts Inc, Microsoft Corp, Alphabet Inc, Starbucks Corp, Pfizer Inc.

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

Student caps may slow rent growth, but won’t solve housing woes, say economists

Leon’s Furniture plans to unlock ‘massive’ real estate value by building 4,000 homes in Toronto

Walmart store managers could soon be making more than $400,000 a year

It’s great when you pick a small-cap company that nobody has ever heard of and then it becomes the next greatest thing. Veteran investor Peter Hodson gives us some reasons why such stocks are ones to investigate.

* * *

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.