Potential 300% Upside: Uncovering Medifast's Investment Opportunity

High returns on capital typically generate substantial value for long-term investors over extended periods. Businesses yielding high returns often command premium valuations in the market. Nevertheless, it is common for any business to face temporary challenges, leading to significant price reductions. This situation often results in more affordable valuations than these businesses usually command, opening up opportunities for long-term investors. This scenario is exemplified by Medifast Inc. (NYSE:MED), a company manufacturing and distributing weight loss, weight management and nutritional products.

Over the past decade, the stock has witnessed significant growth, rising from $25.80 in January 2014 to $296 in May 2021 before adjusting to around $75. Considering its robust profitability, strong balance sheet and currently appealing valuation, Medifast presents itself as a promising option for long-term investment.

Global distribution through coaching

Medifast offers weight management solutions primarily through its meal replacement products, with Optavia being its flagship product. The most intensive of these programs is the 5&1 plan, where consumers are encouraged to consume five Medifast meals and one regular meal daily, as the company recommends. A distinctive aspect of Medifast's business model is its unique multi-level marketing approach centered around a coaching system. The products are distributed globally by trained coaches who assist customers on their weight loss journey. These coaches earn money through product sales without the obligation to hold any inventory. This approach marks a significant difference from Herbalife's (NYSE:HLF) model, where distributors must maintain inventory and resell products at a premium. In contrast, Medifast's coaches can operate without the need to manage stock, focusing solely on customer support and sales.

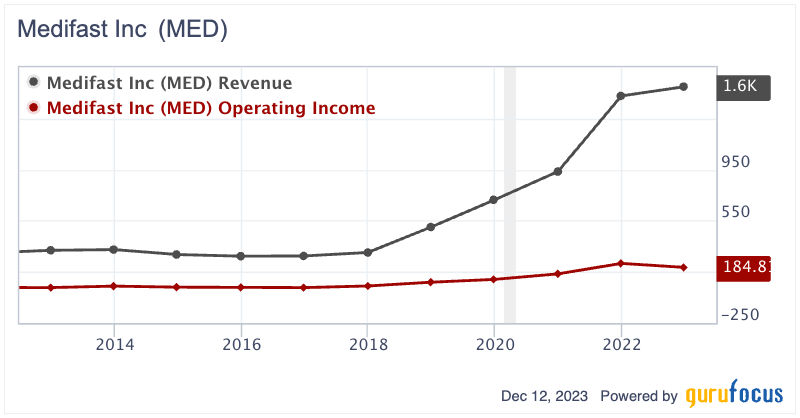

A decade of impressive revenue and income growth

The company has demonstrated impressive growth in revenue and operating income since 2012. Its revenue escalated from $319 million in 2012 to about $1.6 billion in 2022, marking a compounded annual growth rate of 17.5%. Concurrently, its operating income also increased significantly, climbing from $27 million in 2012 to a peak of $216 million in 2021, before slightly decreasing to $185 million in 2022. This growth in operating income from $27 million to $185 million over a decade represents a compounded annual growth rate of 21.2%.

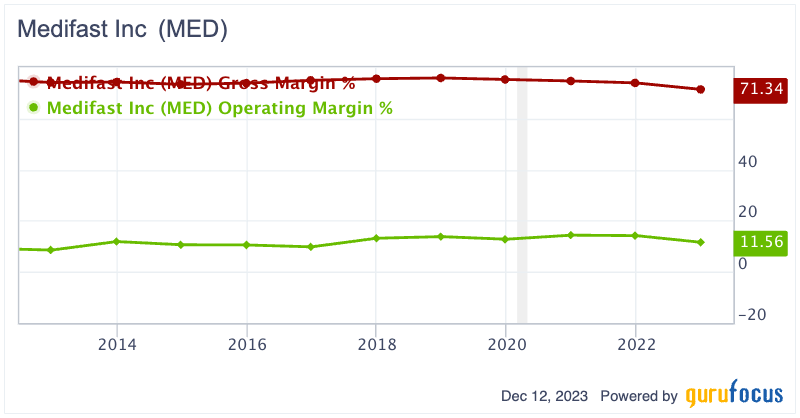

Medifast has maintained a notably high gross margin, consistently ranging between 71.3% and 74.3%, while its operating margin has shown more variation, fluctuating between 8.5% and 14.4%. In 2022, the operating margin decreased from 14.2% to 11.6%, accompanying a slight decrease in operating income. This reduction in operating margin and income can be attributed to increased selling, general and administrative expenses. These elevated costs included higher development expenses for new products, contributions to support Ukraine relief efforts, increased coach compensation and elevated credit card fees.

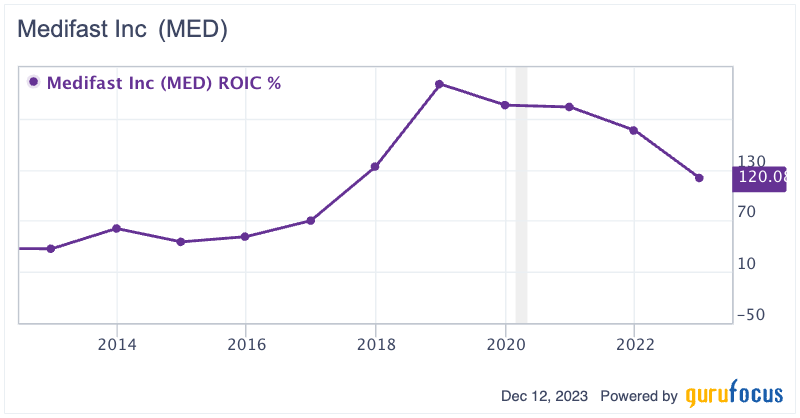

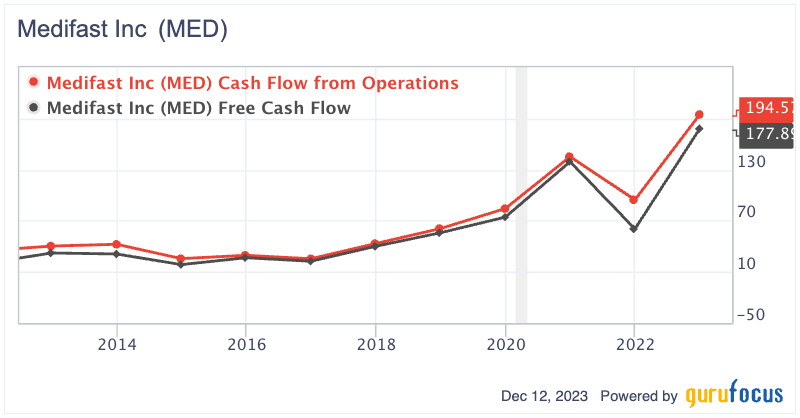

Impressive ROIC and cash flow

Investors will likely be impressed by Medifast's consistently high return on invested capital, which has remained notably robust over the years. From 2012 to 2016, the company's ROIC escalated from 37% to 70%. This upward trajectory continued from 2017 to 2022, with the ROIC consistently reaching triple-digit figures. It peaked impressively at 230% in 2018 and then stabilized at 120% in 2022. Even if the ROIC were to revert to the 37% seen in 2012, Medifast would still be considered a highly profitable business.

Over the past decade, Medifast has successfully translated its profits into substantial cash flow growth. From 2012 to 2022, the company saw a remarkable increase in operating and free cash flow. Specifically, the operating cash flow surged from $40 million to $195 million, while free cash flow rose from $32 million to $178 million over the same period. Free cash flow's annual compounded growth was as high as 18.7% in a decade. This consistent growth in cash flow highlights Medifast's strong financial performance and efficient operations.

Zero debt

Adding to the appeal for investors is Medifast's debt-free balance sheet, which indicates a company operating without leverage. As of September, the total stockholders' equity stood at $193 million. Further, the company's financial strength is underscored by its substantial liquidity, with cash and cash equivalents totaling $112.8 million and investment securities valued at $45 million. This strong financial position not only makes Medifast an interesting investment, but also offers a sense of security to investors.

Significant potential upside

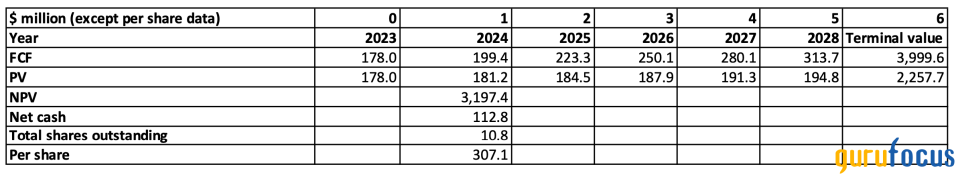

Let's assume that for the next five years, Medifast's free cash flow grows at a rate of 12% per year, followed by a terminal growth rate of 2% per year thereafter. If we apply a discount rate of 10% to this projection, the stock's valuation would be close to $3.2 billion. Adding back the company's net cash position of $112.8 million brings the total valuation to around $3.31 billion. Given that Medifast has 10.8 million outstanding shares, this calculation suggests the company's share price should be approximately $300. This valuation is about four times higher than its current share price, indicating significant potential upside for the stock.

Source: Author's table

Key takeaway

Medifast's unique combination of rapid revenue and profit expansion, a solid financial foundation free of debt and a currently underestimated market valuation with a 300% potential upside positions it not just as a robust player in the wellness industry, but also as a potentially lucrative investment.

This article first appeared on GuruFocus.