Powell Industries Inc (POWL) Reports Substantial Growth in Q1 Fiscal 2024

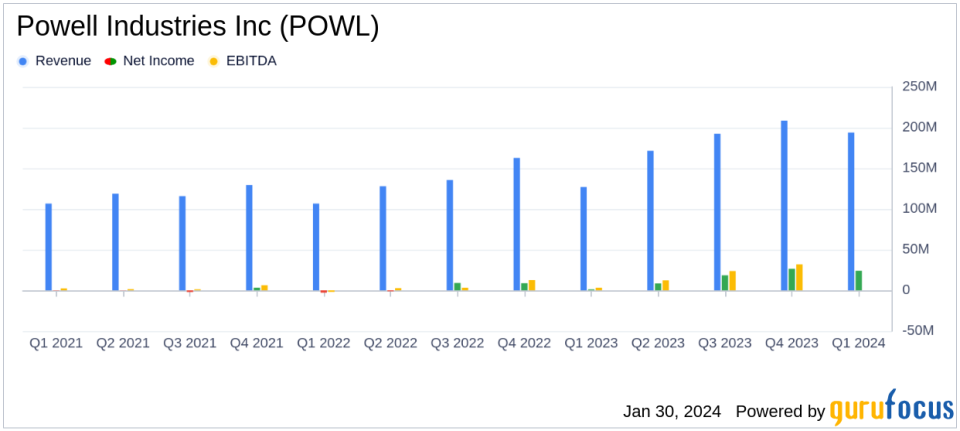

Revenue: Increased by 53% to $194 million in Q1 Fiscal 2024.

Gross Profit: Improved to $48 million, or 24.8% of revenue, up 950 basis points.

Net Income: Grew significantly to $24 million, or $1.98 per diluted share.

New Orders: Amounted to $198 million, indicating robust demand.

Backlog: Nearly doubled to $1.3 billion, showcasing future revenue potential.

Cash Position: Strong liquidity with $355 million in cash and short-term investments.

Dividend: Announced a 1% increase to the common stock dividend, reflecting confidence in financial stability.

Powell Industries Inc (NASDAQ:POWL), a prominent supplier of custom-engineered solutions for electrical energy management, control, and distribution, released its 8-K filing on January 30, 2024, detailing a robust start to Fiscal 2024 with its first-quarter results ended December 31, 2023. The company, which primarily serves large industrial markets such as oil and gas, utilities, and petrochemical plants, has reported significant year-over-year growth in revenue, net income, and backlog, indicating a strong market demand for its products and services.

Financial Performance Highlights

Powell Industries' first-quarter revenue soared to $194 million, a 53% increase from the previous year, driven by strong growth across multiple sectors including Petrochemical, Oil and Gas, Utility, and Commercial and Other Industrial sectors. This impressive top-line growth is a testament to the company's robust market presence and diversified customer base.

The company's gross profit margin saw a substantial improvement, reaching 24.8% of revenue, which translates to a 950 basis point increase compared to the same quarter last year. This margin expansion reflects Powell's efficient project execution and operational efficiencies.

Net income for the quarter was reported at $24 million, or $1.98 per diluted share, a significant leap from the $1.2 million, or $0.10 per diluted share, recorded in the first quarter of Fiscal 2023. This remarkable growth in profitability underscores the company's ability to capitalize on higher revenue while managing costs effectively.

Strategic Position and Outlook

Chairman and CEO Brett A. Cope highlighted the continuation of strong trends from the previous quarter, with new orders totaling $198 million, a 15% sequential increase. The nearly doubled backlog of $1.3 billion positions Powell Industries well for sustained growth and reflects the company's successful market strategies and the ongoing demand for its specialized products.

"Our capacity expansion initiatives continue to progress as planned, which will facilitate our growth across most of the markets we serve. Overall, we remain encouraged by our first fiscal quarter results and the current activity level across most of our markets, which supports our expectation of another strong fiscal year for Powell," said Cope.

Chief Financial Officer Michael Metcalf expressed optimism for the remainder of Fiscal 2024, citing the quality and size of the backlog and the company's confidence in sustaining solid financial results. The board's approval of a dividend increase further demonstrates Powell's commitment to shareholder returns and prudent capital management.

Balance Sheet and Cash Flow

The company's balance sheet remains robust with $355 million in cash and short-term investments, providing ample liquidity to support working capital requirements and growth initiatives. Capital expenditures and dividends paid during the quarter reflect the company's ongoing investments in its business and its commitment to returning value to shareholders.

In conclusion, Powell Industries Inc (NASDAQ:POWL) has started Fiscal 2024 on a strong note, with significant increases in revenue and net income, a nearly doubled backlog, and a solid cash position. The company's strategic initiatives and market presence bode well for its future performance, making it a noteworthy company for value investors to consider.

For more detailed information and to participate in the upcoming conference call, investors and analysts are encouraged to visit powellind.com.

Explore the complete 8-K earnings release (here) from Powell Industries Inc for further details.

This article first appeared on GuruFocus.