Power Integrations Inc (POWI) Faces Revenue Decline in Q4 and Full-Year Earnings Report

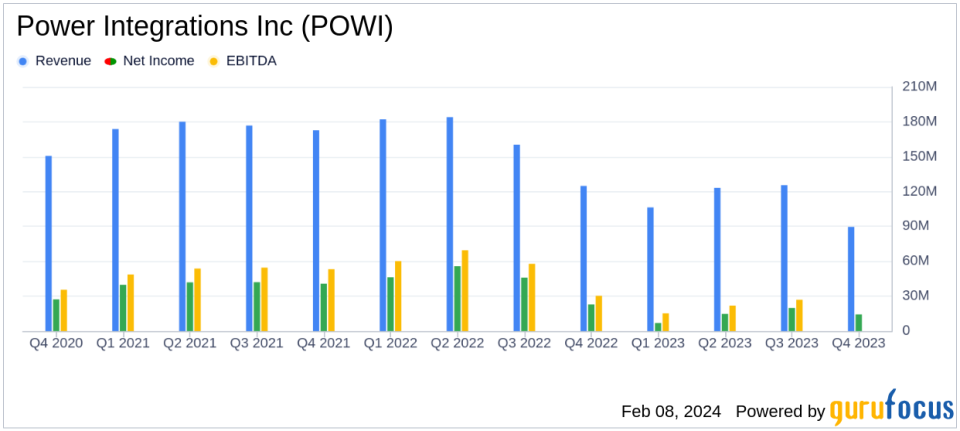

Quarterly Revenue: Q4 revenue fell to $89.5 million, a 29% decrease from the previous quarter and a 28% decrease year-over-year.

Annual Revenue: Full-year revenue declined to $444.5 million from $651.1 million in the previous year.

Net Income: GAAP net income for Q4 was $14.3 million, with full-year GAAP net income at $55.7 million.

Earnings Per Share: Q4 GAAP earnings were $0.25 per diluted share, with non-GAAP earnings at $0.22 per diluted share.

Share Repurchases: The company repurchased 680 thousand shares for $47 million in Q4.

Dividends: A dividend of $0.20 per share was paid on December 29, 2023, with another scheduled for March 29, 2024.

Financial Outlook: Revenue for Q1 2024 is projected to be around $90 million, with a GAAP gross margin of approximately 51.5%.

On February 8, 2024, Power Integrations Inc (NASDAQ:POWI) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, known for its innovative semiconductor technologies for high-voltage power conversion, faced a challenging quarter with significant declines in revenue and earnings per share compared to both the previous quarter and the same period last year.

Financial Performance and Challenges

Power Integrations reported a steep decline in quarterly revenues to $89.5 million, a 29% decrease from the prior quarter and a 28% year-over-year drop. The full-year revenue also saw a substantial fall to $444.5 million from $651.1 million in the previous year. GAAP net income for the fourth quarter was $14.3 million, translating to $0.25 per diluted share, a decrease from $0.34 in the prior quarter and $0.40 in the fourth quarter of 2022. The full-year GAAP net income stood at $55.7 million, or $0.97 per diluted share, compared to $2.93 per diluted share in the prior year.

Despite the revenue and earnings decline, the company maintained a healthy cash flow from operations, amounting to $65.8 million for the full year. This financial resilience is crucial for Power Integrations as it navigates the semiconductor industry's cyclical nature and competitive landscape.

Strategic Financial Moves

During the fourth quarter, Power Integrations continued its share repurchase program, buying back 680 thousand shares for $47 million. This move reflects the company's confidence in its long-term value and commitment to delivering shareholder returns. As of December 31, 2023, the company had $26.0 million remaining on its repurchase authorization.

Furthermore, the company paid a dividend of $0.20 per share on December 29, 2023, and announced another dividend of the same amount to be paid on March 29, 2024. These dividends signify the company's ability to generate consistent cash flow and reward its investors despite the current economic headwinds.

Management's Commentary

Commented Balu Balakrishnan, chairman and CEO of Power Integrations: Fourth-quarter revenues declined as expected, and we project first-quarter sales to be about flat sequentially due to continued soft demand and elevated supply-chain inventories. However, channel inventory fell significantly in the fourth quarter, and we expect a further reduction in the first quarter. Based on lower inventories and seasonal patterns we expect sequential revenue growth beginning in the June quarter. We also expect gross margin to rise in the June quarter driven by the dollar/yen exchange rate, higher manufacturing utilization and end-market mix.

Looking Ahead

The company's financial outlook for the first quarter of 2024 anticipates revenues to be around $90 million, with a GAAP gross margin of approximately 51.5%. Non-GAAP gross margin is expected to be about 52.5%, with the difference between GAAP and non-GAAP gross margins attributable to stock-based compensation and amortization of acquisition-related intangible assets.

GAAP operating expenses are projected to be approximately $49 million, with non-GAAP operating expenses expected to be around $42.5 million, excluding an estimated $6.5 million of stock-based compensation.

Power Integrations' performance in a challenging market underscores the importance of strategic financial management and the ability to adapt to industry fluctuations. As the company looks forward to potential growth in the coming quarters, investors and stakeholders will be closely monitoring its progress and the semiconductor industry's broader trends.

For detailed financial tables and a full reconciliation of GAAP to non-GAAP financial measures, please refer to the original 8-K filing.

For more information and analysis on Power Integrations Inc (NASDAQ:POWI) and the semiconductor industry, stay tuned to GuruFocus.com.

Contact Joe Shiffler, Power Integrations, Inc., at (408) 414-8528 or via email at joe@power.com for further inquiries.

Explore the complete 8-K earnings release (here) from Power Integrations Inc for further details.

This article first appeared on GuruFocus.