PPG Industries Inc Reports Record Sales and Strong Cash Flow in Q4 and Full-Year 2023

Net Sales: Achieved record fourth quarter net sales of $4.4 billion, a 4% increase YOY.

Adjusted EPS: Fourth quarter adjusted EPS rose to $1.53, marking a 25% increase YOY.

Operating Cash Flow: Recorded over $2.4 billion for the year, a significant increase from the previous year.

Margin Recovery: Segment margin improved by 260 basis points YOY in the fourth quarter.

Share Repurchases: PPG repurchased $100 million of its shares in the fourth quarter.

Dividend Consistency: Continued its 124-year legacy of dividend payments, with 52 consecutive years of increases.

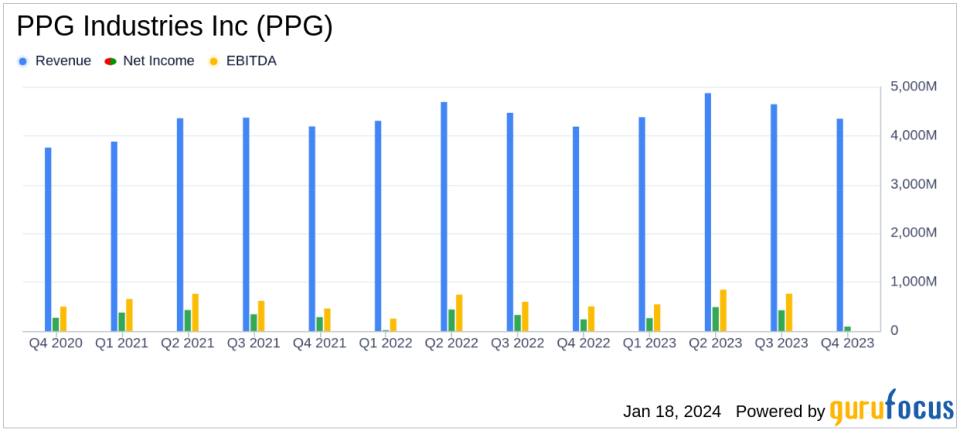

On January 18, 2024, PPG Industries Inc (NYSE:PPG), a global leader in coatings, released its 8-K filing, revealing a robust financial performance for the fourth quarter and full-year 2023. The company, known for its expansive product range serving automotive, aerospace, construction, and industrial markets, reported record sales and strong cash flow, underlining its resilience in a challenging economic environment.

Financial Performance and Challenges

PPG's fourth quarter saw net sales increase by 4% year-over-year to $4.4 billion, with organic sales growth contributing 1%. However, net income experienced a significant decline of 62% to $90 million, primarily due to a non-cash goodwill impairment charge for the Traffic Solutions business. Adjusted net income, which excludes certain items, showed a more positive trend with a 27% increase to $363 million. The adjusted earnings per share (EPS) for the quarter stood at $1.53, a 25% rise from the previous year. These figures are crucial as they reflect the company's ability to grow earnings and manage costs effectively, despite economic pressures.

Financial Achievements and Industry Significance

PPG's record operating cash flow of over $2.4 billion, up more than $1.4 billion year-over-year, underscores the company's strong financial discipline and operational efficiency. In the Chemicals industry, where capital investments and cash flow management are pivotal, PPG's performance demonstrates its robust business model and strategic execution. The improvement in segment margin by 260 basis points year-over-year is particularly noteworthy, indicating PPG's successful efforts in margin recovery and cost management.

Income Statement and Balance Sheet Highlights

For the full year, PPG reported net sales of $18.2 billion, a 3% increase from the previous year, with organic sales growth also at 3%. The company's net income from continuing operations rose by 24% to $1.27 billion, and adjusted net income increased by 27% to $1.82 billion. The EPS from continuing operations was $5.35, and the adjusted EPS reached a record $7.67, both up 27% year-over-year. PPG's balance sheet remained strong, ending the year with cash and short-term investments totaling nearly $1.6 billion, and net debt reduced by about $1.2 billion compared to the prior-year fourth quarter.

Commentary from PPG's Leadership

"Capping off a record year, the PPG team delivered solid year-over-year sales growth, strong adjusted earnings growth and record operating cash flow," said Tim Knavish, PPG chairman and chief executive officer. He also noted the company's focus on strategic initiatives, portfolio optimization, and shareholder value creation. Looking ahead, Knavish expressed confidence in PPG's growth and value creation for 2024.

Outlook and Projections

PPG's outlook for the first quarter and full year 2024 is cautiously optimistic, with adjusted EPS projections of $1.80 - $1.87 per share for Q1 and $8.34 - $8.59 per share for the full year. These projections are based on current global economic activity, including expectations of demand improvement in China, demand stabilization in Europe, and continued growth in Mexico.

Value investors and potential GuruFocus.com members may find PPG's strong financial performance, despite economic headwinds, a testament to the company's resilience and strategic agility. With a solid balance sheet, consistent dividend payments, and a clear focus on growth, PPG Industries Inc (NYSE:PPG) presents a compelling case for investment consideration.

Explore the complete 8-K earnings release (here) from PPG Industries Inc for further details.

This article first appeared on GuruFocus.