PPG Industries (PPG) to Post Q3 Earnings: What's in Store?

PPG Industries, Inc. PPG is scheduled to report third-quarter 2023 results after the closing bell on Oct 18.

The company surpassed the Zacks Consensus Estimate for earnings in three of the last four quarters while missing it once. It delivered a trailing four-quarter earnings surprise of around 7.3% on average.

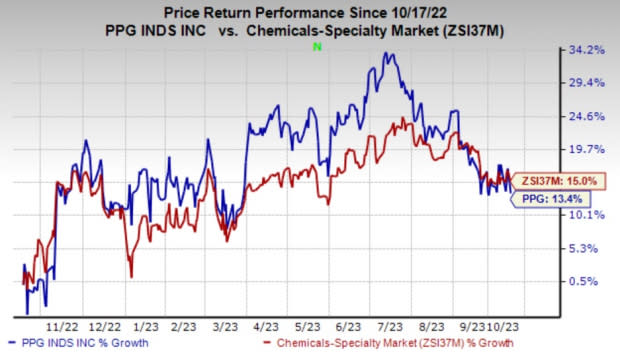

The stock has gained 13.4% over the past year compared with a 15% rise recorded by its industry.

Image Source: Zacks Investment Research

What Do the Estimates Say?

The Zacks Consensus Estimate for sales for the to-be-reported quarter is currently pegged at $4,621 million, which implies a rise of 3.4% from the year-ago reported number.

The Zacks Consensus Estimate for PPG’s Industrial Coatings segment’s net sales is pegged at $1,767 million, indicating a year-over-year rise of 0.2%. Our estimate for the segment is pegged at $1,749.8 million.

Also, the consensus estimate for net sales for PPG’s Performance Coatings segment stands at $2,860 million, suggesting an increase of 5.7%. Our estimate for the quarter for the segment is $2,765.9 million.

Factors to Watch

In the third quarter, PPG is expected to continue to have faced subdued demand on weak global industrial production, impacted by cautious consumer buying behavior in Europe and a slow recovery in China. This is likely to have been compounded by softening demand in certain end-use markets in the United States. Specific industry sectors, including aerospace and automotive, are demonstrating resilience. Demand is expected to remain weak in industrial and packaging coatings in the September quarter.

Throughout the third quarter, the company is expected to have realized additional benefits stemming from the moderation of cost inputs. Per the company, at the peak of supply disruptions, PPG grappled with over 160 force majeures in its global supply chain, which has now declined to approximately 10, aligning with historical norms. Despite this progress, the full financial advantages of normalizing the commodity supply chain are yet to be fully recognized. As of the end of June, input costs remained 20% higher than pre-pandemic levels. Further reductions in inventories are expected to have yielded additional earnings benefits.

The company's ongoing restructuring initiatives are making headway, with an anticipated year-over-year earnings benefit of $15 million expected to have realized in the third quarter. Moreover, PPG's recent acquisition in the paint film industry has strategically positioned the company in the premium segment of the emerging market, showcasing robust customer demand and promising growth potential. This business segment currently generates approximately $100 million in annual sales. This acquisition is likely to have contributed to the company's top line in the third quarter.

PPG Industries, Inc. Price and EPS Surprise

PPG Industries, Inc. price-eps-surprise | PPG Industries, Inc. Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for PPG this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings Beat: Earnings ESP for PPG Industries is -0.06%. The Zacks Consensus Estimate for earnings for the third quarter is currently pegged at $1.95. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PPG Industries currently carries Zacks Rank #3.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider, as our model shows these have the right combination of elements to post an earnings beat this quarter:

Element Solutions Inc ESI, slated to release its earnings on Oct 25, has an Earnings ESP of +1.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for ESI’s third-quarter earnings per share is currently pegged at 34 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +8.70%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #2.

CF Industries Holdings, Inc. CF, slated to release earnings on Nov 1, has an Earnings ESP of +0.73% and carries a Zacks Rank #2 at present.

The consensus mark for CF’s third-quarter earnings is currently pegged at 97 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report