PPG Industries (PPG) Stock Up 14% in 3 Months: Here's Why

PPG Industries Inc.’s PPG shares have popped 13.7% over the past three months. The company has also outperformed its industry’s rise of 10.1% over the same time frame. It has also topped the S&P 500’s roughly 6% rise over the same period.

Let’s take a look into the factors behind the stock’s price appreciation.

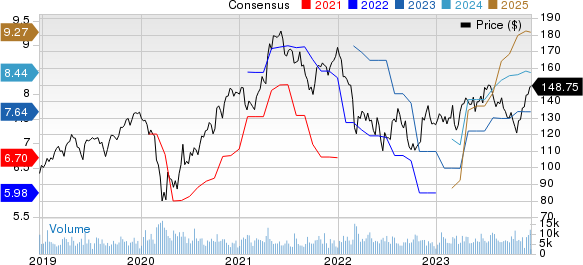

Image Source: Zacks Investment Research

Pricing & Cost Actions, Acquisitions Drive PPG

PPG Industries, a Zacks Rank #3 (Hold) stock, is benefiting from higher pricing across its segments, manufacturing efficiencies, cost discipline and efforts to grow its business through acquisitions amid headwinds from soft demand in Europe and China.

The company is implementing a cost-cutting and restructuring strategy, as well as optimizing its working capital requirements. The cost savings generated by these restructuring initiatives will act as a tailwind for the company. PPG Industries has undertaken extensive restructuring efforts to reduce its cost structure, primarily focusing on regions and end markets with weak business conditions. The company achieved $15 million in incremental cost reductions through restructuring programs and acquisition synergies in the third quarter of 2023 and expects incremental savings of around $15 million in the fourth quarter.

PPG Industries is also undertaking measures to grow business inorganically through value-creating acquisitions. Contributions from the acquisitions are expected to get reflected in its performance. Acquisitions, including Tikkurila, Worwag and Cetelon, are likely to contribute to its top line.

Moreover, the company is raising selling prices across its business segments to offset the impact of raw material and other cost inflation and drive profitability. Significant progress has been made in increasing consolidated segment margins, which were about 15% in the third quarter of 2023, an increase of 260 basis points compared to the same quarter in 2022, aided by strong selling price realization. Pricing measures are likely to continue to support its margins in the fourth quarter.

PPG Industries also remains committed to boost shareholder returns with cash deployment. It has an impressive record of returning cash to shareholders through dividends and share buybacks. The company, in July 2023, raised its quarterly dividend by around 5% to 65 cents per share. PPG paid dividends worth $153 million in the third quarter and $445 million during the first nine months of 2023.

Estimates Going Up

Over the past two months, the Zacks Consensus Estimate for PPG for third-quarter 2023 has increased around 2.1%. The consensus estimate for 2023 has also been revised 2% upward over the same time frame. The favorable estimate revisions instill investor confidence in the stock.

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. price-consensus-chart | PPG Industries, Inc. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and Hawkins, Inc. HWKN.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 61% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current-year earnings has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained around 33% in the past year.

Hawkins has a projected earnings growth rate of 21% for the current year. It currently carries a Zacks Rank #2 (Buy). Hawkins has a trailing four-quarter earnings surprise of roughly 27.5%, on average. HWKN shares have rallied around 82% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report