PPL Unit Boosts Reliability & Cuts Cost by Using DLR Tech

PPL Corporation’s PPL subsidiary, PPL Electric Utilities, is increasing the reliability of its electricity supply services to more than 1.4 million customers, with the use of the Dynamic Line Rating (DLR) technology. The company was awarded by two organizations — Edison Electric Institute and Southeastern Electric Exchange — for first-of-its-kind use of this technology.

The first U.S. electric utility to integrate this technology into real-time and market operations was PPL Electric Utilities in 2022. The DLR technology uses sensors to provide real-time data on factors influencing the operation of transmission lines, such as wind speed and line temperature. This information is used to increase the volume of electricity delivered over existing lines when required, thereby decreasing congestion.

Since October 2022, the PPL subsidiary has been providing hourly, day-ahead projections produced by the DLR system to PJM Interconnection, the local transmission organization. The objective was to help coordinate more effective power generation and ensure reliability.

Importance of DLR Technology

Many utilities are either already deploying DLR as a practical means of increasing the transmission capacity of grids or considering doing the same. This is because the technology provides system operators with a quickly deployable, inexpensive method of increasing line ratings that can be implemented without the need to build new physical infrastructure or take key lines out of service.

DLR deployment can increase transmission and distribution capacity, which, in turn, can boost the amount of power available for dispatch. This increased power supply can help reduce generation dispatch costs.

It can also aid in the reduction of congestion costs due to more accurate forecasts by traders and generator commitments in day-ahead markets, as well as a more efficient real-time market with a better estimate for transmission capacity.

In 2022, PPL Electric Utilities expected the DLR project to save $23 million annually in congestion costs. Thanks to technology, the unit can now control expenses and allocate funds to other initiatives aimed at enhancing system dependability while eliminating or postponing the need for transmission line modification and extension.

Along with PPL, National Grid Transco NGG is also leveraging technology for its electricity transmission network that could expand the capacity of its existing overhead power lines. NGG, along with LineVision, is installing sensors and the DLR platform on a circuit in the North of England to boost its power carrying limit.

The Zacks Consensus Estimate for NGG’s 2023 earnings per share (EPS) is pegged at $4.52, indicating a year-over-year increase of 17.1%.

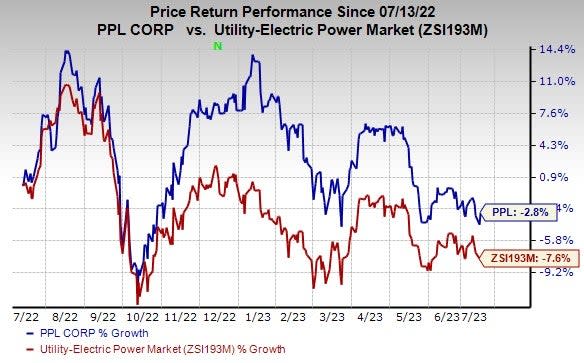

Price Performance

In the last year, shares of PPL have nosedived 2.8% compared with the industry’s 7.6% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

PPL currently carries a Zacks Rank #2 (Buy).

A couple of other top-ranked stocks from the same industry are TransAlta TAC, sporting a Zacks Rank #1 (Strong Buy), and NiSource Inc. NI, carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TAC’s 2023 EPS implies year-over-year growth of 1,350%. The same for sales indicates an increase of 5.9% from the previous year’s level.

NiSource’s long-term earnings growth rate is 7%. The Zacks Consensus Estimate for 2023 EPS indicates a year-over-year improvement of 8.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

National Grid Transco, PLC (NGG) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report