PRA Group Inc (PRAA) Reports Mixed 2023 Financial Results with Strong Portfolio Purchases

Total Portfolio Purchases: Reached $1.2 billion in 2023, a 36% increase year-over-year.

U.S. Performance: U.S. business underperformance being addressed, with a focus on improving profitability in 2024.

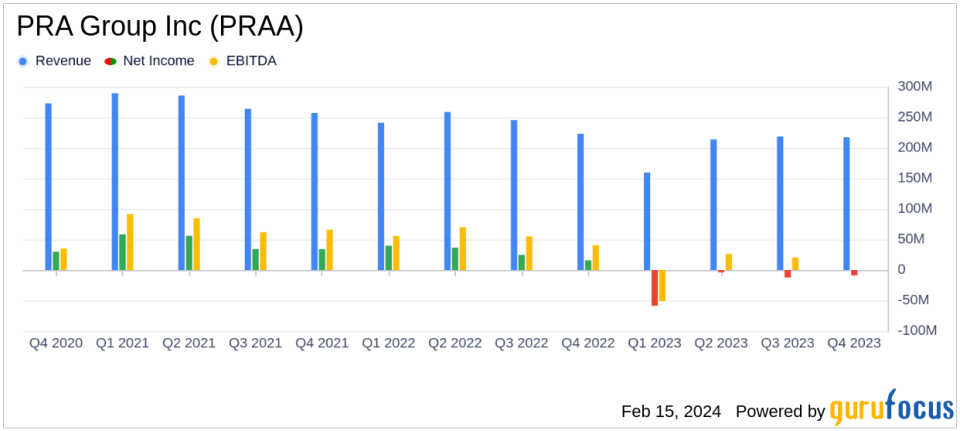

Net Income/Loss: Reported a net loss of $(83.5) million for the full year 2023, compared to a net income of $117.1 million in 2022.

Diluted Earnings Per Share (EPS): Decreased to $(2.13) in 2023 from $2.94 in the previous year.

Cash Collections: Total cash collections amounted to $1.7 billion for the full year, with a decrease in U.S. collections.

Debt to Adjusted EBITDA Ratio: Stood at 2.89x at the end of 2023.

On February 15, 2024, PRA Group Inc (NASDAQ:PRAA), a global leader in acquiring and collecting nonperforming loans, released its financial results for the fourth quarter and full year of 2023 through its 8-K filing. The company, which returns capital to banks and other creditors to help expand financial services for consumers in the Americas, Europe, and Australia, reported a significant increase in portfolio purchases but faced challenges in its U.S. operations.

Financial Performance Overview

PRA Group Inc (NASDAQ:PRAA) reported total portfolio purchases of $284.9 million for Q4 2023 and $1.2 billion for the full year, marking a 36% increase from the previous year and the third-highest level in the company's history. Despite this growth, the company faced underperformance in its U.S. business, which it is addressing with urgency. The company's president and CEO, Vikram Atal, expressed optimism about the future, citing initiatives in the U.S. business that are expected to transform PRA into a more efficient and profitable enterprise.

"2023 was an important and pivotal transition year for PRA. We delivered strong performance in our European business and worked with speed and intensity to address the shortcomings in our U.S. business," said Vikram Atal, president and chief executive officer.

However, PRA Group Inc (NASDAQ:PRAA) reported a net loss of $(83.5) million for the full year 2023, a stark contrast to the net income of $117.1 million in 2022. The diluted earnings per share (EPS) also reflected this downturn, decreasing to $(2.13) from $2.94 in the previous year.

Income Statement and Balance Sheet Highlights

The company's total cash collections for the full year were $1.7 billion, with a decrease in U.S. collections. Operating expenses for the full year increased by 3.1% to $702.1 million, driven by growth-related expenses such as legal collection costs and communication expenses. Interest expense also rose by 39.1% to $181.7 million, reflecting a higher average debt balance and increased interest rates.

The balance sheet showed that as of December 31, 2023, PRA Group Inc (NASDAQ:PRAA) had cash and cash equivalents of $112.5 million and total assets of $4.5 billion. The company's borrowings stood at $2.9 billion, with a debt to Adjusted EBITDA ratio of 2.89x.

Looking Ahead

Despite the challenges faced in 2023, PRA Group Inc (NASDAQ:PRAA) is well-positioned for meaningful profitability in 2024. The company's solid platform for future growth, combined with disciplined growth in Estimated Remaining Collections (ERC) and cash collections, as well as cost optimization efforts, are expected to drive shareholder value in the upcoming year.

Value investors may find PRA Group Inc (NASDAQ:PRAA)'s commitment to addressing its U.S. business underperformance and its strong portfolio purchases as indicators of the company's potential for a turnaround and future growth. The company's strategic focus on operational efficiency and profitability could present opportunities for long-term investment.

For more detailed information on PRA Group Inc (NASDAQ:PRAA)'s financial results, investors are encouraged to review the full earnings release and consider the company's future prospects in light of the challenges and achievements of the past year.

Investors and interested parties can access the conference call and accompanying slides to further understand the company's performance and strategies. For more insights and financial analysis, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from PRA Group Inc for further details.

This article first appeared on GuruFocus.