PRA Group (PRAA) Q2 Loss Relieved by Lower Operating Costs

PRA Group, Inc. PRAA incurred a second-quarter 2023 loss of 10 cents per share, narrower than the Zacks Consensus Estimate of 16 cents. Notably, earnings of 91 cents per share were reported in the prior-year quarter.

Total revenues dropped 19% year over year to $209.2 million. However, the top line beat the consensus mark by 2.46%.

The better-than-expected results were supported by lower operating expenses, strong portfolio acquisition volumes and improving European operations, partially offset by underperformance witnessed in the Americas and weaker portfolio income.

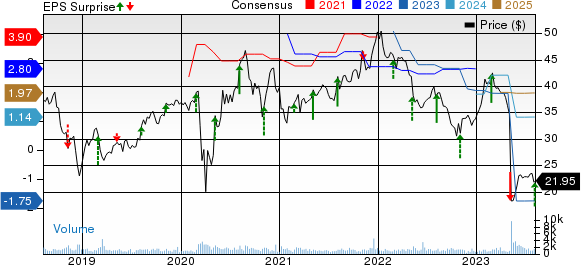

PRA Group, Inc. Price, Consensus and EPS Surprise

PRA Group, Inc. price-consensus-eps-surprise-chart | PRA Group, Inc. Quote

Quarterly Operational Update

PRA Group’s cash collection amounted to $419.3 million, which fell 5.6% year over year in the quarter under review. The metric suffered a blow due to a 23.9% year-over-year decline in U.S. call center and other collections, partially offset by a 58.6% jump in Other Americas and Australia Core cash collections. The reported figure beat the Zacks Consensus Estimate by 6.5% and our estimate of $372.1 million.

The portfolio income tumbled 5% year over year to $184.3 million, missing the Zacks Consensus Estimate by 0.9% but beating our model estimate of $169.7 million. Other revenues of $3.8 million declined 50.4% year over year in the second quarter and missed both the Zacks Consensus Estimate, as well as our model estimate.

Total operating expenses fell 6.2% year over year to $163.7 million in the second quarter due to lower compensation and employee services, and outside fees and services, partly offset by higher legal collection costs and agency fees. The figure was lower than our model estimate of $166.4 million.

PRA Group recorded a net income of $1.2 million, which comfortably beat our estimate but declined from the prior-year quarter’s net income of $39.1 million.

It purchased nonperforming loan portfolios of $327.8 million in the quarter under review, which surged 41.7% year over year. The cash efficiency ratio of 61.2% remained flat year over year due to a favorable cash collection seasonality, as well as lower collection costs in European countries.

The estimated remaining collections (“ERC”) of PRA Group totaled $5.9 billion at the second-quarter end.

Financial Update (as of Jun 30, 2023)

PRA Group exited the second quarter with cash and cash equivalents of $111.4 million, which surged from the 2022-end level of $83.4 million. It had $1.4 billion remaining under its credit facilities at the second-quarter end.

Total assets of $4,320.9 million increased from the figure of $4,175.7 million at 2022 end.

Borrowings totaled $2,739.7 million, up from the $2,494.9 million figure as of Dec 31, 2022.

Total equity of $1,239.7 million decreased from the 2022-end level of $1,286.8 million.

Business Outlook

PRAA expects compensation expenses to be in the mid-$70 million range in the third quarter.

Legal collection expenses for the third quarter are anticipated to stay in line with the second quarter. The same is likely to reach the mid-$20 million range by the fourth quarter.

Interest expenses are projected to be around $50 million in the third quarter of 2023. It expects the full-year effective tax rate to be in the mid-20% scale.

By the fourth quarter of 2023, the cash efficiency ratio is estimated to be 60% on a quarterly run rate basis. Management expects to collect an ERC balance of $1.5 billion within the next 12 months.

Zacks Rank & Other Key Picks

PRA Group currently has a Zacks Rank #2 (Buy). Investors interested in the broader finance space can also consider other top-ranked companies like Globe Life Inc. GL, NewtekOne, Inc. NEWT and Ponce Financial Group, Inc. PDLB, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Globe Life’s 2023 earnings indicates a 28.7% year-over-year increase to $10.49 per share. It has witnessed five upward estimate revisions over the past month against no movement in the opposite direction. GL beat earnings estimates in all the last four quarters, with the average surprise being 2.2%.

The Zacks Consensus Estimate for NewtekOne’s 2023 earnings has improved 0.6% over the past week. It has witnessed one upward estimate revision over the past month against no movement in the opposite direction. NEWT beat earnings estimates in one of the last four quarters, met once and missed in the remaining occasions.

The Zacks Consensus Estimate for Ponce Financial’s 2023 bottom line suggests an 81.7% year-over-year improvement. It has witnessed one upward estimate revision in the past week against none in the opposite direction. PDLB beat earnings estimates in two of the last four quarters and missed twice.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PRA Group, Inc. (PRAA) : Free Stock Analysis Report

NewtekOne, Inc. (NEWT) : Free Stock Analysis Report

Ponce Financial Group, Inc. (PDLB) : Free Stock Analysis Report

Globe Life Inc. (GL) : Free Stock Analysis Report