Do Praemium's (ASX:PPS) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Praemium (ASX:PPS). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Praemium

Praemium's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Praemium's stratospheric annual EPS growth of 47%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

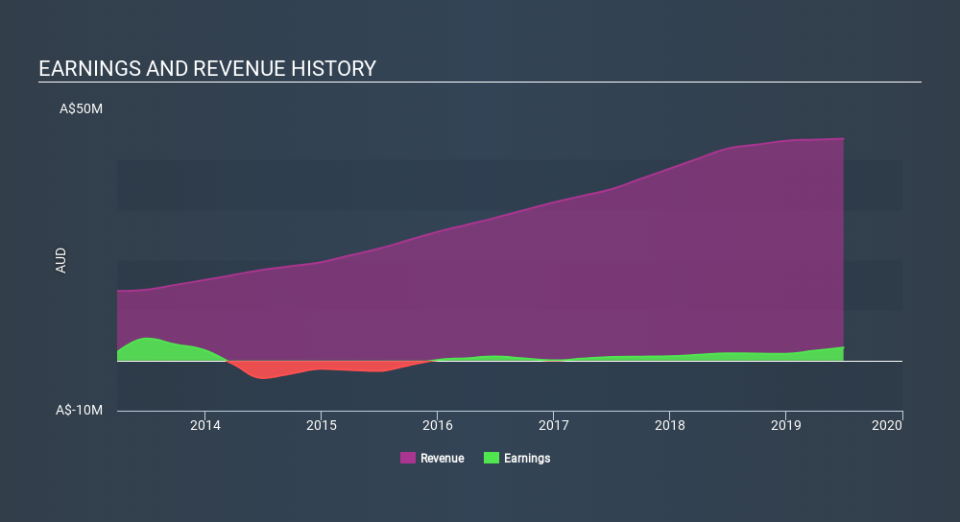

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Praemium maintained stable EBIT margins over the last year, all while growing revenue 4.7% to AU$44m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Praemium?

Are Praemium Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Praemium insiders walking the walk, by spending AU$350k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by Non-Executive Director Stuart Robertson for AU$104k worth of shares, at about AU$0.63 per share.

The good news, alongside the insider buying, for Praemium bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$25m worth of shares. That's a lot of money, and no small incentive to work hard. That amounts to 11% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Praemium To Your Watchlist?

Praemium's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Praemium belongs on the top of your watchlist. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Praemium's ROE with industry peers (and the market at large).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Praemium, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.