Praesidium Investment Management Company, LLC Adjusts Stake in Zuora Inc

On November 14, 2023, Praesidium Investment Management Company, LLC (Trades, Portfolio) made a notable adjustment to its investment in Zuora Inc (NYSE:ZUO), a company specializing in cloud-based subscription management software. The firm reduced its holdings by 190,566 shares, resulting in a 2.87% decrease in its stake, which now stands at 6,444,030 shares. This transaction had a -0.14% impact on Praesidium's portfolio, with the shares being traded at a price of $8.30 each. The current position of Zuora Inc in Praesidium's portfolio is 4.87%, slightly down from the previous 4.90%.

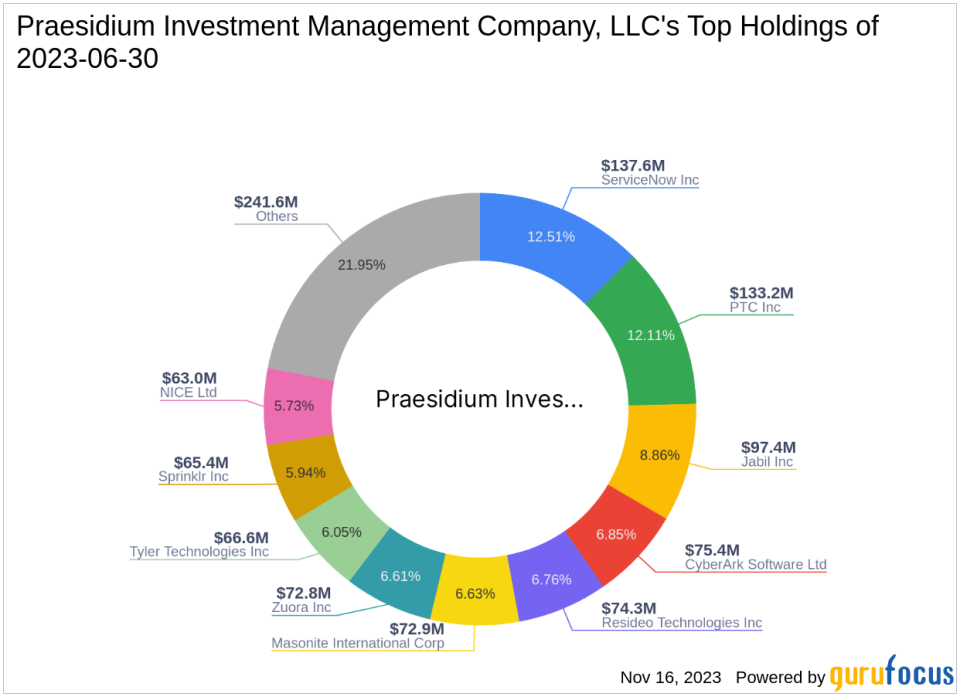

Insight into Praesidium Investment Management

Praesidium Investment Management Company, LLC (Trades, Portfolio), based in New York, is a significant player in the investment field, managing an equity portfolio worth approximately $1.1 billion. The firm's investment philosophy emphasizes a concentrated portfolio, with a strong focus on technology and industrials sectors. Among its top holdings are CyberArk Software Ltd (NASDAQ:CYBR), PTC Inc (NASDAQ:PTC), Jabil Inc (NYSE:JBL), ServiceNow Inc (NYSE:NOW), and Resideo Technologies Inc (NYSE:REZI). Praesidium's strategic approach to investing has positioned it as a key influencer in the market.

Zuora Inc at a Glance

Zuora Inc, traded under the symbol ZUO, operates within the software industry in the United States. Since its IPO on April 12, 2018, the company has been providing a suite of cloud-based solutions that enable businesses to manage subscription services effectively. Zuora's offerings, such as Zuora Billing and Zuora CPQ, cater to a diverse range of industries. Despite a market capitalization of $1.16 billion and a year-to-date stock price increase of 27.38%, the company's stock is currently considered a possible value trap, with a GF Value of $13.22 and a price to GF Value ratio of 0.63.

Trade's Impact on Praesidium's Portfolio

The recent reduction in Praesidium's holdings of Zuora Inc represents a slight shift in the firm's investment strategy. With the trade price at $8.30, marginally above Zuora's current stock price of $8.28, the transaction suggests a strategic move by Praesidium. The firm's decision to reduce its stake comes at a time when Zuora's stock is trading below its GF Value, indicating that Praesidium may be taking a cautious approach to its investment in the company.

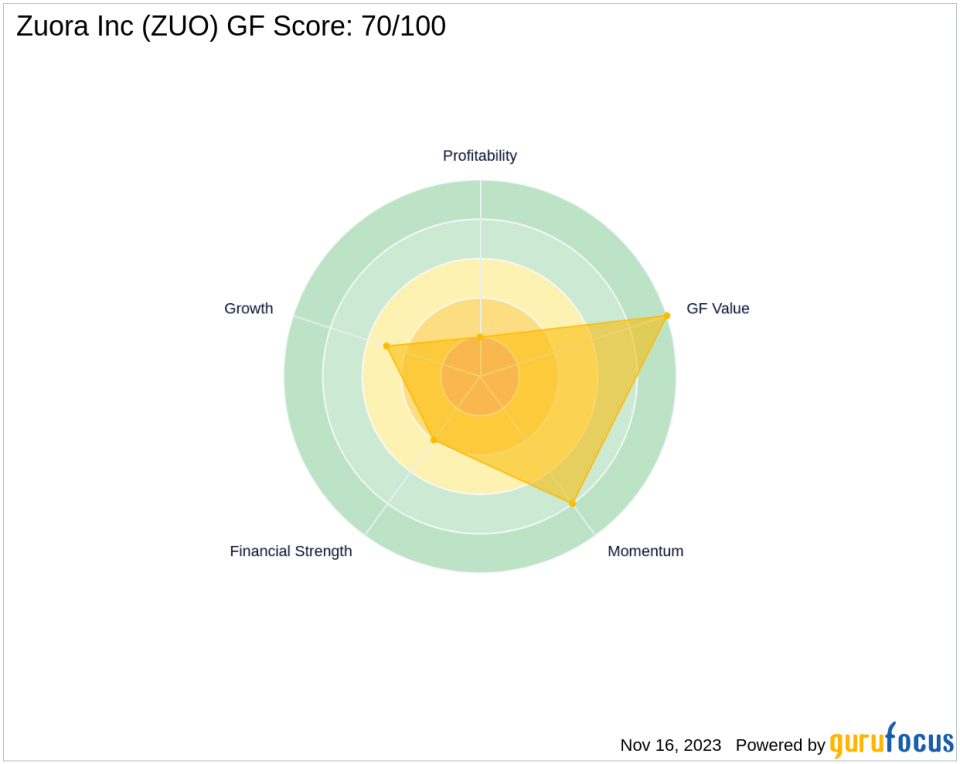

Financial Health and Market Performance of Zuora Inc

Zuora Inc's financial health and market performance present a mixed picture. The company's GF Score stands at 70 out of 100, suggesting poor future performance potential. Zuora's financial strength and profitability ranks are low, with a Profitability Rank of 2/10 and a Financial Strength Rank of 4/10. The company's Piotroski F-Score is 3, indicating some concerns regarding its financial stability. However, Zuora's Growth Rank and Momentum Rank are more favorable, at 5/10 and 8/10, respectively. The stock's negative return on equity (ROE) of -135.30% and return on assets (ROA) of -27.87% are areas of concern for investors.

Broader Market Implications and Comparative Insight

Praesidium's trade action in Zuora Inc must be viewed within the broader market context. The software industry faces unique challenges, and Zuora's stock momentum and industry-specific issues will be critical factors for investors to monitor. In comparison, Gotham Asset Management, LLC holds a significant position in Zuora Inc, although the exact share percentage is not disclosed. The comparative size and impact of Praesidium's holding relative to other major investors like Gotham Asset Management, LLC will influence the market's perception of Zuora's investment attractiveness.

Concluding Thoughts on Praesidium's Strategic Move

In conclusion, Praesidium Investment Management Company, LLC (Trades, Portfolio)'s recent reduction in its stake in Zuora Inc reflects a strategic adjustment in line with its investment philosophy. While the firm maintains a substantial position in Zuora, the trade's timing and price suggest a cautious stance towards the company's current valuation and future prospects. Value investors will be watching closely to see how this transaction influences Zuora's stock performance and Praesidium's portfolio dynamics in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.