Prediction: This Little-Known Artificial Intelligence (AI) Stock Could Go Parabolic in 2024

When it comes to artificial intelligence (AI), the so-called "Magnificent Seven" stocks garner the lion's share of attention. But looking beyond megacap players, investors can find several budding operations making inroads in AI.

One such company is voice-recognition software developer SoundHound AI (NASDAQ: SOUN), which joined the public markets via a special purpose acquisition company (SPAC) in 2022. Like many of its SPAC predecessors, the stock quickly witnessed some pronounced buying activity, only to crater shortly thereafter.

As of the time of this writing, SoundHound AI stock trades for roughly $2 per share and is down 85% from its high. While this depressed price might not generate much confidence or investor enthusiasm, buying the dip could be a lucrative opportunity. Let's dig into some of my predictions for 2024, and why I view SoundHound AI as a potential beneficiary.

The Federal Reserve is likely to cut interest rates

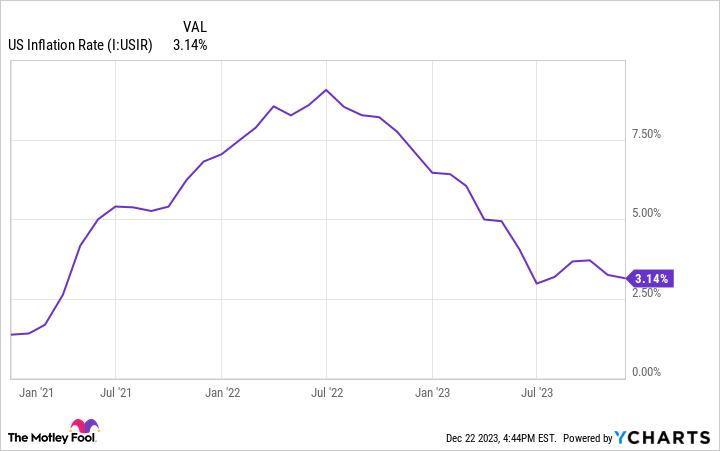

For the last couple of years, the U.S. economy has been in a prolonged nasty battle with inflation. The Federal Reserve increased interest rates 11 times, dramatically affecting businesses by forcing corporate executives to rein in spending or pay more to borrow.

Nevertheless, the chart above illustrates that the current inflation rate of 3.14% is well below levels seen in 2022 and is beginning to cool compared to periods earlier in 2023. While it is not yet known when or if the Federal Reserve will begin to cut rates, I think there is a good chance investors will see some tapering during the spring or summer.

Should this occur, a natural side effect could be a renewed spark in business activity, making investments in growth areas such as AI robust for 2024. Although SoundHound AI has several applications, two of its core end markets are the restaurant industry and automobile manufacturers. Both of these sectors could very well see new life as consumer purchasing power would go much further with lower interest rates.

Mergers and acquisitions should rebound

Given widespread economic uncertainty, mergers and acquisitions (M&A) activity slowed down through 2023. Through the first three quarters of 2023, global M&A volume declined 27% year over year on an absolute dollar basis, according to one analysis. However, several variables suggest that 2024 could be a rebound year for M&A.

According to research firm Gartner, "techquisitions" could be a thing in 2024. The company defines these as "acquisitions of digital or IT companies by enterprises in other conventional industries that have not created or sold information and communication technology-based products or services before." In other words, bigger enterprises could still be interested in acquiring smaller counterparts purely due to their technology portfolio.

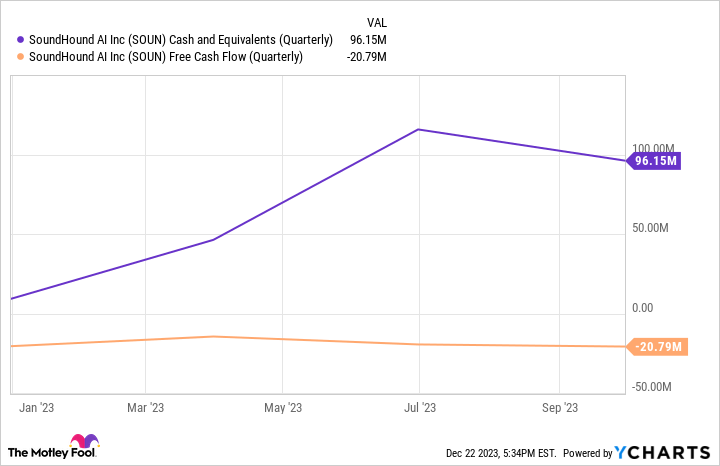

The chart below illustrates SoundHound AI's quarterly cash balance and free cash flow. Given that the company is still burning money, it's obvious that it will become constrained from a liquidity standpoint unless it quickly figures out a way to generate meaningful, sustained profits. The company's financial profile and its unique position in the overall AI landscape make it a compelling acquisition target.

Moreover, recent history suggests that tech behemoths have a big interest in voice-powered AI technology. For example, nearly a decade after buying voice assistant Siri, Apple acquired SoundHound AI's competitor Shazam in 2018 for $400 million. Microsoft bought voice assistant Nuance for $20 billion in 2022. Investing in a company based on the possibility of a buyout would not be wise, but SoundHound could see increased interest in 2024.

If things go right, the company could skyrocket

Should the Fed start to cut rates in 2024, restaurants and car companies could be some of the businesses that benefit the most. A dollar will go further for the average shopper, which could spark renewed spending in discretionary areas like restaurant meals or even bigger purchases like a new car. For this reason, businesses could be eager to make investments that better serve their customers, and SoundHound AI looks prepared to penetrate these markets.

While the prospects of M&A look compelling, I would not buy SoundHound AI stock purely based on speculation of a takeover. Instead, I encourage investors to think about the long-term theme here.

Big tech has already demonstrated its interest in voice-powered AI technology. Given the secular demand fueling AI, I would not be surprised to see another player follow in the footsteps of big tech and either become a strategic partner or investor in SoundHound AI sometime in 2024. This could materially impact its growth in the short term and help put the AI developer on the radar or more institutional investors.

In the long run, this could eventually lead to an acquisition or a rebound in the stock price, generating a fantastic return for investors who buy at its current levels.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and SoundHound AI wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Adam Spatacco has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple and Microsoft. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Prediction: This Little-Known Artificial Intelligence (AI) Stock Could Go Parabolic in 2024 was originally published by The Motley Fool