Preferred Bank (PFBC) Rises 7.3% on Share Buyback Plan Approval

Shares of Preferred Bank PFBC have gained 7.3% following the announcement of the company’s board of directors’ approval of the first leg of its $150 million share repurchase plan. After receiving the required approvals to begin share buybacks, PFBC can now repurchase up to $50 million of common stock.

On May 16, 2023, the said plan was approved by the shareholders of the company, authorizing the repurchase of up to a total of $150 million of shares.

Prior to the current authorization, Preferred Bank had a share repurchase plan of up to $50 million announced in 2021. Under the plan, the company repurchased 464,438 shares for a total consideration of $32 million.

Apart from share repurchases, Preferred Bank pays quarterly dividends on a regular basis and has increased payouts five times in the last five years. In December 2022, it announced a dividend hike of 27.9% from the prior payout.

In March 2023, PFBC made the latest dividend announcement of 55 cents which was paid on Apr 21, 2023. Considering the last day’s closing price of $56.36 per share, its annualized dividend yield stands at 3.9%. Apart from being attractive to investors, the yield represents a steady income stream.

We believe such regular disbursements highlight PFBC’s operational strength and commitment to enhance shareholders’ wealth. Also, these capital deployment activities will stoke investors’ confidence.

As of Mar 31, 2023, Preferred Banks’ cash and cash equivalent balance of $865.69 million increased from $747.53 million at the end of 2022. The cash levels of the company are higher than its subordinated debt issuance, net of unamortized costs and premium of $148.06 million. Hence, a solid balance-sheet position along with its earnings strength indicates that its capital deployments seem sustainable.

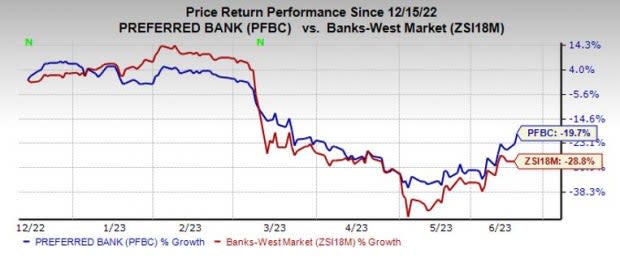

Shares of Preferred Bank have lost 19.7% over the past six months compared with the industry’s decline of 28.8%.

Image Source: Zacks Investment Research

Currently, PFBC carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enhanced Capital Deployment Activities by Other Banks

NorthEast Community Bancorp, Inc. NECB announced its second share repurchase program. Under the plan, the board of directors of this White Plains, NY-based bank has authorized the repurchase of up to an aggregate of 1.5 million shares, or 10%, of its currently issued and outstanding common stock.

NECB announced its first stock repurchase program on Jul 27, 2022, and authorized the buyback of up to an aggregate of 1.6 million shares of its common stock. The company completed this program at a cost of $22.8 million or $13.93 per share.

Stellar Bancorp, Inc. STEL announced the expansion and extension of its existing share repurchase program. Under the program, the board of directors of this Houston, TX-based bank has authorized the repurchase of up to an aggregate of $60 million of its common stock through May 31, 2024.

The original share repurchase program was announced back in September 2022, which authorized STEL to repurchase up to $40 million of its common stock through Sep 30, 2023. However, it did not repurchase any shares during the three months ended Mar 31, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Preferred Bank (PFBC) : Free Stock Analysis Report

Stellar Bancorp, Inc. (STEL) : Free Stock Analysis Report

Northeast Community Bancorp Inc. (NECB) : Free Stock Analysis Report