Prem Watsa Bolsters Stake in BlackBerry Ltd

On February 15, 2024, Prem Watsa (Trades, Portfolio), through Fairfax Financial Holdings, made a notable addition to its investment portfolio by acquiring 425,571 shares of BlackBerry Ltd (NYSE:BB). This transaction increased the firm's holding in the company to a total of 47,150,271 shares, marking a trade impact of 0.08% at a trade price of $2.86 per share. The addition of these shares has adjusted the firm's position in BlackBerry to 9.17% of its portfolio, while its holdings in BlackBerry now represent 8.10% of the company's outstanding shares.

Guru Profile: Prem Watsa (Trades, Portfolio)

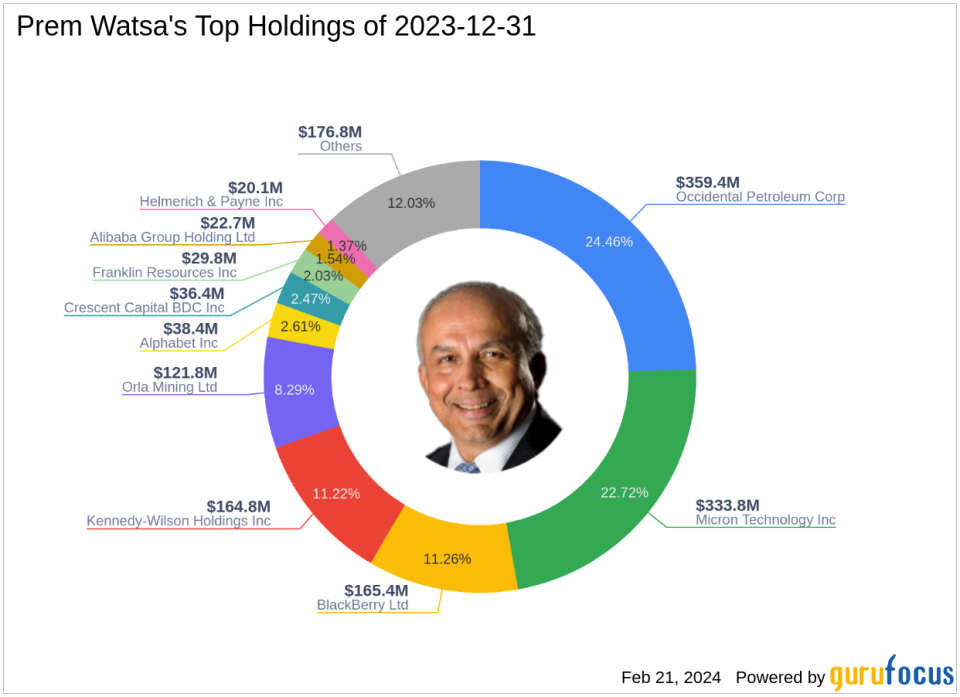

Prem Watsa (Trades, Portfolio), the founder and leader of Fairfax Financial Holdings, is a renowned investor with a career that spans several decades. Born in India and having moved to Canada for higher education, Watsa has built a reputation for his conservative investment philosophy, which is heavily influenced by Warren Buffett (Trades, Portfolio)'s strategy of investing insurance float. Fairfax Financial's objective is to achieve a high rate of return on invested capital and build long-term shareholder value, focusing on disciplined underwriting and total return investment. With 57 stocks in its portfolio, Fairfax's top holdings include BlackBerry Ltd (NYSE:BB), Micron Technology Inc (NASDAQ:MU), and Occidental Petroleum Corp (NYSE:OXY), with a strong emphasis on the technology and energy sectors.

BlackBerry Ltd Company Overview

BlackBerry Ltd, headquartered in Canada, has transitioned from a leading smartphone manufacturer to a software provider focused on secure communication for enterprises. The company's operations are segmented into Cybersecurity, Internet of Things (IoT), and Licensing. With a market capitalization of $1.58 billion and a current stock price of $2.685, BlackBerry is dedicated to providing endpoint management and protection, particularly in regulated industries, and embedded software for various markets.

Financial and Market Analysis of BlackBerry Ltd

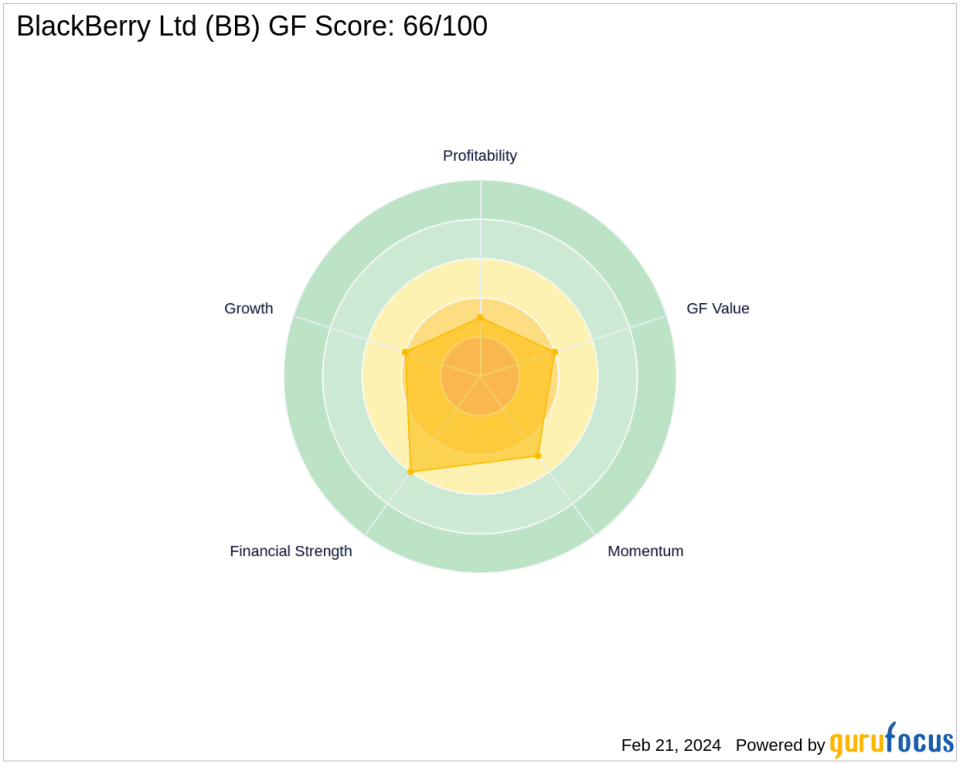

BlackBerry Ltd's stock performance indicators present a mixed picture. The company's PE Percentage stands at 0.00, indicating it is currently not profitable. The GF Valuation suggests that the stock might be a Possible Value Trap, and investors should think twice before investing. The Price to GF Value ratio is 0.40, and the stock has experienced a decline of 6.12% since the transaction date. Year-to-date, the stock's price has decreased by 21.72%. Despite these challenges, the GF Score of 66/100 indicates that BlackBerry has some potential for future performance.

Guru's Investment in BlackBerry Ltd

The recent acquisition of BlackBerry shares by Prem Watsa (Trades, Portfolio)'s firm is significant, as it represents a substantial portion of the firm's portfolio. The increase in shares solidifies the firm's confidence in BlackBerry's future prospects, despite the current market valuation and performance indicators. The firm's investment strategy, which values long-term growth and conservative value investment, suggests a belief in BlackBerry's potential to rebound and provide returns over time.

Sector and Top Holdings of Prem Watsa (Trades, Portfolio)

Prem Watsa (Trades, Portfolio)'s investment strategy is heavily weighted towards the technology and energy sectors, reflecting a belief in the long-term growth potential of these industries. The firm's top holdings, including BlackBerry Ltd, Micron Technology Inc, and Occidental Petroleum Corp, showcase a diversified approach within these sectors, aiming to capitalize on both the innovative aspects of technology and the fundamental demand for energy.

BlackBerry Ltd's Financial Health and Performance Metrics

BlackBerry's financial health and performance metrics present a varied landscape. The company's Financial Strength is rated at 6/10, while its Profitability Rank and Growth Rank are lower at 3/10 and 4/10, respectively. The Piotroski F-Score of 4 indicates a relatively average financial situation, and the negative Altman Z score of -1.20 raises concerns about financial distress. However, the company's Cash to Debt ratio of 1.07 is a positive sign, indicating a reasonable level of liquidity.

Market Sentiment and Other Gurus' Positions

Market sentiment towards BlackBerry Ltd is cautious, with the largest guru shareholder being Fairfax Financial Holdings itself. Other notable investors, such as Kahn Brothers (Trades, Portfolio), also maintain positions in the company, suggesting that while BlackBerry faces challenges, it still garners interest from seasoned investors who may see long-term value in its business model and market position.

Transaction Analysis

The recent transaction by Prem Watsa (Trades, Portfolio)'s firm has a modest impact on the overall portfolio but signifies a strong vote of confidence in BlackBerry Ltd. The firm's increased stake in the company, despite the current market valuation and performance indicators, aligns with its long-term investment philosophy and suggests a belief in BlackBerry's potential for recovery and growth. As the largest guru shareholder, Fairfax Financial Holdings' movements are closely watched and may influence other investors' perceptions of BlackBerry's future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.