Prem Watsa Bolsters Stake in BlackBerry Ltd

Recent Acquisition by Prem Watsa (Trades, Portfolio)

On November 13, 2023, Prem Watsa (Trades, Portfolio), through Fairfax Financial Holdings, made a notable addition to its investment in BlackBerry Ltd (NYSE:BB). The transaction involved the acquisition of 129,000 shares at a price of $3.52 per share, increasing the total holdings to 46,853,700 shares. This move had a 0.03% impact on the portfolio, adjusting the position to 10.77% and marking a significant vote of confidence in the company's prospects.

Investment Guru: Prem Watsa (Trades, Portfolio)

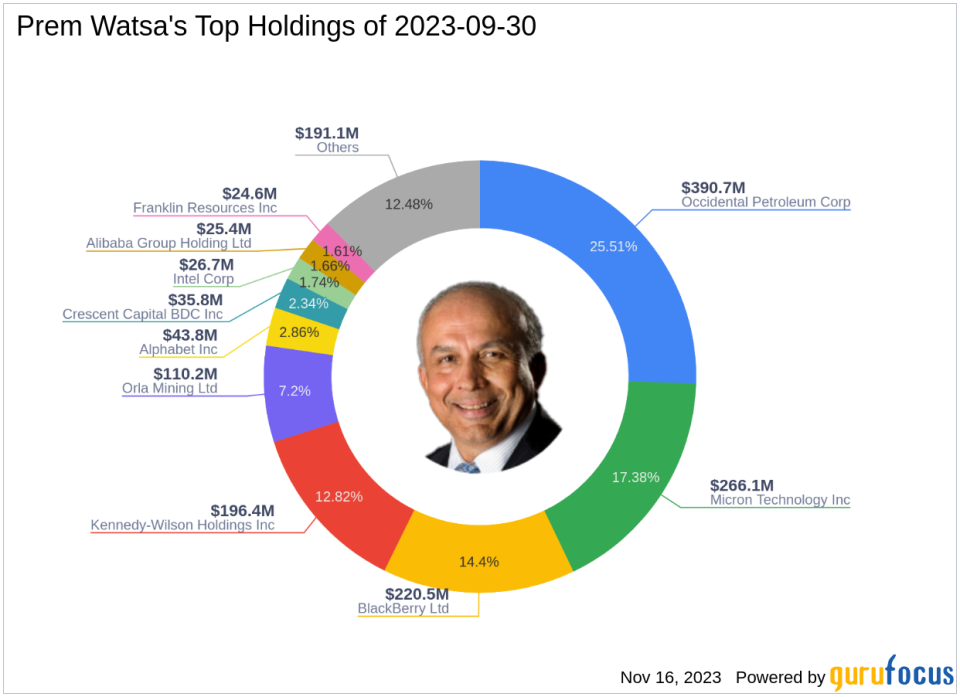

Prem Watsa (Trades, Portfolio), the founder and CEO of Fairfax Financial Holdings, is a renowned investor often compared to Warren Buffett (Trades, Portfolio). With a career that began in 1974, Watsa has built a reputation for a conservative investment approach, focusing on long-term value and the prudent management of insurance float. Fairfax Financial's strategy, inspired by Buffett's Berkshire Hathaway, has been pivotal in achieving sustained growth and shareholder value. The firm's top holdings, including BlackBerry Ltd, reflect a strong inclination towards the technology and energy sectors, with an equity portfolio valued at $1.53 billion.

Overview of BlackBerry Ltd

BlackBerry Ltd, once a dominant player in the smartphone market, has pivoted to become a software-centric company, focusing on cybersecurity, the Internet of Things (IoT), and licensing. With a market capitalization of $2.09 billion, BlackBerry has redefined its business model to cater to the needs of enterprises requiring secure communication. The current stock price stands at $3.58, reflecting the company's ongoing transformation and market adaptation.

BlackBerry's Financial Landscape

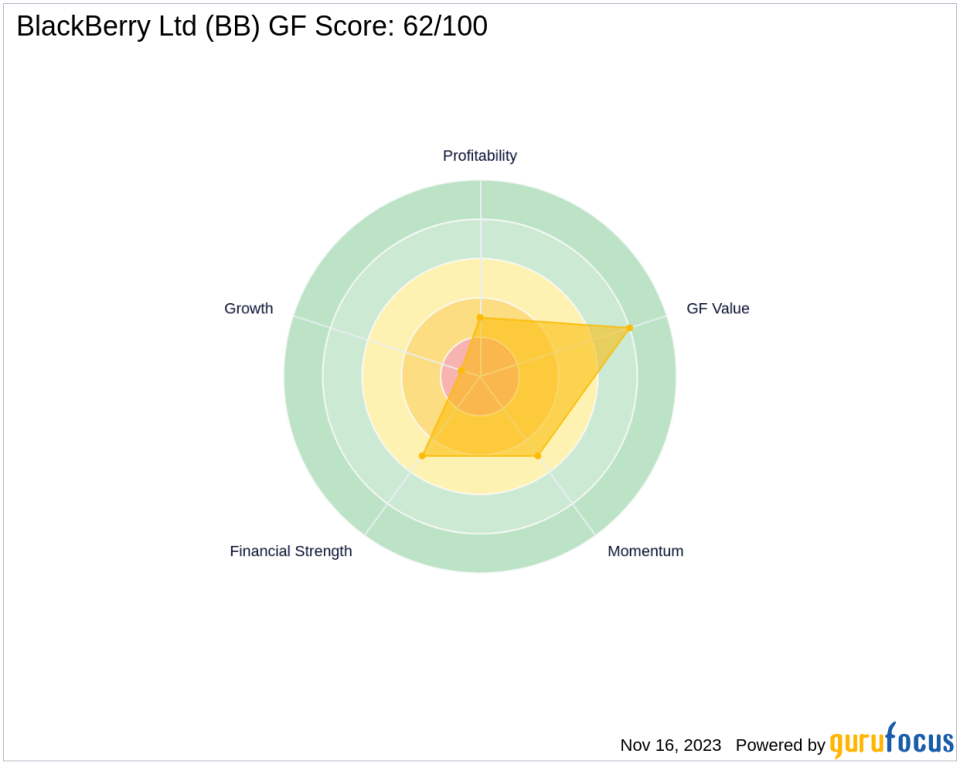

BlackBerry Ltd's financial metrics present a mixed picture. The company's PE Ratio is currently not applicable, indicating that it is not generating net profits. The GF Valuation suggests caution, labeling the stock as a possible value trap. However, the stock's price to GF Value ratio is 0.49, and there has been a 1.7% gain since the transaction date. Despite these challenges, BlackBerry has maintained a GF Score of 62/100, which suggests moderate future performance potential.

Guru's Increased Confidence in BlackBerry

Following the recent transaction, Prem Watsa (Trades, Portfolio)'s stake in BlackBerry Ltd has become even more significant, with the company occupying a substantial 8.00% of Fairfax's portfolio. This investment reflects Watsa's confidence in BlackBerry's strategic direction and potential for long-term value creation.

BlackBerry's Market Trajectory

Since its IPO on February 4, 1999, BlackBerry's stock has seen an 86.46% price change, with a year-to-date increase of 8.16%. The company's financial health, as indicated by its Financial Strength rank of 5/10 and Profitability Rank of 3/10, shows room for improvement. Growth ranks at a low 1/10, but the GF Value Rank is a more optimistic 8/10.

Comparative Guru Holdings

Other notable investors in BlackBerry Ltd include Kahn Brothers (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). However, Prem Watsa (Trades, Portfolio)'s Fairfax Financial Holdings remains the largest guru shareholder, underscoring the firm's commitment to BlackBerry's future.

Indicators of BlackBerry's Future Performance

The GF Score of 62/100 for BlackBerry Ltd, alongside its momentum and RSI indicators, provides insights into the stock's potential trajectory. While the company's momentum has been negative in recent months, the RSI levels suggest a neutral stance, indicating that the stock may not be overbought or oversold at current levels.

Transaction Impact Analysis

Prem Watsa (Trades, Portfolio)'s increased investment in BlackBerry Ltd is a strategic move that aligns with Fairfax Financial's value investment philosophy. The transaction not only reinforces the guru's position in the technology sector but also signals a belief in BlackBerry's turnaround strategy and future growth potential. As BlackBerry continues to evolve, investors will be watching closely to see if Watsa's confidence translates into tangible financial success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.