Premier Financial Corp. (PFC) Reports Full Year 2023 Earnings

Net Income: $111.3 million for 2023, or $3.11 per diluted share, compared to $102.2 million in 2022.

Loan Growth: $279 million increase (up 4%) with commercial loans up $179 million (up 4%).

Deposit Growth: $236 million increase (up 3%) with core customer deposits excluding brokered up $38 million (up 1%).

Net Interest Margin: Decreased to 2.65% in Q4 2023 from 3.28% in Q4 2022.

Non-Interest Income: $11.8 million in Q4 2023, down 11% from Q3 2023 but up 10.7% from Q4 2022.

Efficiency Ratio: Improved to 59.5% in Q4 2023 from 56.8% in Q4 2022.

Dividend: Declared quarterly cash dividend of $0.31 per common share payable on February 16, 2024.

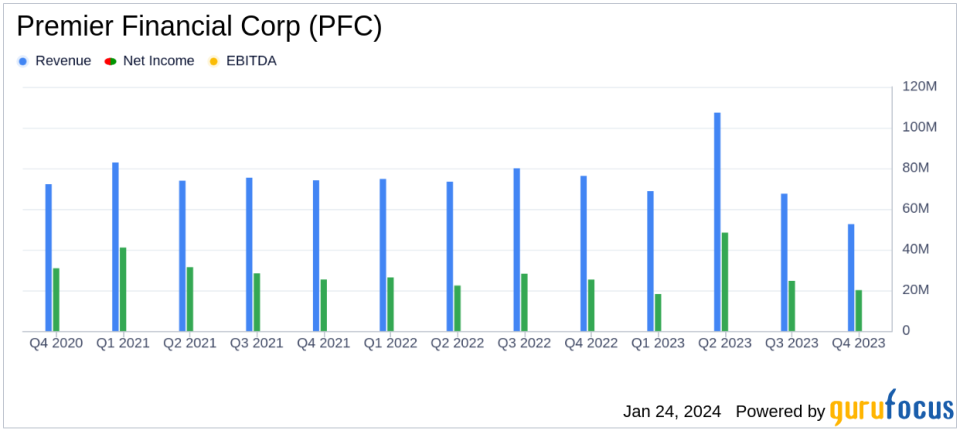

Premier Financial Corp (NASDAQ:PFC) released its 8-K filing on January 23, 2024, disclosing its financial results for the fourth quarter and full year of 2023. The company, a community banking and financial services corporation, reported a net income of $20.1 million for the fourth quarter, or $0.56 per diluted share, a decrease from the $25.3 million, or $0.71 per diluted share, reported in the same period of the previous year. For the full year, net income was $111.3 million, or $3.11 per diluted share, up from $102.2 million, or $2.85 per diluted share, in 2022. This performance includes the impact of the sale of the company's insurance agency, which contributed significantly to the year's results.

Financial Performance and Challenges

During the fourth quarter, Premier Financial Corp. experienced a mix of growth and challenges. The company saw a deposit growth of $77 million and a loan growth of $43 million, with commercial loans contributing $63 million to this increase. Despite these gains, the company faced a net interest margin compression, which decreased to 2.65% in the fourth quarter from 3.28% in the same quarter of the previous year. This margin compression reflects the competitive environment for deposits and the impact of higher interest rates on borrowing costs.

Non-interest income for the fourth quarter stood at $11.8 million, a decrease from the previous quarter but an increase from the fourth quarter of 2022. This was primarily due to fluctuations in mortgage banking and gains/losses on securities. Non-interest expenses saw a slight decrease from the third quarter and a more significant decrease from the fourth quarter of the previous year, reflecting the company's focus on expense management.

Balance Sheet and Income Statement Highlights

The balance sheet showed total assets of $8.63 billion at the end of 2023, with loans receivable at $6.74 billion and total deposits at $7.14 billion. The company's equity increased by $88 million, or $2.37 per share, with tangible equity up $117 million, or $3.22 per share. The tangible equity ratio improved by 1.25%.

Net interest income for the year was $217.4 million on a tax-equivalent basis, a decrease from the previous year's $243.7 million. The core net interest margin for 2023 was 2.73%, down from 3.28% in 2022. The cost of funds increased significantly, largely due to the higher average deposit costs.

"In the fourth quarter, we saw a continuation of performance improvement on many topics outlined in our third quarter release," said Gary Small, President and CEO of Premier. "Positive elements include purposefully moderate loan growth, excellent deposit growth, strong wealth management revenue growth, deliberate cost containment, and a decline in non-performing assets."

"Expense containment remains a high priority for us as we continue to manage the net interest margin challenges," said Paul Nungester, CFO of Premier. "The successful implementation of cost saving initiatives enabled us to reduce our ratio of expenses to average assets to 1.76% for the last two quarters of 2023, representing a 30 basis point improvement from the fourth quarter of 2022."

Looking Forward

As Premier Financial Corp. moves into 2024, the company anticipates moderate growth in earning assets and a continued focus on deposit growth, aiming for low-to-moderate year-over-year net interest income growth. Management also emphasizes strong expense management and solid credit performance as key components of their strategy.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Premier Financial Corp. will host a conference call to discuss the earnings results and business trends, which can be accessed via the company's website.

For more comprehensive analysis and insights, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Premier Financial Corp for further details.

This article first appeared on GuruFocus.