Premier Inc (PINC) Faces Revenue Decline but Advances Strategic Focus in Q2 FY2024

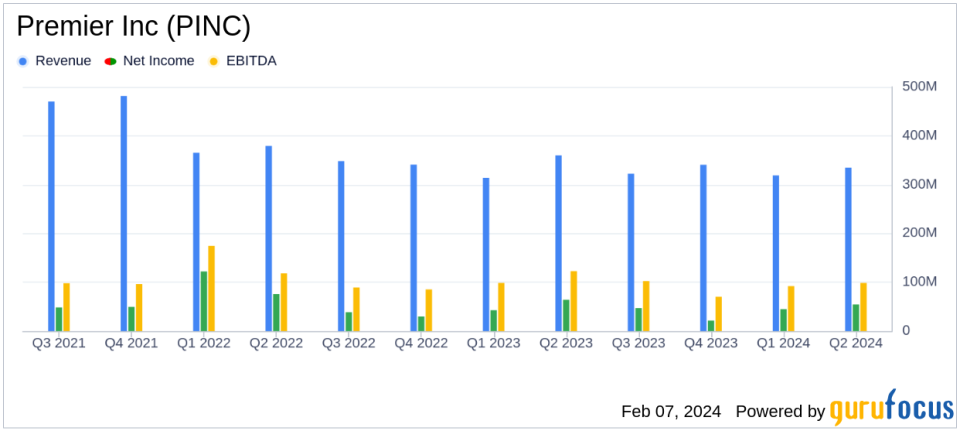

Net Revenue: Reported a 7% year-over-year decrease to $334.7 million in Q2 FY2024.

Net Income: Decreased by 18% year-over-year to $52.9 million in Q2 FY2024.

Diluted EPS: Dropped by 17% to $0.45 compared to $0.54 in the prior-year period.

Adjusted EBITDA: Fell by 18% to $114.1 million in Q2 FY2024.

Strategic Alternatives: Completed review process, focusing on supply chain automation and AI, with divestitures in non-core businesses.

Share Repurchase Authorization: Board approved a new $1.0 billion share repurchase plan, including a $400 million accelerated transaction.

FY2024 Guidance: Adjusted EPS forecasted at $2.06 to $2.18 on net revenues of $1.265 to $1.325 billion.

On February 5, 2024, Premier Inc (NASDAQ:PINC) released its 8-K filing, detailing its financial results for the fiscal-year 2024 second quarter ended December 31, 2023. The healthcare improvement company, which unites an alliance of U.S. hospitals and health systems to optimize supply chains and improve patient care, reported a 7% decrease in net revenue compared to the same quarter last year, totaling $334.7 million. This decline was primarily attributed to a challenging revenue comparison for enterprise license agreements in the Performance Services segment and the impact of higher aggregate member fee share in the group purchasing business.

Premier Inc (NASDAQ:PINC) is a Charlotte, North Carolina-based company that plays a pivotal role in the healthcare industry by providing supply chain solutions, data analytics, and consulting services to improve care quality and reduce costs. The company operates domestically through two business segments: Supply Chain Services and Performance Services.

Financial Performance and Strategic Developments

Despite the revenue decline, Premier Inc's President and CEO, Michael J. Alkire, expressed that the company's second-quarter results reflect ongoing discipline in managing the business to meet profitability expectations. The company's net income also saw a decrease, falling 18% to $52.9 million, with diluted earnings per share (EPS) dropping to $0.45 from $0.54 in the prior-year period. Adjusted EBITDA declined by 18% to $114.1 million, and adjusted net income decreased by 15% to $71.9 million, with adjusted EPS falling to $0.60 from $0.70.

The company's Board of Directors has concluded its exploration of strategic alternatives, deciding to focus on automating and streamlining supply chain aspects and leveraging data, technologies, and AI capabilities. As part of this strategy, Premier Inc has divested its non-healthcare GPO operations and is seeking partners for its direct sourcing business, S2S Global, and its direct-to-employer business, Contigo Health.

Segment Performance and Outlook

The Supply Chain Services segment saw an 8% decrease in net revenue, primarily due to lower products revenue and net administrative fees. Performance Services segment revenue decreased by 6%, mainly due to a decline in enterprise license agreements. For fiscal 2024, Premier Inc expects net revenue between $1.265 billion and $1.325 billion, with adjusted EBITDA ranging from $405 million to $425 million, and adjusted EPS between $2.06 and $2.18.

The company's balance sheet remains robust, with cash and cash equivalents of $371.1 million as of December 31, 2023. The Board has also approved a new $1.0 billion share repurchase authorization, including a $400 million accelerated share repurchase transaction, signaling confidence in the company's value proposition and commitment to returning value to shareholders.

Investors and stakeholders can expect Premier Inc to continue its focus on strategic growth areas while navigating the challenges presented by market conditions and the evolving healthcare landscape.

For more detailed information, Premier Inc will host a conference call to discuss the earnings report and future outlook. Interested parties can access the live webcast on the company's website or join the call using the provided dial-in numbers.

For a comprehensive understanding of Premier Inc's financial health and strategic direction, readers are encouraged to review the full earnings release and consult the supplemental financial information provided by the company.

Explore the complete 8-K earnings release (here) from Premier Inc for further details.

This article first appeared on GuruFocus.