Be Prepared for a SLB Decline in 2024

Houston-based SLB (NYSE:SLB) released its fourth-quarter and full-year 2023 results on Jan. 19.

Formerly known as Schlumberger Ltd., it is one of my favorite oilfield services companies. I have owned a medium-sized position in the stock for many years. The outlook for the next five years is positive due to the increasing demand for oil and gas. This demand is driven by global economic growth and the need to maintain and upgrade existing oil and gas infrastructure.

Although the industry is experiencing a period of growth, it is not all smooth sailing. There are several significant challenges that it is currently facing, which have the potential to impede its progress.

One of the primary concerns is the shift toward more sustainable energy sources, such as solar and wind power. Additionally, the costs of extracting oil and gas are increasing, making new projects less financially viable. Finally, there is also the looming threat of a potential recession.

SLB is widely considered the best company in this sector for various reasons.

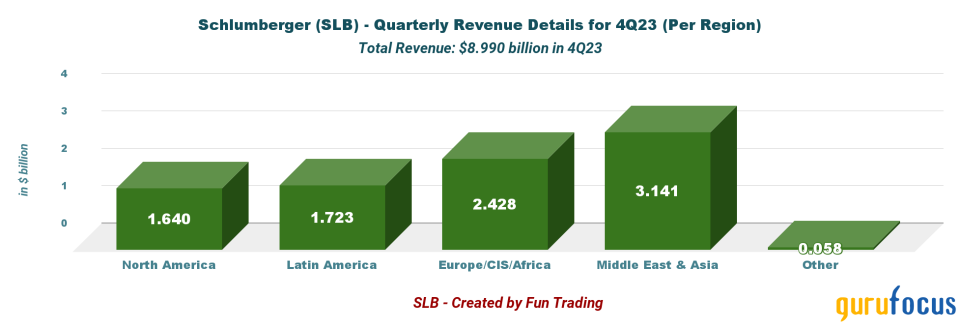

First, the company is well-diversified and has a strong global reputation. Second, it has a good presence in the United States, generating 18.20% of its revenue. It also operates extensively in the Middle East and Asia, generating 34.90% of its revenue. The chart below reveals the significance of the Middle East and Asia segments for the company.

As a reminder, the company sold its OneStim fracking business to Liberty Oil Services in late 2020, reducing its North American business.

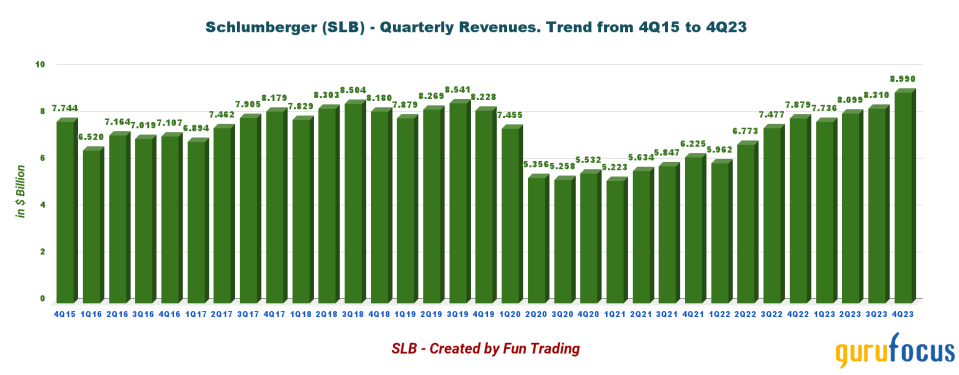

For 2023, revenue was $33.13 billion, a multiyear record as shown below.

The company indicated substantial international growth, wguke North American expansion fueled strong full-year performance.

CEO Olivier Le Peuch said in the conference call:

"The fourth quarter was an impressive conclusion to the year's financial results. We grew revenue both sequentially and year-on-year, and we achieved cycle-high margins and cash flows during the quarter. Our strong performance was fueled by the international and offshore markets and was supported by robust sales in digital and integration of the acquired Aker subsea business."

Thanks to increased working capital and strong cash flow, SLB bought back 1.80 million shares in the fourth quarter.

Finally, the company is raising its quarterly dividend to 27.50 cents per share, which is still insufficient when compared to oil supermajors.

2024 oil and gas outlook

Oilfield services companies have observed a decrease in activity in 2024. However, capital expenditure is expected to remain constant year over year. Most oil producers are focused on maintaining their production levels.

On the other hand, larger companies are using their cash flow to acquire producing assets, pay dividends and buy back shares, leaving less for spending.

Due to reduced funding, SLB's growth will be impacted, leading to a possible slight decline in the oilfield service industry's performance in 2024 and a more significant decline in 2025.

Le Peuch said during the conference call:

"Looking across this wide baseload of activity, a significant portion is taking place offshore, while capital expenditure will continue their growth momentum in 2024. As a result, the rig count will continue to rise, mainly in the Middle East and Asia, responding to a strong FID pipeline in both shallow and deepwater. All in all, we see the potential for more than $100 billion in global offshore FIDs in both 2024 and 2025, underscoring the enduring strength of the offshore markets and supporting a very favorable subsea outlook for years to come."

One advantage SLB has is that the Middle East, Asia, Europe and Africa benefit from long-cycle developments, capacity expansions and exploration, which may decline in North America in 202425.

The company's service relies solely on oil and gas producers, so the capital expenditure outlook is paramount.

In December, OPEC declared it would reduce production, which might not be reliable or effective. However, the decision to cut output indicates that OPEC will not attempt to increase production in 2024. Recently, Saudi Aramco (SAU:2222) decided to halt previously planned oil production growth. As Offshore Technology reported:

"State-owned Saudi Aramco has been directed by the government of Saudi Arabia to stop its oil expansion plan and focus on a maximum sustained oil production capacity of 12 million barrels per day."

This trend will relieve pressure on U.S. shale producers, which will be inclined to reduce capital spending. Thus, I do not see how the oilfield services could repeat what has been done in 2023 and break out from a bearish descending channel.

Stock performance

SLB's stock has been declining since September and October 2023 and is currently down over 5% year over year.

This trend is not unique to Schlumberger, as Halliburton (NYSE:HAL) and Baker Hughes (NASDAQ:BKR) have also experienced a similar pattern. All three companies peaked around October 2023 and have been slowly declining, with occasional short-term uptrends. This pattern is concerning and suggests the oilfield services industry may struggle this year.

Quarterly revenue, free cash flow and debt analysis

The company reported revenue of $8.99 billion for the fourth quarter, a 14% increase year over year and up 8% from the previous quarter. Net income was $1.11 billion, or 77 cents per diluted share, compared with $1.06 billion, or 74 cents per share. The chart below highlights the steady recovery that has taken place since 2021.

During the conference call, Chief Financial Officer Stephane Biguet said, "Our full-year 2023 revenue of $33.1 million grew 18% year on year. While this revenue is roughly the same as the pre-pandemic level 2019, our adjusted Ebitda in 2023 in absolute dollars was 22% higher."

The sales showed sequential growth owing to the international business. However, as depicted in the graph below, the quarter-over-quarter revenue for the North American segment was a bit low due to decreased activities in the U.S. and Canada. Nevertheless, the Gulf of Mexico offshore performed well.

Europe and Africa and the Middle East and Asia regions generate the highest revenue. Only 19.8% of the total comes from North America.

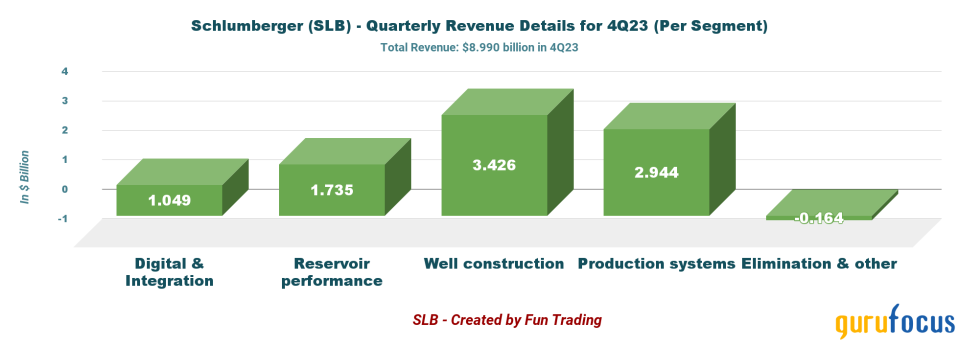

The company divides its revenue into four main segments, primarily focusing on well construction and production systems.

SLB reported that Well Construction remained stable sequentially as international growth offset a decline in North America.

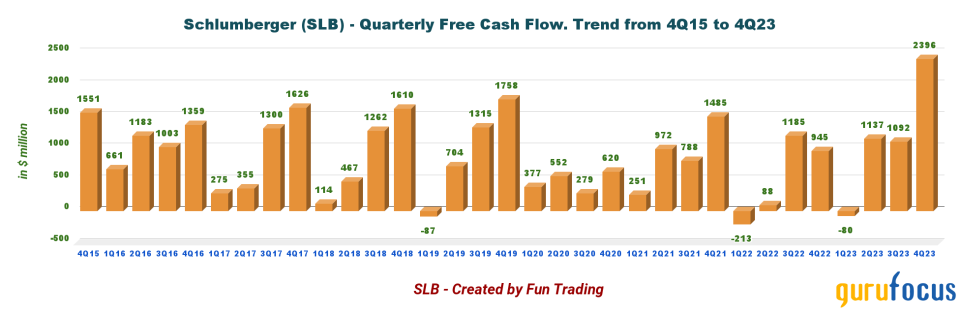

The company recorded free cash flow of $2.39 billion. The generic definition of free cash flow is the cash generated from operating activities after deducting capital expenditures. However, SLB reported a different figure of $2.28 billion for its free cash flow. This is because investments in APS projects were added to its capital expenditures of $626 million.

Trailing 12-month free cash flow was $4.54 billion, while quarterly free cash flow increased to $2.39 billion from $1.02 billion a year ago.

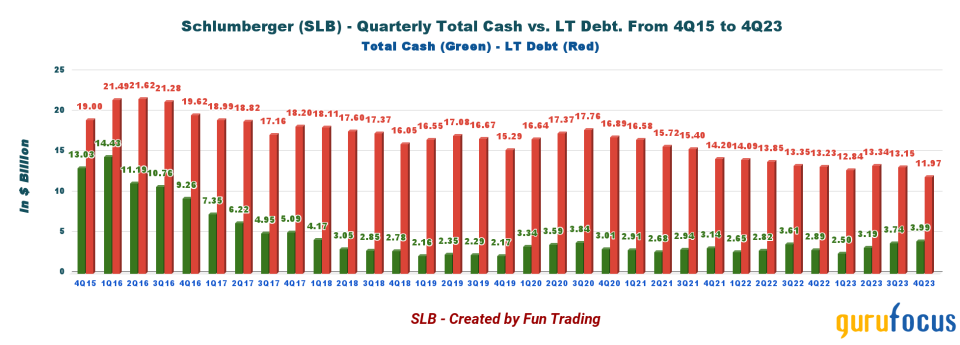

While net debt decreased sequentially to $7.98 billion, the total debt, including current debt, was $11.96 billion. This figure shows a decrease from the $12.23 billion recorded in the previous quarter. The cash balance was $3.98 billion.

The net debt also saw a significant reduction to $7.97 billion. Although the debt-to-equity ratio is still high at 0.59 (it should be reduced to below 0.40), the company has made impressive progress in reducing debt, which is a positive sign. Overall, I am pleased with the progress that should continue in 2024.

During the conference call, Biguet said:

"Looking ahead to the full year of 2024. We expect continued margin expansion in our core, driven by sustained operating leverage, a favorable geographic mix and pricing tailwinds. In our Digital and Integration division, we expect margins to remain approximately at the same level as 2023 as digital margins will increase due to the accelerated adoption of our new technology platforms, while APS margins will decrease as a result of higher amortization expenses."

Technical analysis and commentary

Please note the chart has been adjusted to include dividends.

SLB develops a descending channel pattern, with support at $52.20 and resistance at $47.90. The relative strength index of 60 indicates we are approaching a fast, overbought situation.

Descending channel patterns are mostly bearish in the short term as the stock moves lower within a descending channel. However, these common patterns often form within longer-term uptrends and are considered continuation patterns.

It is expected that prices will increase after following a descending channel pattern. However, this will only happen if the upper trend line is penetrated. Since Jan. 16, there has been a turnaround in SLB, and it is now on its way to testing the resistance level again.

Although it is still being determined if there will be enough momentum to break out this time, it remains a possibility, but only if oil prices experience a sudden boost. Otherwise, it will be difficult.

Based on my investment strategy, selling around 50% of your short-term last in, first out position is advisable. If there is strong momentum, selling within the $53 to $54.80 range would be reasonable, with a possibility of higher resistance at $56.50. However, if the stock price falls between $47.50 and $48.80, it would be wise to add to your position, with a possible lower support level at $45.20

Utilizing the LIFO strategy can be an effective approach to trading your long-term core position. It means you hold onto your oldest position while selling off your most recent purchases. This strategy can significantly reduce your risk while offering higher profit potential.

This article first appeared on GuruFocus.