President & CEO Brian Lian Sells 85,000 Shares of Viking Therapeutics Inc

Viking Therapeutics Inc (NASDAQ:VKTX), a clinical-stage biopharmaceutical company focused on the development of novel therapies for metabolic and endocrine disorders, has reported an insider sell according to the latest SEC filings. The insider, President & CEO Brian Lian, sold 85,000 shares of the company on January 31, 2024. The transaction was documented in an SEC Filing.

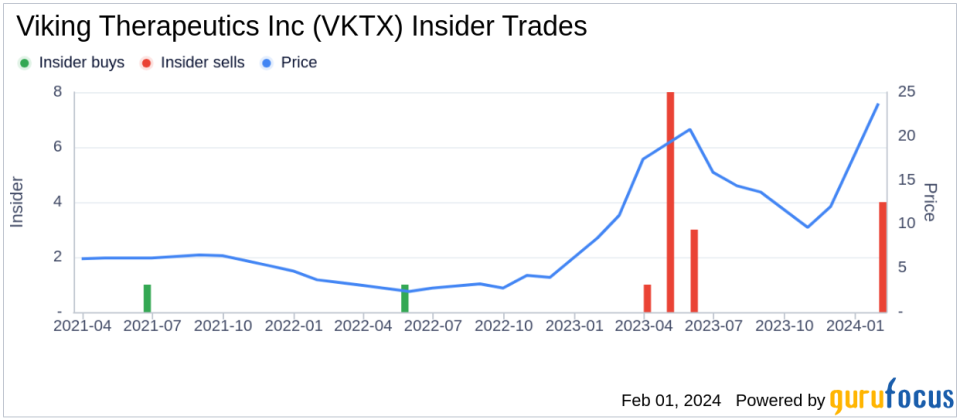

Over the past year, the insider has engaged in significant stock transactions, selling a total of 434,336 shares and making no purchases. This latest transaction continues the trend of insider sales for the company, with a total of 16 insider sells and no insider buys reported over the past year.

On the date of the recent sell, shares of Viking Therapeutics Inc were trading at $24.71, valuing the company at a market cap of $2.403 billion. The insider's sale is part of a broader pattern of insider transactions that can be visualized in the following trend image:

Investors often monitor insider transactions as they can provide insights into the company's performance and insider perspectives on the stock's value. While the reasons behind the insider's decision to sell shares are not disclosed, the consistent pattern of sales over the past year could be a point of interest for current and potential shareholders.

It is important for investors to consider insider transaction trends alongside other financial data and market analysis when evaluating their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.