President and CEO Tomer Weingarten Sells 104,521 Shares of SentinelOne Inc

Tomer Weingarten, President and CEO of SentinelOne Inc (NYSE:S), executed a sale of 104,521 shares in the company on February 9, 2024, according to a recent SEC filing. The transaction was carried out at an average price of $29.36 per share, resulting in a total value of $3,068,896.56.

SentinelOne Inc is a cybersecurity company that provides autonomous endpoint protection through a single agent that successfully prevents, detects, responds, and hunts attacks across all major vectors. The company aims to protect organizations of all sizes with its AI-powered technology that autonomously identifies and blocks threats in real-time.

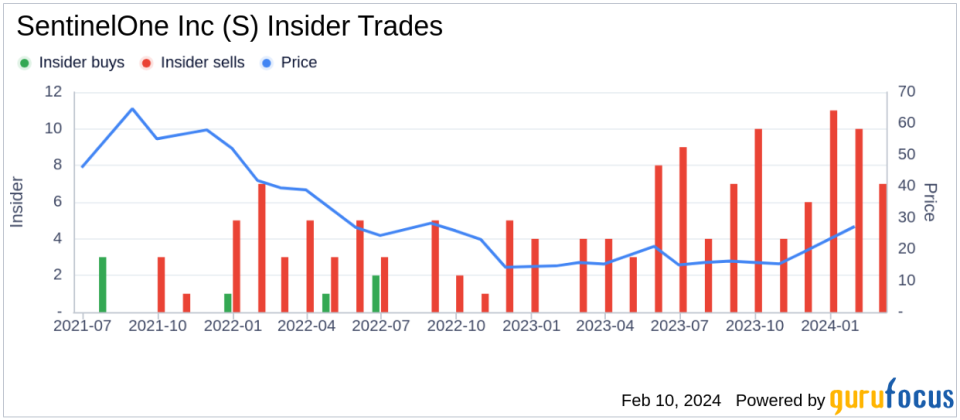

Over the past year, the insider has sold a total of 1,373,300 shares of SentinelOne Inc and has not made any purchases of the stock. The recent sale by the insider is part of a trend observed over the past year, where there have been no insider buys and 83 insider sells.

On the date of the insider's recent transaction, shares of SentinelOne Inc were trading at $29.36, giving the company a market capitalization of $8.87 billion.

The insider transaction history and the absence of insider purchases over the past year may be of interest to current and potential shareholders as they evaluate the company's stock performance and insider confidence. The market capitalization of SentinelOne Inc reflects the aggregate value of the company's outstanding shares and is a metric often used to compare companies within the same industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.