Prestige Consumer Healthcare Inc. (PBH) Reports Modest Revenue and EPS Growth in Q3 Fiscal 2024

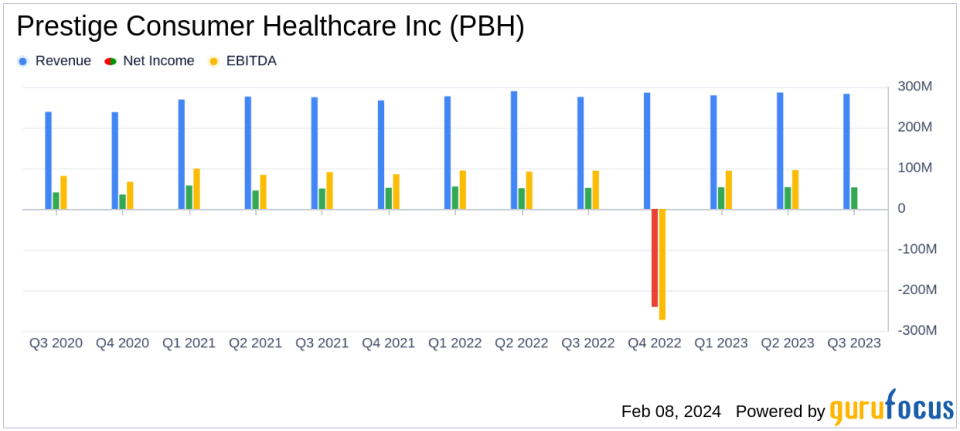

Revenue: Q3 revenue increased by 2.6% year-over-year to $282.7 million.

Net Income: Q3 net income rose to $53.0 million, a 2.2% increase from the previous year.

Earnings Per Share (EPS): Diluted EPS for Q3 was $1.06, up from $1.04 year-over-year.

Free Cash Flow: Non-GAAP free cash flow for Q3 reached $69.5 million, compared to $53.1 million in the prior year.

Leverage Ratio: Reduced to 2.9x at the end of Q3.

Full-Year Outlook: Fiscal 2024 earnings outlook raised to approximately $4.33 per diluted share.

Prestige Consumer Healthcare Inc (NYSE:PBH) released its 8-K filing on February 8, 2024, detailing its financial performance for the third quarter of fiscal year 2024, which ended on December 31, 2023. The company, a leading provider of over-the-counter healthcare products, reported a revenue increase of 2.6% to $282.7 million, compared to the same quarter in the previous year. The growth was attributed to strong performance in the Eye & Ear Care category in North America and the Hydralyte brand in the International segment.

Financial Performance and Challenges

Prestige Consumer Healthcare's net income for the quarter rose to $53.0 million, marking a 2.2% increase from the third quarter of fiscal 2023. The diluted earnings per share (EPS) also saw a slight uptick to $1.06, compared to $1.04 in the prior year. The company's leverage ratio improved, reducing to 2.9x at the quarter's end. Despite these positive results, the company faced challenges, including an expected decline in the Cough & Cold category and the strategic exit from private label revenues, which could impact future performance.

Financial Achievements and Industry Importance

The company's financial achievements, particularly the growth in revenue and net income, underscore its ability to navigate market challenges and maintain profitability. For a company in the Drug Manufacturers industry, consistent revenue growth and effective cost management are critical for sustaining operations and investing in future growth. Prestige Consumer Healthcare's ability to generate strong free cash flow, which increased significantly from the prior year, is particularly important as it provides the company with the flexibility to reduce debt, fund operations, and pursue strategic initiatives.

Key Financial Metrics

Key metrics from the income statement, balance sheet, and cash flow statement highlight the company's financial health. The net cash provided by operating activities for the third quarter was $71.5 million, an increase from $54.9 million in the prior year. The company also continued its disciplined capital deployment, repurchasing approximately 0.4 million shares at a total investment of $25.0 million, completing its previously authorized share repurchase program.

"Our continued top-line momentum delivered solid growth led by our Eye & Ear Care category brands Clear Eyes, TheraTears, and Debrox in North America and the Hydralyte brand in our International segment. The resulting strong profitability and free cash flow enabled our continued disciplined capital deployment, which reduced debt by $65 million in the quarter and improved our leverage to 2.9x at the end of December," said Ron Lombardi, Chief Executive Officer of Prestige Consumer Healthcare.

Analysis of Company Performance

The company's performance in Q3 fiscal 2024 reflects its strategic focus on brand strength and market presence, particularly in North America. The revenue growth, coupled with a disciplined approach to capital management, positions Prestige Consumer Healthcare well for sustainable growth. The raised earnings outlook for the full fiscal year 2024 indicates management's confidence in the company's continued performance and its ability to generate shareholder value.

For more detailed information on Prestige Consumer Healthcare Inc's financial performance, investors and interested parties can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Prestige Consumer Healthcare Inc for further details.

This article first appeared on GuruFocus.