Previewing Microsoft Earnings as Expectations Soften

Microsoft MSFT reports its Q2 FY23 earnings Tuesday January 24 after the market closes. With a Zacks Rank #4 (Sell), we can see analysts have been revising earnings estimates lower. Following these downward revisions will Microsoft be able to meet these now lowered expectations?

The past year has not been easy for MSFT investors. The stock price is down 22% over the last 12 months, underperforming the S&P 500 over that same period.

Just this week Microsoft joined the likes of Amazon AMZN, Meta Platforms META and other mega cap tech stocks in large scale layoffs letting go of 10,000 employees. As one of the stock market leaders, Microsoft’s earnings results should provide color for the direction of the broader market.

Earnings Estimates

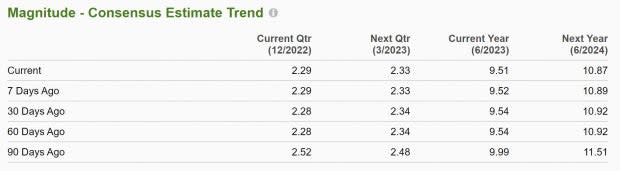

Zacks estimates call for Microsoft’s Q2 FY23 sales to climb 2.3% to $53 billion. Meanwhile, its adjusted earnings are projected to fall 8% YoY to $2.29 per share. Microsoft will report its annual figures during the Q4 FY23 earnings call scheduled for June.

Earnings estimate revisions, Zacks bread and butter, do not look great for the technology giant. Analysts have revised Q2 FY23 earnings estimates lower by 10% over the last 90 days. A bit more promising is that over the last 60 days estimates have remained consistent.

Next quarter, current year, and next year estimates have followed a similar pattern.

Image Source: Zacks Investment Research

Earnings Surprises

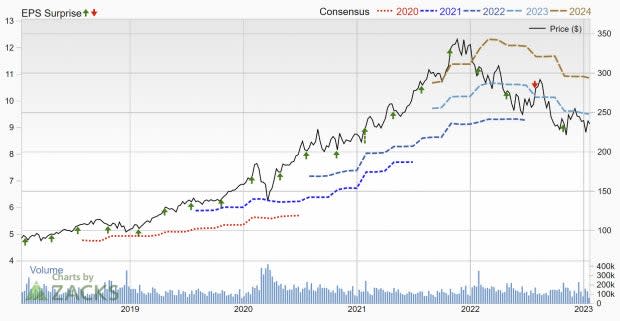

Microsoft is a consistent earner, and earnings almost always surprise to the upside. Q4 FY22 earnings were their first miss since 2016, and although MSFT beat Q1 FY23 expectations, it was the smallest revenue beat since 2018. Additionally, the stock experienced significant volatility, falling 6.5% following the report. It should be noted that the market was amid a sell-off at the time which may have also dragged down MSFT’s share price.

Zacks Earnings ESP (Expected Surprise Prediction) methodology still thinks MSFT can beat. The current forecast is for a small earnings beat of +0.34%.

Image Source: Zacks Investment Research

Business Segments

Microsoft obviously has a diverse suite of products used around the world. From hardware to Windows OS, Office, gaming, Teams among many others, they are well positioned for the future, which is going exceedingly digital.

There is one segment I want to address, specifically, cloud computing. Cloud is one of Microsoft’s most profitable, fastest growing and now largest business segment. Cloud computing is an amazing business model, but because it is now such a significant portion of MSFT’s sales, I think it may leave earnings a bit more fragile.

Cloud computing is moving from early to mid-cycle adoption. This means it will certainly continue to grow quite fast, but not at the blistering rate seen up until now. Q1 FY23 reports showed YoY Cloud growth of 24%, which sounds amazing, but this is down from 36% growth the year earlier.

Slowing cloud growth combined with the slowing of the economy, especially in white-collar businesses which pay Microsoft’s bills, leave these figures at risk of missing.

OpenAI Investment

An exciting development for Microsoft, and the technology world in general, is the public success of OpenAI and their ChatGPT product. In 2019 Microsoft invested $1 billion in the artificial intelligence research company, which was cofounded by Sam Altman of Y Combinator, and Elon Musk.

Microsoft also invested an additional $10 billion a few weeks ago and valuing the venture at a staggering $29 billion. In a unique deal structure, MSFT will receive 75% of profits until their initial investment is repaid, after which they will hold a 49% stake in the company.

ChatGPT is a product based on OpenAi’s GPT3 technology. GPT3 is an autoregressive language model, which uses deep learning to produce text conversations based on prompts. If you haven’t yet I recommend playing with the application. It’s definitely not perfect, but something worth seeing in action.

Integrating this technology is a long-term development in Microsoft’s business but may have wide-reaching and potentially world altering effects.

You don’t need to look far to see Microsoft’s savviness when it comes to investing. The LinkedIn acquisition has given them access to 875 million users, and 17% YoY earnings growth on the platform.

Valuation

Without a doubt, Microsoft’s business is as good as they get. It is so widely held by institutions because over a long enough period you are going to get paid. But I think there are some headwinds for the stock.

The big layoffs this week were significant. It should be noted that over the last few years big tech companies have hired many more people than they have fired. But it seems the post Covid boom pulled forward a lot of spending and MSFT may have to reverse more of that over expansion.

Microsoft is currently trading at a P/E of 23x, above the sector’s 21x, and its 15-year median of 17x. In the past Microsoft’s P/E ratio has dipped below the industry and even the S&P’s P/E during tough times.

Nobody knows if that will happen again, but MSFT stock doesn’t appear to be trading at a discount. At this price you will be buying shares above the median valuation, and with a current Zack’s Rank #4 (Sell), it’s possible you may be able to buy shares at a discount in the future.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Microsoft’s earnings should be eventful. MSFT and the other major tech companies experienced very tough drawdowns in their stock prices during 2022, but are they done? After the epic, decade long FANGMAN rally, I think it’s possible a bit more downside is in store.

Looking at the weekly price chart of MSFT gives some interesting clues. At ~$230 MSFT stock is trading in a balance area. If the price can trade, and close below the $220 level, it opens up downside to test the pre Covid highs of $190. Below $190 would be an appealing price to buy Microsoft stock.

Alternatively, if price can hold up, and trade above ~$245, it may signal an end to the correction.

Image Source: Tradingview

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report