The Price Is Right For FitLife Brands, Inc. (NASDAQ:FTLF)

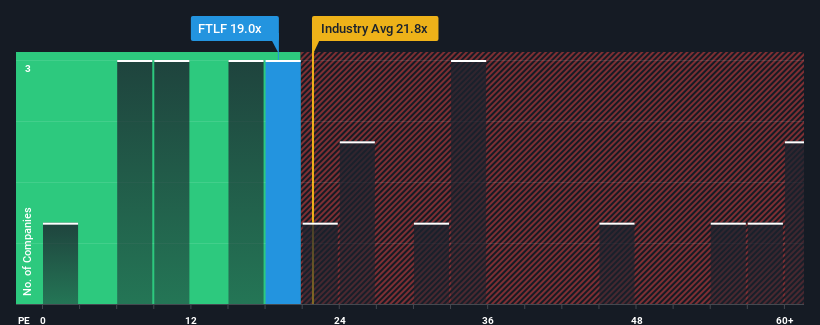

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 15x, you may consider FitLife Brands, Inc. (NASDAQ:FTLF) as a stock to potentially avoid with its 19x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at FitLife Brands over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for FitLife Brands

Although there are no analyst estimates available for FitLife Brands, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Enough Growth For FitLife Brands?

In order to justify its P/E ratio, FitLife Brands would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 54% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 7.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why FitLife Brands is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that FitLife Brands maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for FitLife Brands that we have uncovered.

If these risks are making you reconsider your opinion on FitLife Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.