The Price Is Right For Veru Inc. (NASDAQ:VERU) Even After Diving 29%

Veru Inc. (NASDAQ:VERU) shares have had a horrible month, losing 29% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 84% loss during that time.

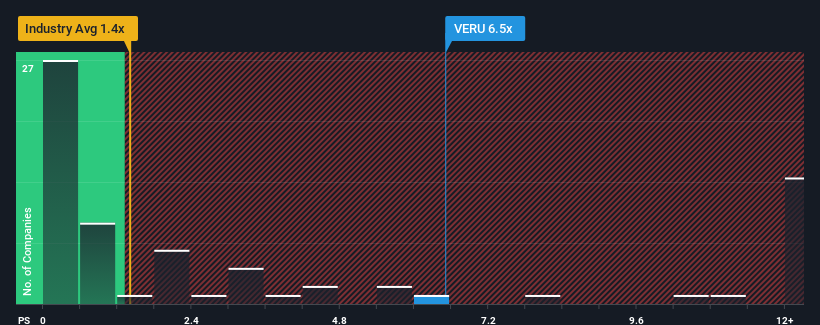

In spite of the heavy fall in price, you could still be forgiven for thinking Veru is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in the United States' Personal Products industry have P/S ratios below 1.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Veru

What Does Veru's Recent Performance Look Like?

Veru could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Veru.

What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Veru would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 59% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 62% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 116% per year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 5.7% per annum growth forecast for the broader industry.

With this information, we can see why Veru is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Even after such a strong price drop, Veru's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Veru maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Personal Products industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Veru has 3 warning signs (and 1 which can't be ignored) we think you should know about.

If you're unsure about the strength of Veru's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.