PriceSmart's (PSMT) Q1 Earnings & Revenues Increase Y/Y

PriceSmart, Inc. PSMT delivered first-quarter fiscal 2020 results, wherein the top and bottom lines increased year over year. Also, comparable net merchandise sales (comps) increased despite foreign currency headwinds.

The company reported quarterly earnings of 64 cents a share. In the prior-year quarter, it reported earnings of 48 cents a share, which included the negative impact of 13 cents a share from the separation related costs associated with the resignation of its chief executive officer. The increase in bottom line can be attributed to growth in revenues.

Total revenues grew 4.1% to $811.9 million from $779.6 million reported in the prior-year quarter. Net merchandise sales rose 4.2% to $778.7 million, including adverse currency impacts of about 1.6%. Export sales improved 1% to $8.3 million, while membership income increased 7.9% to $13.7 million. Other revenues and income came in at $11.2 million compared with $11.3 million in the year-ago quarter.

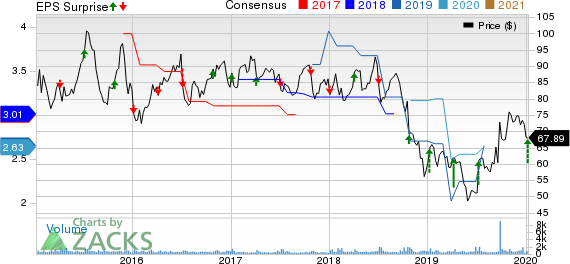

PriceSmart, Inc. Price, Consensus and EPS Surprise

PriceSmart, Inc. price-consensus-eps-surprise-chart | PriceSmart, Inc. Quote

Comparable net merchandise sales for the 41 warehouse clubs increased 1%. The metric was adversely impacted by currency rate fluctuations to the tune of $11.3 million or 1.5%.

Warehouse club and other operations expenses came in at $79.4 million, up 6.9% from the year-ago quarter.

General and administrative expenses decreased 5.3% to roughly $25.9 million. Pre-opening expenses came in at $953,000, up from $15,000 in the year-ago quarter.

Other Financial Aspects

PriceSmart, which operates 45 warehouse clubs, ended the quarter with cash and cash equivalents of $111.4 million and long-term debt (including current portion) of $111.8 million. The company’s shareholders’ equity was $816.8 million, excluding non-controlling interests.

Notably, shares of this operator of membership warehouse clubs have increased approximately 20% in the past six months compared with the industry’s growth of 12.4%.

Key Picks

Ross Stores, Inc. ROST has a long-term earnings growth rate of 10.5% and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dollar General Corporation DG has a long-term earnings growth rate of 11.4% and a Zacks Rank #2.

Target Corporation TGT has a long-term earnings growth rate of 7.5% and a Zacks Rank #2.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

PriceSmart, Inc. (PSMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research