Pricing Actions, Acquisitions Aid Timken (TKR) Amid High Costs

The Timken Company TKR is expected to benefit from strong demand in the food and beverage industry, and price realization. The company’s strategic acquisitions to broaden its portfolio and capabilities across diverse markets, with a focus on bearings, adjacent power transmission products and related services, will continue to drive growth. However, higher manufacturing and selling, general and administrative expenses, as well as elevated interest expenses, are expected to hurt earnings.

The company’s efforts to grow its wind and solar businesses will be key catalysts, considering the growing demand for renewable energy.

Solid Demand Bodes Well

Timken is experiencing strong demand for its broad range of products and services in the food and beverage industry. It has witnessed a sales CAGR of more than 30% in the market over the last five years, aided by the solid portfolio that it has built through the years. Timken’s expanding global footprint, new and innovative products and growing demand for food are expected to fuel growth in the coming years. The market for food and beverage processing equipment is estimated to increase from $64.6 billion in 2023 to $84.9 billion by 2028.

Demand for the company’s products will remain strong in the years to come. Its diversity in terms of end market, customer and geography, product innovation, and engineering expertise provides it with a competitive edge.

Over the past few years, the company has been focused on building its renewable energy portfolio through innovation and acquisitions. Renewable energy is currently Timken’s largest individual end-market sector, generating 10% of sales in 2022 compared with 5% in 2018. The global demand for renewable energy is expected to witness a CAGR of around 8% over the next 10 years. The share of electricity generation from renewable is expected to more than double by 2030.

Thus, the company is focused on targeted investments in this sector to capitalize on this trend and make it a bigger part of its portfolio in the future.

Strategic Acquisitions to Boost Portfolio

Timken continues to pursue strategic acquisitions to broaden its portfolio and capabilities across diverse markets, with a focus on bearings, adjacent power transmission products and related services. Timken acquired the assets of American Roller Bearing in January 2023, which augmented the company’s market position in engineered bearings. The acquisition of Nadella Group in April 2023 expanded the company’s linear motion portfolio in attractive market sectors.

In the third quarter of 2023, Timken completed the acquisitions of Des-Case and Rosa Sistemi, expanding its Industrial Motion product portfolio. Earlier this month, Timken completed the buyout of iMECH, boosting its Engineered Bearings Portfolio. Taking into account the divestiture of TWB Bearings business in China, the impact of these four transactions is expected to add around $50 million of annual revenues and will be accretive to Timken’s margins.

Solid Balance Sheet to Aid Growth

Timken is taking actions to enhance liquidity, reduce costs and generate a strong cash flow. The company’s total debt-to-capital ratio was 0.38 as of Sep 30, 2023, lower than the industry’s 0.74. The company's times interest earned ratio was 6.8, in line with the industry. Its current ratio is 1.73 compared with the industry’s 1.54. Timken expects free cash flow in 2023 to be around $425 million, higher than its earlier stated range of $400 million. The company has a long-term target of delivering a free cash flow of more than 100% of net income aided by continued focus on working capital and asset efficiency.

Near-Term Concerns

Timken’s margins have been impacted by higher operating costs. Also, labor shortages and supply-chain constraints are expected to persist and may impair the company’s ability to capture the full opportunity that comes with a strong demand environment.

Price Performance

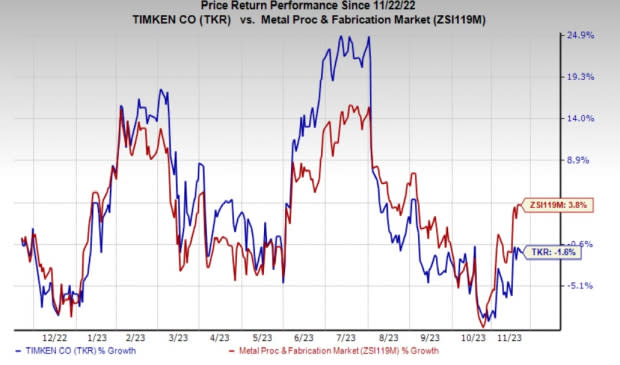

In the past year, shares of Timken have declined 1.6% against the industry’s 3.8% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Timken currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Alamo Group ALG, Flowserve FLS and A. O. Smith AOS. ALG and FLS sport a Zacks Rank #1 (Strong Buy) at present, and AOS has a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Alamo has an average trailing four-quarter earnings surprise of 19.8%. The Zacks Consensus Estimate for ALG’s fiscal 2023 earnings is pegged at $11.59 per share, which indicates year-over-year growth of 34.5%. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. Its shares have gained 24% in the past year.

The Zacks Consensus Estimate for Flowserve’s fiscal 2023 earnings per share is pinned at $2.01, indicating growth of 83% from the prior-year actual. Earnings estimates have moved 2% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 27.3%. FLS shares have gained 20% in the past year.

A. O. Smith has an average trailing four-quarter earnings surprise of 14%. The Zacks Consensus Estimate for AOS’ 2023 earnings is pegged at $3.75 per share. The estimate projects year-over-year growth of 19.4%. Earnings estimates have gone up 4.5% in the past 60 days. AOS shares have gained 23% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Timken Company (The) (TKR) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report