Can Pricing, Demand Shield Church & Dwight (CHD) From Cost Woes?

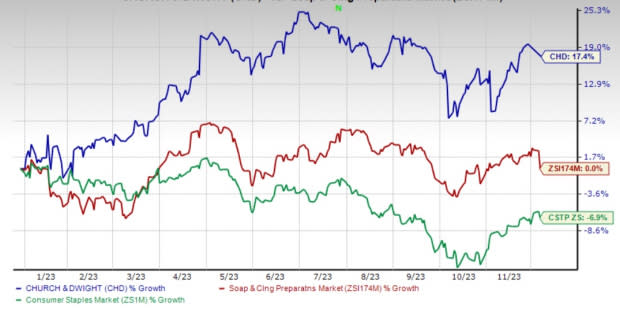

Church & Dwight Co., Inc. CHD has displayed an overall decent performance year to date, comfortably outpacing the industry and the Zacks Consumer Staples sector. The developer, manufacturer and marketer of household, personal care and specialty products has seen its shares rally 17.4% year to date compared with the industry’s breakeven performance. Meanwhile, the Zacks Consumer Staples sector has declined 6.9% in the same period.

The company's success is attributed to robust consumer demand, bolstered by consistent innovation, new product launches and strategic acquisitions. These upsides, along with efficient pricing and productivity gains, have been working well for this Zacks Rank #3 (Hold) company amid manufacturing cost inflation and escalated SG&A expenses and marketing costs.

Factors Narrating CHD’s Growth Tale

Church & Dwight has prioritized product innovation as a key driver of its growth strategy. On its third-quarter earnings call, Church & Dwight announced the online launch of ARM & HAMMER Power Sheets laundry detergent. Additionally, the company unveiled ARM & HAMMER Hardball, strategically targeting a larger share of the lightweight litter category. Similarly, the TROJAN brand is capitalizing on the success of the Raw franchise with the introduction of the new TROJAN Raw Non-Latex condom.

Management further highlighted that the THERABREATH brand has extended operations to the kids’ category with the launch of three new fluoride types of mouthwashes. The NAIR brand has introduced Prep & Smooth, a one-step solution that preps the face for makeup application in a No-Touch, No-Mess format. The company’s HERO brand remains focused on undertaking innovation in the acne treatment arena.

Church & Dwight has expanded its portfolio through the acquisition of various high-margin brands, playing a pivotal role in its top-line growth. The company recently completed the buyout of the Hero Mighty Patch brand (or Hero) and other acne treatment products. In December 2021, CHD concluded the buyout of TheraBreath, which marks the company's 14th power brand. THERABREATH mouthwash and the HERO brand delivered impressive consumption growth and grew market share in the third quarter of 2023.

Image Source: Zacks Investment Research

Leveraging Pricing Strategies Amid Elevated Costs

Church & Dwight has been witnessing increasing marketing and SG&A expenses for the past few quarters. The company has been undertaking increased marketing to fuel brand awareness, especially for new products and acquired brands. Management continues to expect increased SG&A expenses in 2023, both on a dollar basis and as a percentage of sales. The expected increase in SG&A can be attributed to additional R&D investments and elevated incentive compensation, among other factors.

Management expects marketing as a percentage of net sales to be 11% in 2023, reflecting an increase from 10% in 2022. Church & Dwight expects SG&A expenses and marketing costs to increase considerably year over year in the fourth quarter of 2023. Though the company expects gross profit expansion in the fourth quarter and full year 2023, high SG&A expenses and elevated marketing spend are likely to affect the EPS. Apart from this, CHD expects elevated manufacturing costs to the tune of nearly $120 million in 2023.

In response to escalating costs, Church & Dwight has implemented incremental pricing strategies across its product portfolio. Pricing remained a positive contributor to the company's organic sales performance in the third quarter of 2023. Organic sales increased 4.8% due to gains from volumes to the tune of 2.7% and a favorable product mix and pricing of 2.1%. Another factor working for CHD is the online channel. The company’s global online sales continued to grow in the third quarter. Global online sales, as a percentage of total consumer sales, stood at 17%.

For 2023, the company anticipates organic sales growth of nearly 5%. For the fourth quarter, Church & Dwight estimates organic sales growth of roughly 4%.

3 Appetizing Picks

The Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2 (Buy). KHC has a trailing four-quarter earnings surprise of 9.9%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kraft Heinz’s current financial-year sales and earnings suggests growth of 1.1% and 6.5%, respectively, from the year-ago reported numbers.

Celsius Holdings, Inc. CELH, which develops, processes, markets, distributes and sells functional drinks and liquid supplements, holds a Zacks Rank #2. CELH has a trailing four-quarter earnings surprise of 110.9%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 98.5% and 184.1%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29.4% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report