Pricing & Energy Drinks Demand to Aid Monster Beverage (MNST)

Monster Beverage Corporation MNST has been in good stride, driven by continued strength in its energy drinks category. Product launches and innovation as well as pricing actions bode well. Pricing increases, along with lower freight-in costs and reduced aluminum can costs, have been contributing to robust margins.

The company’s steady lineup of product launches is likely to help retain its business momentum. It is anticipated to reap gains from its strong distribution network in international markets and investments in growth opportunities.

Backed by these trends, Monster Beverage’s top and bottom lines improved year over year in third-quarter 2023. Its earnings advanced 36.7%, while sales improved 14.3%. Results gained from an expansion of the energy drinks category and product launches.

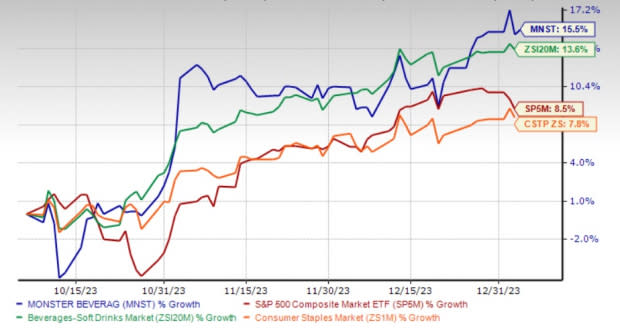

The Zacks Rank #3 (Hold) company has a market capitalization of $59.8 billion. In the past year, shares of the company have gained 15.5% compared with the industry’s growth of 13.6%. The stock also outpaced the sector and the S&P 500’s growth of 7.8% and 8.5%, respectively, in the same period.

The Zacks Consensus Estimate for MNST’s 2023 sales and earnings indicates growth of 13.3% and 39.3%, respectively, from the year-ago registered numbers.

Image Source: Zacks Investment Research

Trends Favoring Monster Beverage

Monster Beverage is benefiting from continued expansion of the energy drink market worldwide. This growth indicates a steady rise in consumer demand for energy drinks, providing a favorable environment for MNST to increase its market share.

Amid these positive market trends, its energy drinks segment has been the key contributor to its revenues. The company’s portfolio includes a diverse range of energy drink brands, leading to a 13.7% year-over-year increase in net sales for the Monster Energy Drinks segment in third-quarter 2023.

Additionally, management has strategically adjusted its pricing in response to the ongoing inflationary cost pressures. These pricing actions are designed to balance the need to offset increased costs, while maintaining customer loyalty and demand. These efforts resulted in a 170 basis points gross margin expansion to 53% in the third quarter and a 22% year-over-year rise in operating income.

Product innovation has been a crucial driver of MNST's success. In the third quarter, it launched its first flavored-malt-beverage alcohol product, The Beast Unleashed, in the United States, receiving positive feedback. The product is now available in 43 states, with plans for nationwide distribution. An extension of its product line, Nasty Beast Hardcore Tea, is slated for release, targeting nationwide distribution in the first half of 2024.

Cost Hurdles

Monster Beverage has been witnessing rising costs. The shift in consumers’ preferences is impacting the volumes of soda beverages and energy drinks. Its profits and margins are particularly pressured due to higher product-mix costs and stepped-up advertising expense.

Key Picks

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Dutch Bros BROS, Fomento Economico Mexicano FMX and Molson Coors TAP.

Dutch Bros currently sports a Zacks Rank #1 (Strong Buy). BROS has a trailing four-quarter earnings surprise of 57.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and earnings indicates growth of 30.6% and 81.3%, respectively, from the prior-year levels. The consensus mark for BROS’ earnings per share (EPS) has remained unchanged in the past 30 days.

Fomento Economico Mexicano, alias FEMSA, currently flaunts a Zacks Rank #1. FMX has a trailing four-quarter earnings surprise of 23.2%, on average.

The Zacks Consensus Estimate for FEMSA’s current financial-year sales and earnings indicates a rise of 32.3% and 60.3%, respectively, from the year-ago numbers. The consensus mark for FMX’s EPS has remained unchanged in the past 30 days.

Molson Coors currently carries a Zacks Rank #2 (Buy). TAP has a trailing four-quarter earnings surprise of 41.3%, on average.

The Zacks Consensus Estimate for Molson Coors’ current financial year’s sales and earnings implies an improvement of 9.1% and 28.8%, respectively, from the year-earlier actuals. The consensus mark for TAP’s EPS has remained unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report