PRIMECAP Management Adjusts Portfolio, Notably Trims Eli Lilly Stake

Insight into PRIMECAP Management (Trades, Portfolio)'s Latest 13F Filings for Q3 2023

PRIMECAP Management (Trades, Portfolio), a distinguished investment firm known for its value-driven approach and long-term investment horizon, has disclosed its 13F holdings for the third quarter of 2023. Founded in 1983 and based in Pasadena, CA, PRIMECAP is renowned for its commitment to fundamental research and individual decision-making. The firm's investment strategy often involves identifying undervalued stocks, particularly in sectors that are currently out of favor, and holding onto these investments until the market recognizes their true value.

New Additions to PRIMECAP's Portfolio

During the third quarter, PRIMECAP Management (Trades, Portfolio) expanded its portfolio with 10 new stock positions:

ARM Holdings PLC (NASDAQ:ARM) was the most significant new addition, with 973,000 shares valued at $52.07 million, making up 0.04% of the portfolio.

KeyCorp (NYSE:KEY) followed, with 2,187,600 shares worth approximately $23.54 million, accounting for 0.02% of the portfolio.

Moog Inc (NYSE:MOG.A) was also a notable addition, with 233,700 shares valued at $26.40 million, representing 0.02% of the portfolio.

PRIMECAP Increases Stakes in Key Holdings

PRIMECAP Management (Trades, Portfolio) also raised its stakes in 59 companies:

Intel Corp (NASDAQ:INTC) saw a significant increase of 4,226,790 shares, bringing the total to 74,762,291 shares. This represents a 5.99% increase in share count and a 0.13% impact on the portfolio, with a total value of $2.66 billion.

Seagen Inc (NASDAQ:SGEN) had an additional 222,990 shares added, resulting in a total of 6,261,798 shares. This adjustment marks a 3.69% increase in share count, with a total value of $1.33 billion.

Exiting Positions

In the same quarter, PRIMECAP Management (Trades, Portfolio) exited seven positions:

O'Reilly Automotive Inc (NASDAQ:ORLY) was completely sold off, with all 11,000 shares liquidated, impacting the portfolio by -0.01%.

AutoZone Inc (NYSE:AZO) also saw a complete exit, with 2,750 shares sold, causing a -0.01% impact on the portfolio.

Significant Reductions in PRIMECAP's Holdings

PRIMECAP Management (Trades, Portfolio) reduced its positions in 207 stocks. The most significant reductions include:

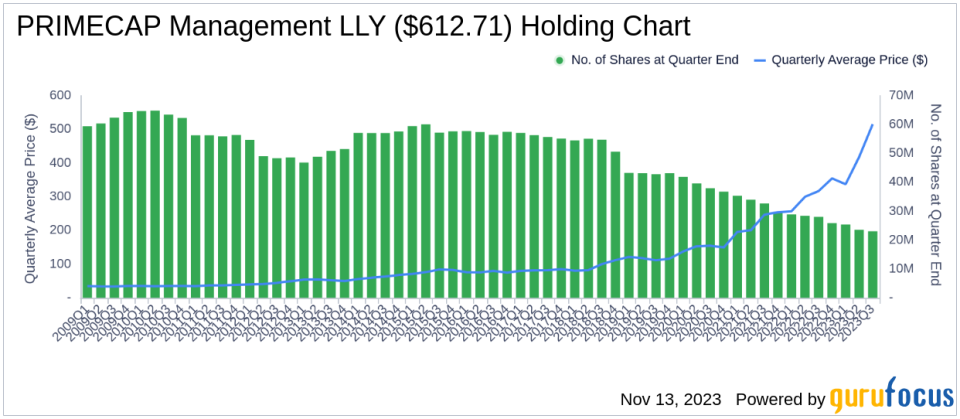

Eli Lilly and Co (NYSE:LLY) was reduced by 482,665 shares, leading to a -2.05% decrease in shares and a -0.19% impact on the portfolio. The stock traded at an average price of $515.29 during the quarter and has seen a 16.38% return over the past three months and a 69.04% year-to-date return.

Fidelity National Information Services Inc (NYSE:FIS) was cut by 1,628,885 shares, resulting in a -46.95% reduction in shares and a -0.08% impact on the portfolio. The stock's average trading price was $57.55 for the quarter, with a -5.99% return over the past three months and a -20.61% year-to-date return.

Portfolio Overview

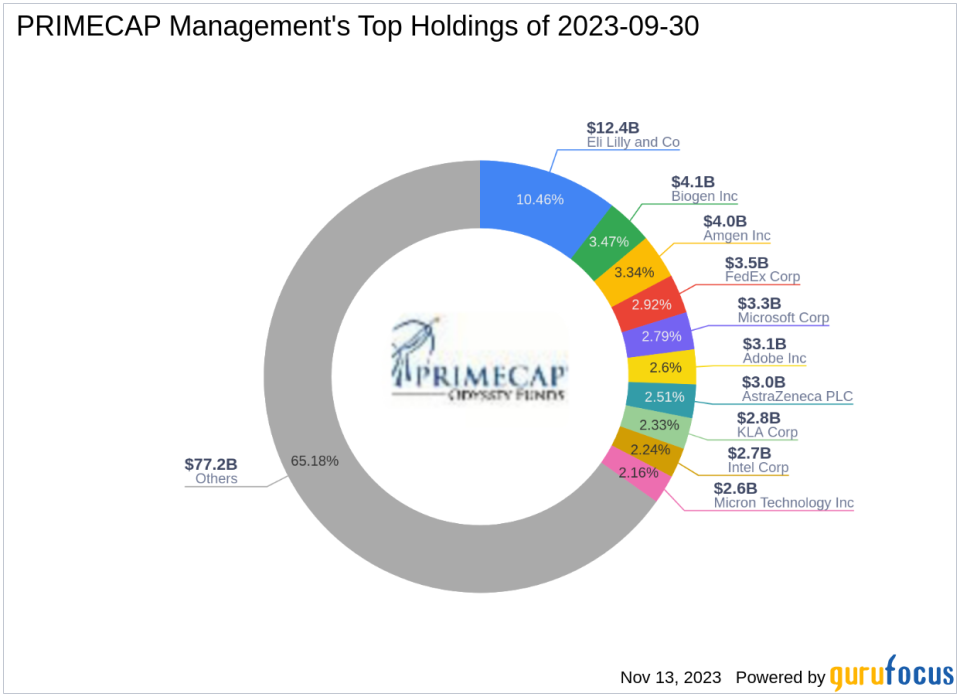

As of the third quarter of 2023, PRIMECAP Management (Trades, Portfolio)'s portfolio comprised 333 stocks. The top holdings included 10.46% in Eli Lilly and Co (NYSE:LLY), 3.47% in Biogen Inc (NASDAQ:BIIB), 3.34% in Amgen Inc (NASDAQ:AMGN), 2.92% in FedEx Corp (NYSE:FDX), and 2.79% in Microsoft Corp (NASDAQ:MSFT). The investments are predominantly concentrated across 11 industries, with a particular focus on Healthcare, Technology, and Industrials.

For value investors and those interested in PRIMECAP Management (Trades, Portfolio)'s investment strategies, the latest 13F filings provide a window into the firm's current market positions and adjustments. These insights can serve as a valuable resource for informed financial decision-making and portfolio management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.