PRIMECAP Management Adjusts Stake in AECOM

Overview of PRIMECAP Management (Trades, Portfolio)'s Recent Stock Transaction

PRIMECAP Management (Trades, Portfolio), a notable investment firm, has recently made a significant adjustment to its holdings in AECOM (NYSE:ACM), a leading global provider of design, engineering, and construction services. On December 31, 2023, the firm reduced its position in AECOM, signaling a strategic shift in its investment portfolio.

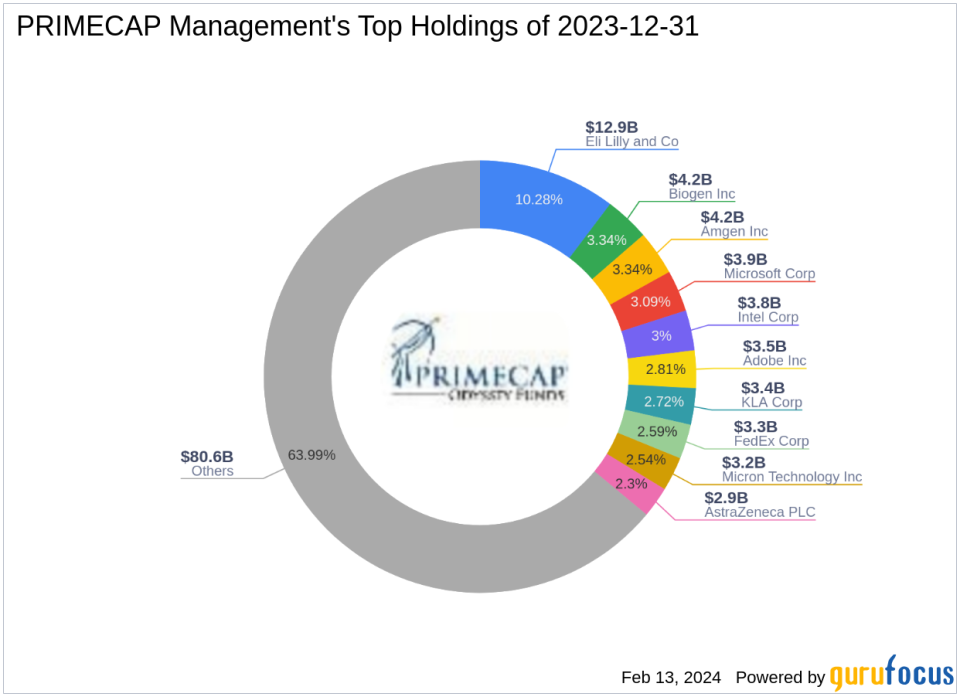

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) has established itself as an independent investment management company with a focus on U.S.-centered equity portfolios. The firm's investment philosophy is rooted in four key principles: individual decision-making, a commitment to fundamental research, a long-term investment horizon, and a focus on value. PRIMECAP Management (Trades, Portfolio) is known for its multi-counselor investment model, which grants each portfolio manager autonomy over a distinct portion of the fund. The firm's top holdings include prominent companies such as Amgen Inc (NASDAQ:AMGN), Biogen Inc (NASDAQ:BIIB), and Microsoft Corp (NASDAQ:MSFT), with a strong presence in the technology and healthcare sectors. As of the latest data, PRIMECAP Management (Trades, Portfolio) oversees an equity portfolio valued at $125.95 billion.

AECOM's Business and Financial Performance

AECOM, traded under the symbol ACM, operates across various segments including AECOM Capital, Americas, and International. Since its IPO on May 10, 2007, the company has expanded its global footprint to over 150 countries and employs approximately 51,000 individuals. In fiscal 2023, AECOM reported $14.4 billion in sales and $847 million in adjusted operating income. Despite a PE ratio of 200.47, indicating a high valuation relative to earnings, the company is considered "Fairly Valued" according to the GF Value with a score of 84.16. AECOM's current market capitalization stands at $12.27 billion, with a stock price of $90.21, slightly below the trade price of $92.43.

Details of PRIMECAP Management (Trades, Portfolio)'s Transaction in AECOM

The transaction, which took place on December 31, 2023, saw PRIMECAP Management (Trades, Portfolio) reduce its stake in AECOM by 575,660 shares, resulting in a 3.95% decrease in their holdings. This adjustment had a minor impact of -0.04% on the firm's portfolio, leaving PRIMECAP Management (Trades, Portfolio) with a total of 14,009,719 shares in AECOM, which now represents 1.09% of their portfolio and 10.30% of their holdings in the traded stock.

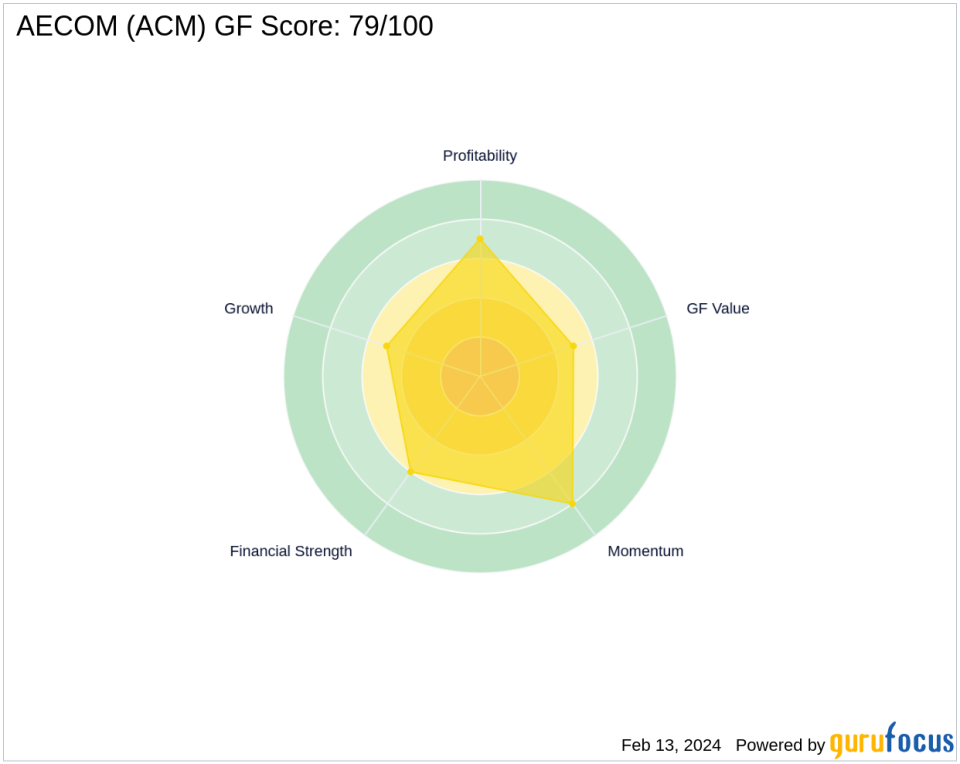

Market Analysis and Performance Metrics of AECOM

AECOM's stock currently trades at $90.21, which is close to the GF Value, suggesting the stock is fairly valued with a price to GF Value ratio of 1.07. The company's GF Score stands at 79/100, indicating likely average performance. AECOM's financial strength and profitability rank are 6/10 and 7/10, respectively, while its growth rank and GF Value rank are both at 5/10. The stock's momentum rank is high at 8/10, supported by a Piotroski F-Score of 7, indicating a healthy financial situation.

Sector Focus and Other Gurus' Interest in AECOM

PRIMECAP Management (Trades, Portfolio)'s top sectors include technology and healthcare, reflecting the firm's strategic investment preferences. AECOM, being part of the construction industry, represents a diversification within PRIMECAP's portfolio. Other notable investors in AECOM include gurus like Joel Greenblatt (Trades, Portfolio) and Ken Fisher (Trades, Portfolio), suggesting a broader interest in the company among savvy market players.

Conclusion: The Impact of PRIMECAP Management (Trades, Portfolio)'s AECOM Trade

The recent reduction in AECOM shares by PRIMECAP Management (Trades, Portfolio) may reflect a tactical decision based on the firm's investment strategy and market outlook. Despite the reduction, AECOM remains a significant holding for the firm, and its position in the market appears stable, with potential for future growth. Investors will be watching closely to see how this transaction influences both PRIMECAP Management (Trades, Portfolio)'s portfolio and AECOM's stock performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.