PRIMECAP Management Adjusts Stake in iRobot Corp

Overview of PRIMECAP Management (Trades, Portfolio)'s Recent Stock Transaction

PRIMECAP Management (Trades, Portfolio), a notable investment firm, has recently altered its investment in iRobot Corp (NASDAQ:IRBT), a leading consumer robot company. On December 31, 2023, the firm reduced its holdings by 32,000 shares, which adjusted its total share count to 1,761,755. Despite the reduction, PRIMECAP Management (Trades, Portfolio) maintains a 0.06% position in its portfolio, reflecting a 6.32% ownership of iRobot Corp's outstanding shares. The transaction was executed at a trade price of $38.70 per share.

PRIMECAP Management (Trades, Portfolio)'s Investment Approach

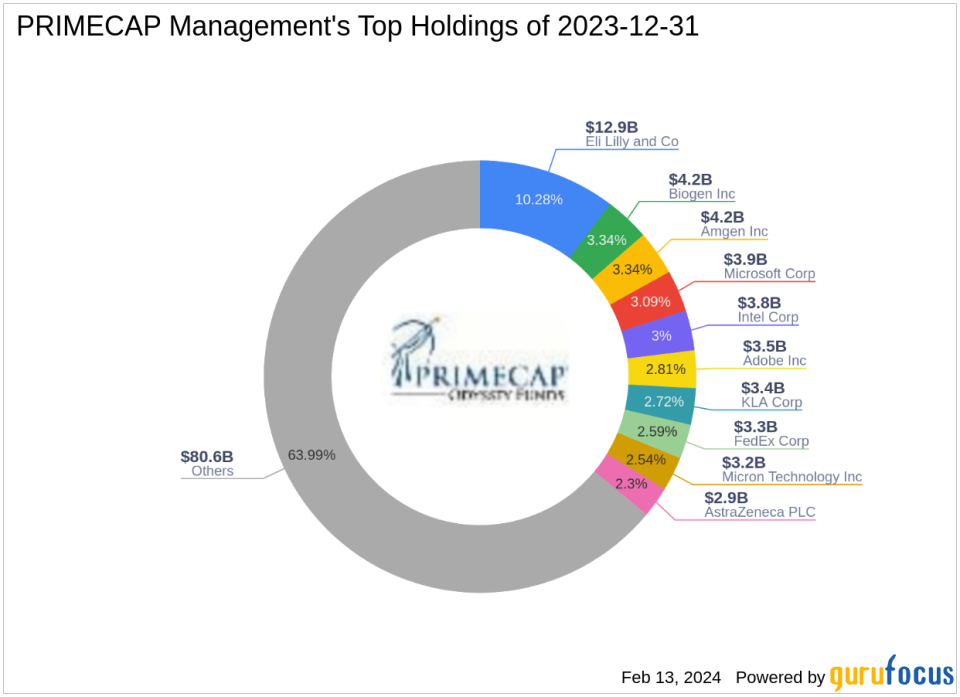

Founded in 1983, PRIMECAP Management (Trades, Portfolio) operates from Pasadena, CA, managing equity portfolios for institutions and mutual funds. The firm's investment philosophy is rooted in four key principles: individual decision-making, fundamental research, a long-term horizon, and a focus on value. PRIMECAP Management (Trades, Portfolio) is known for its multi-counselor investment model, allowing portfolio managers autonomy over distinct portions of the funds. The firm's top holdings include prominent companies such as Amgen Inc (NASDAQ:AMGN), Biogen Inc (NASDAQ:BIIB), and Microsoft Corp (NASDAQ:MSFT), with a strong inclination towards the technology and healthcare sectors. The firm's equity assets total $125.95 billion, showcasing its significant market influence.

iRobot Corp's Market Presence

iRobot Corp, headquartered in the USA, has been a pioneer in the consumer robot industry since its IPO on November 9, 2005. The company specializes in designing and building robots that aid in various household tasks. Despite its innovative product line, iRobot Corp's financial performance has been under scrutiny, with a current market capitalization of $363.091 million and a stock price of $13.03, significantly lower than the trade price. The company's stock is currently labeled as a "Possible Value Trap" by GuruFocus, urging investors to think twice due to its GF Value of $37.92 and a price to GF Value ratio of 0.34.

Trade Impact Analysis

The recent trade by PRIMECAP Management (Trades, Portfolio) has had no significant impact (0) on its portfolio, which could be attributed to the firm's strategy of long-term value investment and the relatively small position size of iRobot Corp within its extensive portfolio. The firm's decision to reduce its stake might reflect a strategic adjustment rather than a shift in its overall investment philosophy.

iRobot Corp's Stock Performance and Valuation

iRobot Corp's stock has experienced a substantial decline, with a -66.33% change since the transaction date, and a year-to-date performance also down by -66.19%. When compared to its IPO, the stock has decreased by -57.14%. These figures indicate a challenging period for the company in the stock market.

PRIMECAP Management (Trades, Portfolio)'s Position Post-Transaction

Following the transaction, PRIMECAP Management (Trades, Portfolio)'s remaining shareholding in iRobot Corp stands at 1,761,755 shares. Although the firm has reduced its stake, iRobot Corp still holds a place in its diverse portfolio, signifying a continued, albeit smaller, investment interest.

Financial Health and Future Prospects of iRobot Corp

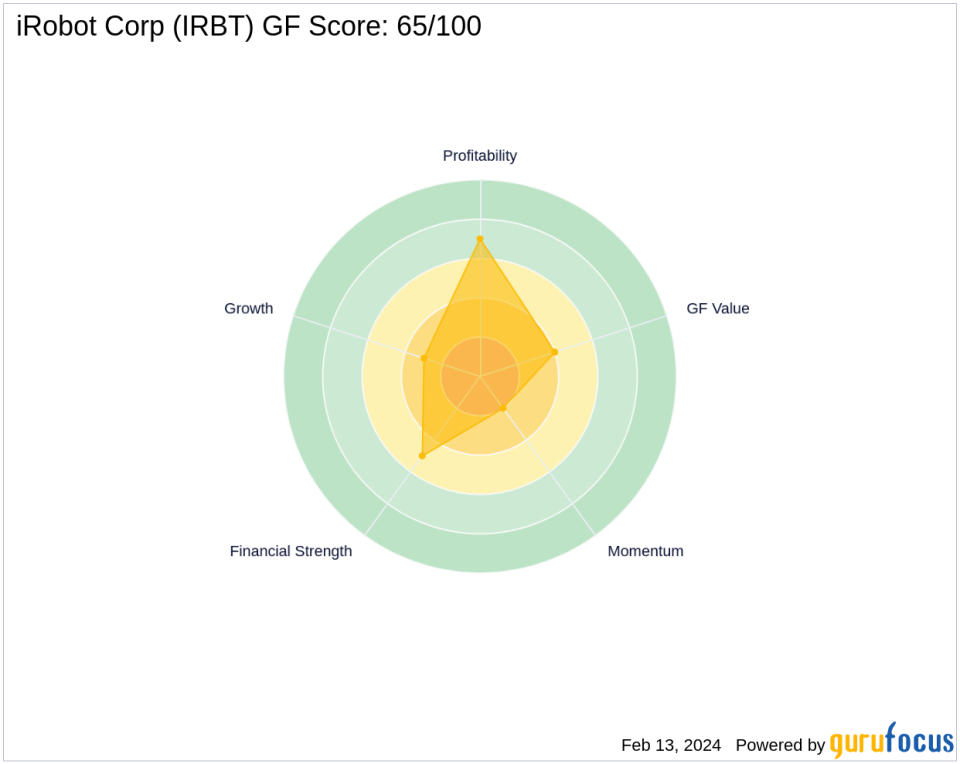

iRobot Corp's financial health presents a mixed picture. The company's Financial Strength is rated at 5/10, while its Profitability Rank stands at 7/10. However, its Growth Rank is a low 3/10, and the GF Value Rank is at 4/10, indicating potential concerns regarding its valuation and growth prospects. The company's Piotroski F-Score is 2, suggesting poor business operation, and the Altman Z score of 0.52 indicates financial distress.

Broader Investment Community on iRobot Corp

Other notable investors in iRobot Corp include GAMCO Investors and Joel Greenblatt (Trades, Portfolio). The actions of these seasoned investors, alongside PRIMECAP Management (Trades, Portfolio)'s recent trade, provide a broader context for evaluating iRobot Corp's appeal to the investment community.

In conclusion, PRIMECAP Management (Trades, Portfolio)'s recent reduction in iRobot Corp shares reflects a strategic portfolio adjustment. While the firm's long-term value investment approach remains unchanged, the current financial indicators and market performance of iRobot Corp suggest caution for potential investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.