PRIMECAP Management Adjusts Stake in NetApp Inc

On the last day of 2023, PRIMECAP Management (Trades, Portfolio) executed a notable transaction involving shares of NetApp Inc (NASDAQ:NTAP). The firm reduced its position in the data management and storage solutions provider by 530,990 shares, which resulted in a 3.48% decrease in their holdings. This trade impacted PRIMECAP Management (Trades, Portfolio)'s portfolio by a mere 0.04%, with the shares being traded at a price of $88.16 each. Following this transaction, the firm's total share count in NetApp stood at 14,709,824, making up 1.1% of its portfolio and representing a 7.14% ownership stake in the company.

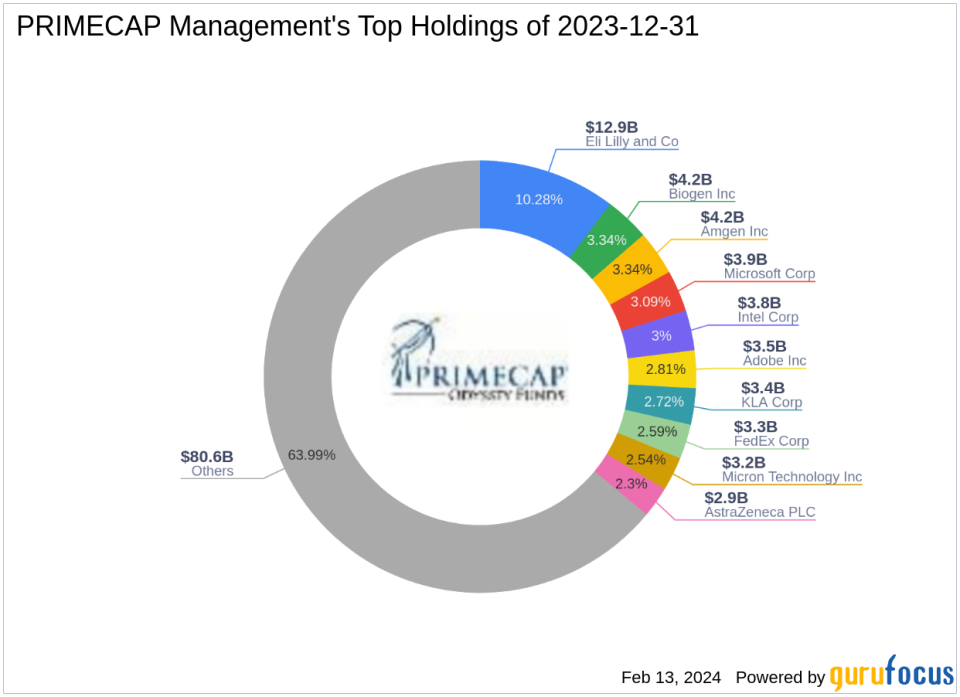

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) Company has established itself as a respected independent investment management firm based in Pasadena, CA. The firm manages equity portfolios primarily for institutions and mutual funds in the United States. PRIMECAP Management (Trades, Portfolio) is known for its long-term investment horizon and a focus on value, guided by individual decision-making, a commitment to fundamental research, and a multi-counselor investment model. The firm's investment philosophy is to identify undervalued stocks that have the potential to outperform the market over a three to five-year period, often starting with companies and industries that are currently out of favor.

NetApp Inc at a Glance

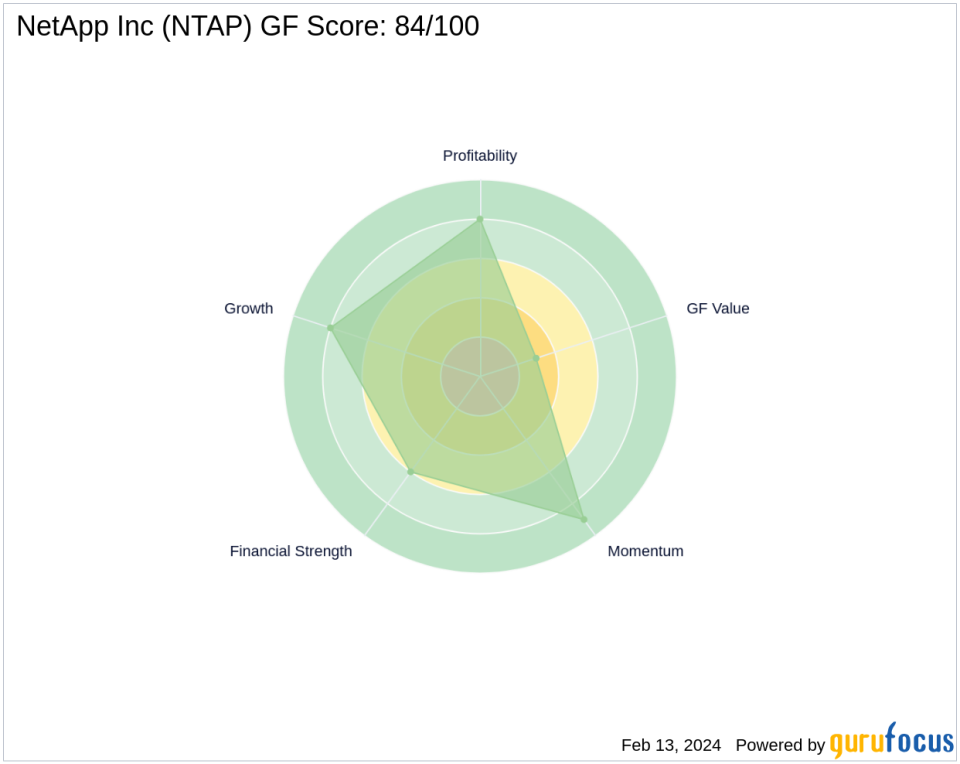

NetApp Inc, with its segments in Hybrid Cloud and Public Cloud, is a leader in enterprise data management and storage solutions. The company has been successful in integrating traditional data centers with cloud capabilities, generating the majority of its revenue from the Hybrid Cloud segment. As of the latest data, NetApp boasts a market capitalization of $18.05 billion and a PE ratio of 27.20, indicating profitability. However, the stock is currently considered modestly overvalued with a GF Value of $78.34 and a price to GF Value ratio of 1.12. NetApp's stock performance indicators, such as a GF Score of 84/100, suggest good outperformance potential.

Impact of PRIMECAP Management (Trades, Portfolio)'s Trade

The recent reduction in NetApp shares by PRIMECAP Management (Trades, Portfolio) has slightly altered the firm's investment landscape. Despite the trade, NetApp remains a significant holding, accounting for 1.1% of PRIMECAP's portfolio. The trade price of $88.16 reflects a slight decrease in stock value, with the current stock price at $87.6, down by 0.64% since the transaction. This move by PRIMECAP Management (Trades, Portfolio) could be a strategic adjustment rather than a shift in conviction, as the firm still maintains a substantial position in NetApp.

NetApp's Market Performance and Financial Health

NetApp's stock has experienced a year-to-date percentage change of 1.61%, with an impressive 6743.75% increase since its IPO. The company's financial health is solid, with a Financial Strength rank of 6/10 and a Profitability Rank of 8/10. The Piotroski F-Score of 6 indicates a relatively stable financial situation, while the Altman Z-Score of 2.44 suggests that the company is not in any immediate financial distress.

NetApp in the Hardware Industry

Within the hardware industry, NetApp stands out for its innovative cloud-integrated storage solutions. PRIMECAP Management (Trades, Portfolio)'s top sectors include Technology and Healthcare, with NetApp aligning with the firm's technology sector interests. The company's growth and profitability have positioned it well within its industry, reflecting PRIMECAP Management (Trades, Portfolio)'s investment strategy of focusing on value and long-term growth potential.

Other Notable Investors in NetApp

Ariel Investment, LLC is currently the largest guru shareholder in NetApp, while other notable investors include Jefferies Group (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). The presence of these prominent investors underscores the attractiveness of NetApp as an investment opportunity and validates the company's strong market position and potential for growth.

In conclusion, PRIMECAP Management (Trades, Portfolio)'s recent transaction in NetApp shares represents a minor adjustment in its portfolio. The firm's long-term investment philosophy and the company's solid financial metrics suggest that PRIMECAP Management (Trades, Portfolio) continues to see value in NetApp Inc. Investors will be watching closely to see how this position evolves in the context of the firm's overall investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.