PRIMECAP Management Bolsters Stake in Biomarin Pharmaceutical Inc

On the last day of 2023, PRIMECAP Management (Trades, Portfolio) made a notable addition to its investment portfolio by acquiring additional shares in Biomarin Pharmaceutical Inc (NASDAQ:BMRN). The transaction, dated December 31, 2023, saw the firm adding 7,835 shares at a trade price of $96.42. This move increased PRIMECAP Management (Trades, Portfolio)'s total holdings in the company to 18,414,374 shares, solidifying its position with a 1.5% portfolio weight and a 9.78% stake in Biomarin Pharmaceutical.

PRIMECAP Management (Trades, Portfolio)'s Investment Approach

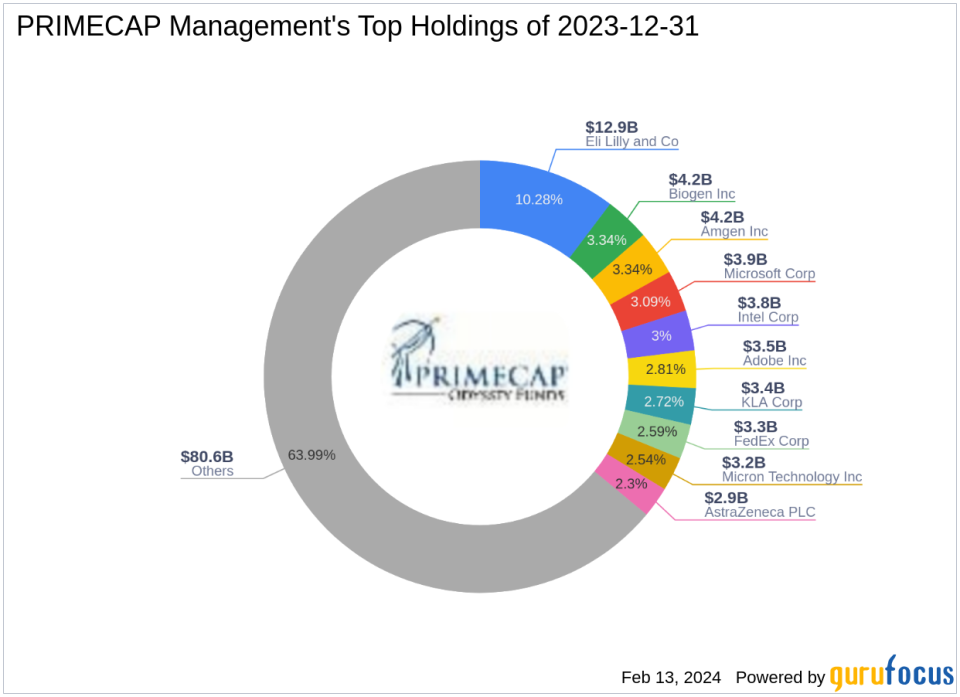

Founded in 1983, PRIMECAP Management (Trades, Portfolio) has established itself as a stalwart in the investment community, managing equity portfolios with a keen focus on the US market. The firm's investment philosophy is rooted in four key principles: individual decision-making, rigorous fundamental research, a long-term investment horizon, and a relentless pursuit of value. With a multi-counselor investment model, each portfolio manager operates autonomously, allowing for a diverse range of investment strategies under the PRIMECAP umbrella. The firm's top holdings include prominent names such as Amgen Inc (NASDAQ:AMGN), Biogen Inc (NASDAQ:BIIB), and Microsoft Corp (NASDAQ:MSFT), with a significant equity of $125.95 billion predominantly allocated to the Technology and Healthcare sectors.

About Biomarin Pharmaceutical Inc

Biomarin Pharmaceutical Inc, headquartered in the USA, has been a pioneer in the biotechnology industry since its IPO on July 23, 1999. The company's dedication to developing rare-disease therapies has led to a robust product portfolio, including treatments like Voxzogo and Roctavian, which have received recent approvals. With a market capitalization of $16.25 billion, Biomarin continues to innovate in the biotech space, offering hope to patients with limited treatment options.

Impact of PRIMECAP's Latest Trade

PRIMECAP Management (Trades, Portfolio)'s recent acquisition of Biomarin shares represents a strategic move within its portfolio, emphasizing the firm's confidence in the biotech company's future. Despite the modest trade impact of 0%, the increased share count underscores PRIMECAP's commitment to Biomarin as a long-term investment, aligning with the firm's philosophy of identifying undervalued opportunities and waiting for the market to recognize their potential.

Financial Health of Biomarin Pharmaceutical

Biomarin Pharmaceutical's financial health is reflected in its current PE ratio of 112.21, indicating a premium market valuation given its earnings. The company is considered "Modestly Undervalued" with a GF Value of $105.33 and a price to GF Value ratio of 0.82. Despite a recent stock price decline of 10.51% since the transaction, the company has experienced a significant increase of 557.2% since its IPO. The year-to-date performance shows a decrease of 11.99%, suggesting a potential buying opportunity for value investors.

Market Valuation and Performance

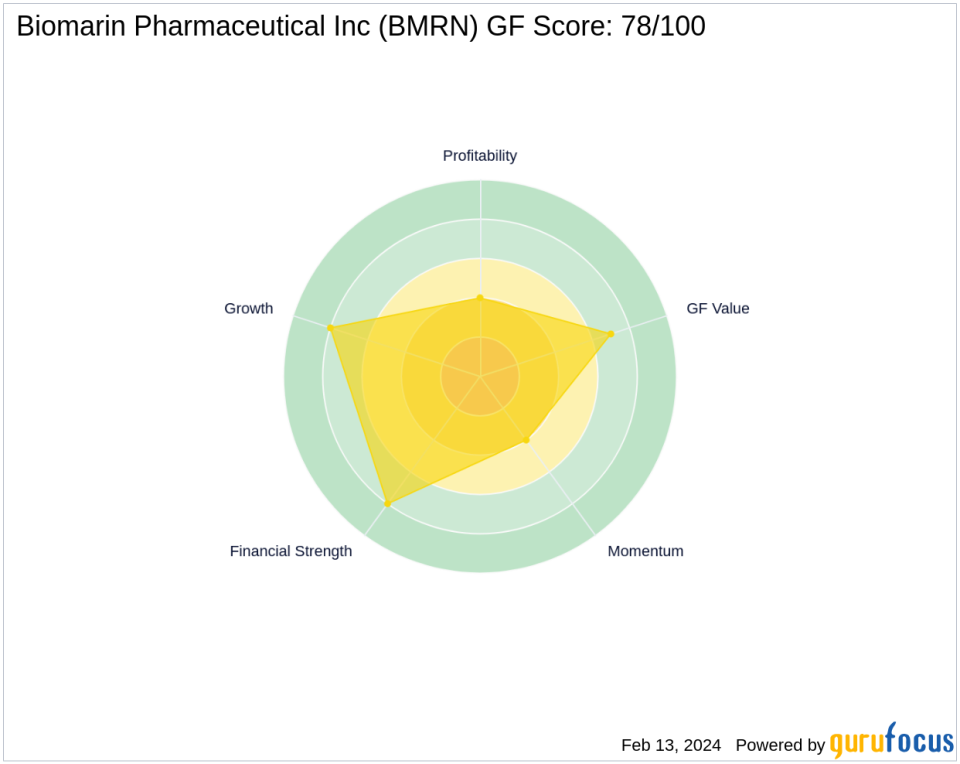

Biomarin's stock performance and valuation metrics are crucial for investors. The stock's GF Score of 78/100 indicates a strong potential for future performance. The company's financial strength, with an interest coverage ratio of 8.40 and an Altman Z score of 5.96, suggests a stable financial position. The Profitability Rank and Growth Rank stand at 4/10 and 8/10, respectively, while the GF Value Rank is at 7/10, indicating a favorable valuation relative to market price.

Biotechnology Sector in PRIMECAP's Portfolio

The biotechnology sector plays a significant role in PRIMECAP Management (Trades, Portfolio)'s investment strategy, with Biomarin Pharmaceutical Inc being a key player. The firm's position in Biomarin stands out among its peers, with other notable gurus like Dodge & Cox, Ken Fisher (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio) also holding shares in the company. This collective interest from top investors highlights the sector's potential and Biomarin's prominence within it.

Concluding Thoughts on PRIMECAP's Investment Decision

PRIMECAP Management (Trades, Portfolio)'s recent investment in Biomarin Pharmaceutical Inc aligns with its long-term value investing strategy and belief in the company's growth prospects. The firm's increased stake in Biomarin, despite short-term market fluctuations, demonstrates a conviction in the biotech firm's future success. As Biomarin continues to advance its rare-disease therapies, PRIMECAP's investment decision may well be vindicated in the years to come.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.