PRIMECAP Management Bolsters Stake in Elanco Animal Health Inc

Recent Acquisition by PRIMECAP Management (Trades, Portfolio)

PRIMECAP Management (Trades, Portfolio), a renowned investment firm, has recently increased its investment in Elanco Animal Health Inc (NYSE:ELAN), a key player in the animal health sector. On December 31, 2023, PRIMECAP Management (Trades, Portfolio) executed an addition to its position, purchasing 1,431,665 shares. This transaction impacted the firm's portfolio by 0.02%, with the shares acquired at a price of $14.9 each. Following this trade, PRIMECAP Management (Trades, Portfolio) now holds a total of 50,600,324 shares in Elanco Animal Health Inc, representing a 0.64% position in the firm's portfolio and a 10.27% stake in the traded company.

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) has established itself as an independent investment management company based in Pasadena, CA. The firm is known for its commitment to superior long-term equity investment results, achieved through a combination of individual decision-making, rigorous fundamental research, a long-term investment horizon, and a keen focus on value. PRIMECAP Management (Trades, Portfolio)'s investment philosophy centers on identifying undervalued stocks, particularly in industries that are currently out of favor, and holding onto these investments with patience and conviction. The firm's top holdings include prominent names such as Amgen Inc (NASDAQ:AMGN), Biogen Inc (NASDAQ:BIIB), and Microsoft Corp (NASDAQ:MSFT), with a significant presence in the Technology and Healthcare sectors. As of now, PRIMECAP Management (Trades, Portfolio) oversees an equity portfolio valued at $125.95 billion.

Elanco Animal Health Inc at a Glance

Elanco Animal Health Inc operates globally in the animal health industry, focusing on the innovation, development, manufacturing, and marketing of products for both companion and food animals. With a presence in over 90 countries, Elanco's business spans across Contract Manufacturing, Farm Animal, and Pet Health segments. As of the date of this article, Elanco boasts a market capitalization of $7.77 billion and a stock price of $15.77. Despite being labeled as modestly undervalued with a GF Value of $22.20, the company's stock is currently trading at a price to GF Value ratio of 0.71. Since its IPO on September 20, 2018, the stock has seen a decline of 51.1%, yet it has experienced a year-to-date increase of 7.72%.

PRIMECAP Management (Trades, Portfolio)'s Strategic Investment

Elanco Animal Health Inc represents a strategic investment for PRIMECAP Management (Trades, Portfolio), aligning with the firm's philosophy of seeking long-term value in out-of-favor industries. The recent addition to PRIMECAP's holdings in Elanco signifies a belief in the company's future prospects and a commitment to its investment thesis. With a 10.27% stake in Elanco, PRIMECAP Management (Trades, Portfolio) is a significant shareholder, reflecting the firm's confidence in the animal health company's potential for growth and profitability.

Elanco's Stock Performance and Metrics

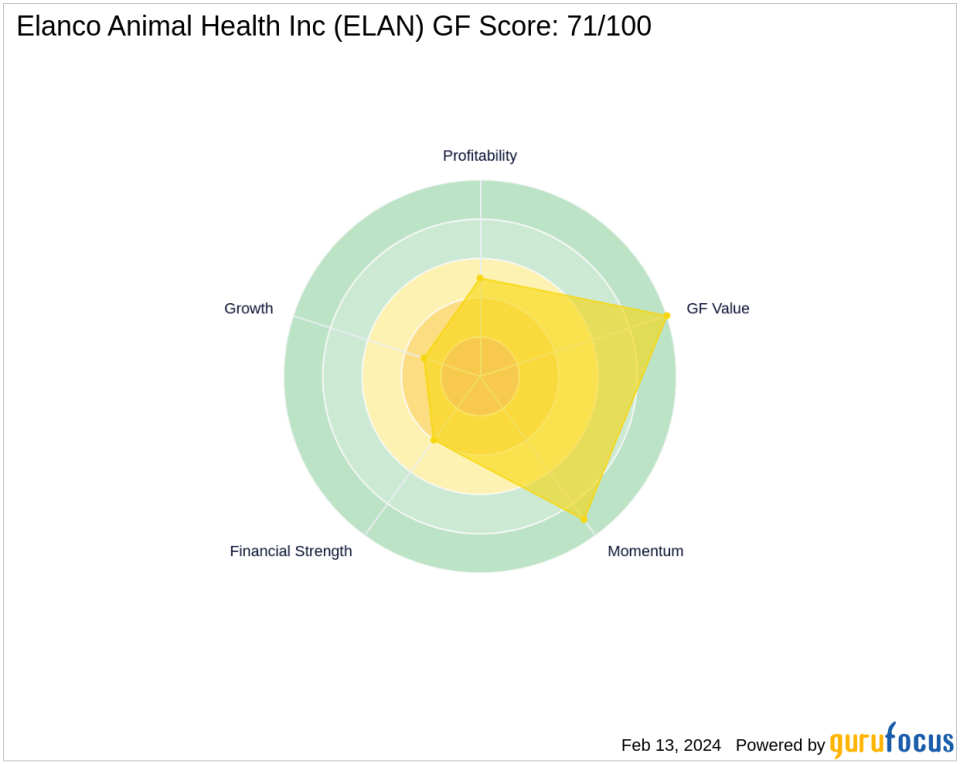

Elanco's stock performance has been a mix of challenges and opportunities. The company's GF Score stands at 71/100, indicating a likelihood of average performance. Elanco's financial strength and profitability are areas of concern, with a Balance Sheet Rank of 4/10 and a Profitability Rank of 5/10. However, the company's GF Value Rank is at the maximum of 10/10, suggesting that the stock is undervalued. The Momentum Rank is also high at 9/10, reflecting positive short-term trading trends. Despite these mixed indicators, PRIMECAP Management (Trades, Portfolio)'s recent investment move suggests a belief in Elanco's potential to overcome its current challenges.

Comparative Sector and Peer Analysis

PRIMECAP Management (Trades, Portfolio)'s portfolio is heavily weighted towards the Technology and Healthcare sectors, with Elanco Animal Health Inc fitting well within the latter. Other notable investors in Elanco include Charles Brandes (Trades, Portfolio), indicating a shared interest in the company's prospects among seasoned value investors. This collective interest from prominent investment firms may signal a positive outlook for Elanco's future performance.

Market Sentiment and Prospects for Elanco

The market sentiment towards Elanco Animal Health Inc appears cautiously optimistic, with recent stock momentum and RSI indicators suggesting a potential uptick in performance. The company's growth, profitability, and market trends will be critical factors in determining its future success. PRIMECAP Management (Trades, Portfolio)'s increased stake in Elanco could be a precursor to improved market confidence and a potential rebound in the stock's valuation.

Transaction Impact Analysis

PRIMECAP Management (Trades, Portfolio)'s recent acquisition of Elanco shares has a modest yet notable impact on its portfolio, reinforcing the firm's investment strategy and confidence in Elanco's value proposition. As the stock continues to trade below its GF Value, PRIMECAP's decision to bolster its position may be well-timed, capitalizing on the current undervaluation. The firm's significant stake in Elanco underscores its potential influence on the company's strategic direction and shareholder value creation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.