PRIMECAP Management Bolsters Stake in LivaNova PLC

Recent Acquisition by PRIMECAP Management (Trades, Portfolio)

On December 31, 2023, PRIMECAP Management (Trades, Portfolio), a renowned investment firm, expanded its investment portfolio by adding shares of LivaNova PLC (NASDAQ:LIVN). The transaction saw the firm acquiring an additional 5,920 shares at a trade price of $51.74. This purchase increased PRIMECAP Management (Trades, Portfolio)'s total holdings in LivaNova to 5,791,280 shares, signifying a 0.25% impact on its portfolio and marking a 10.75% ownership in the medical device company.

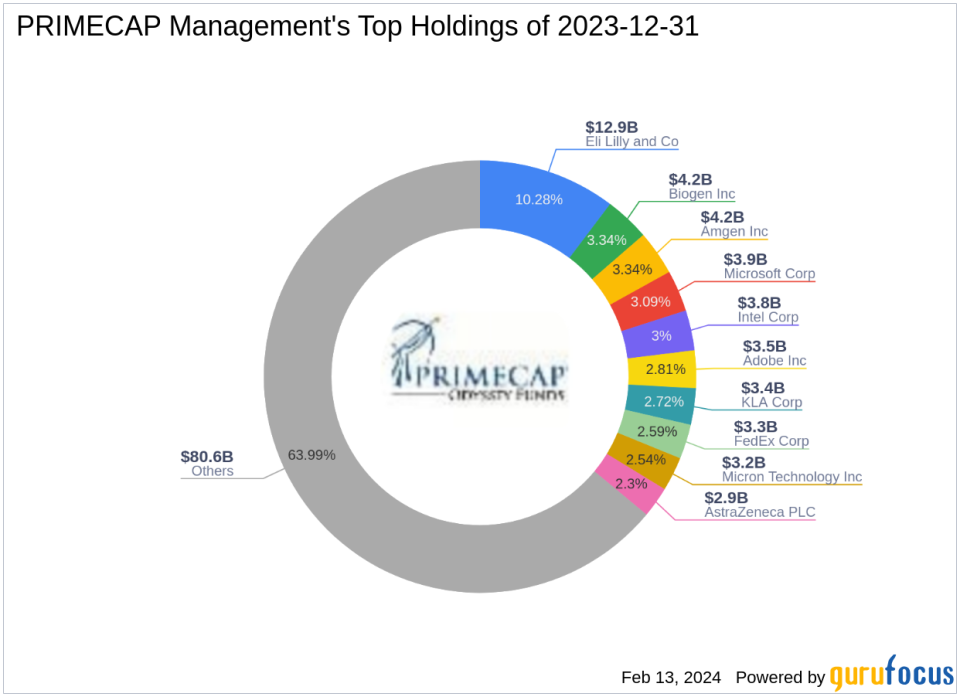

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) Company has established itself as a leading independent investment management firm based in Pasadena, CA. The firm manages equity portfolios with a focus on the US market for institutions and mutual funds. PRIMECAP Management (Trades, Portfolio) is known for its long-term investment horizon and a value-driven approach, emphasizing individual decision-making and fundamental research. The firm's investment philosophy centers on identifying undervalued stocks with the potential to outperform the market over a three to five-year period, often starting with companies that are currently out of favor. PRIMECAP Management (Trades, Portfolio)'s top holdings include prominent names such as Amgen Inc (NASDAQ:AMGN), Biogen Inc (NASDAQ:BIIB), and Microsoft Corp (NASDAQ:MSFT), with a significant equity of $125.95 billion primarily in the Technology and Healthcare sectors.

Overview of LivaNova PLC

LivaNova PLC, a UK-based medical device firm, was formed from the merger of Cyberonics in the US and Sorin in Italy. The company specializes in cardiovascular and cardiopulmonary solutions, as well as neuromodulation devices for epilepsy and depression. With a market capitalization of $2.67 billion, LivaNova has a significant presence in the US and European markets. Despite a high PE ratio of 992.90, indicating profitability challenges, the stock is considered modestly undervalued with a GF Value of $67.03. LivaNova's stock is currently trading at $49.645, which is 74% of its GF Value, reflecting a potential undervaluation.

Impact of PRIMECAP's Trade on Its Portfolio

The recent acquisition of LivaNova shares by PRIMECAP Management (Trades, Portfolio) has a modest impact on the firm's portfolio, given the 0.25% trade impact. However, the 10.75% stake in LivaNova underscores the firm's confidence in the company's future prospects and aligns with PRIMECAP's strategy of investing in undervalued companies with long-term growth potential.

Market Valuation and Stock Performance

LivaNova's current market valuation, as indicated by its stock price of $49.645, is slightly below the GF Value, suggesting a modest undervaluation. Since the trade, the stock has experienced a -4.05% change, while the year-to-date performance shows a -1.77% change. Historically, since its IPO on February 10, 1993, LivaNova's stock has seen a significant increase of 313.71%.

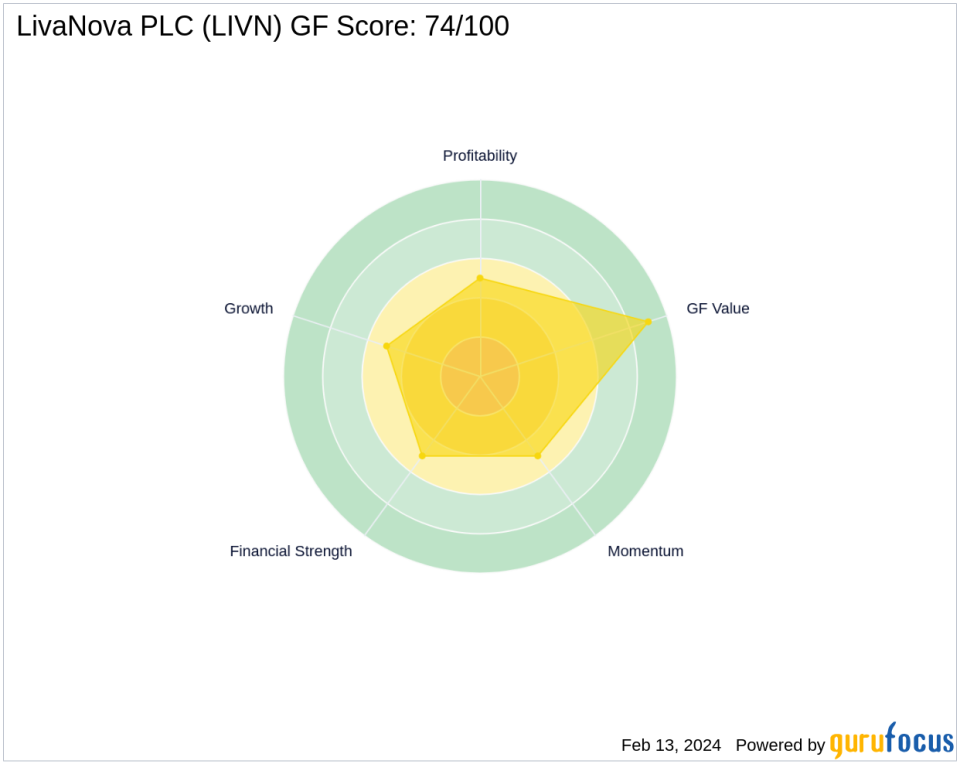

Financial Health and Growth Prospects

LivaNova's financial health, as reflected by its balance sheet rank of 5/10 and a cash to debt ratio of 0.38, indicates a moderate level of financial stability. The company's GF Score of 74/100 suggests a good potential for future performance. However, the company's profitability and growth ranks, both at 5/10, along with a Piotroski F-Score of 6, present a mixed picture of its growth prospects.

Other Prominent Investors in LivaNova

PRIMECAP Management (Trades, Portfolio) is not the only notable investor in LivaNova PLC. Other significant investors include Barrow, Hanley, Mewhinney & Strauss, and David Einhorn (Trades, Portfolio), highlighting the company's appeal to value-oriented investment firms.

Concluding Thoughts on PRIMECAP's Investment Decision

In conclusion, PRIMECAP Management (Trades, Portfolio)'s recent addition of LivaNova shares is consistent with its strategy of identifying undervalued opportunities with long-term growth potential. The firm's substantial stake in LivaNova, coupled with the company's modest undervaluation and solid GF Score, suggests a strategic move that aligns with PRIMECAP's investment philosophy. As the market continues to assess LivaNova's value, PRIMECAP Management (Trades, Portfolio)'s decision may well position it to capitalize on the company's future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.