PRIMECAP Management Bolsters Stake in Transocean Ltd

PRIMECAP Management (Trades, Portfolio), a renowned investment firm, has recently increased its investment in Transocean Ltd (NYSE:RIG), a significant player in the offshore drilling sector. On December 31, 2023, PRIMECAP Management (Trades, Portfolio) added 5,168,000 shares to its holdings, bringing the total share count to 50,699,389. This transaction impacted the firm's portfolio by 0.03% and was executed at a trade price of $6.35 per share. Currently, Transocean Ltd constitutes 0.27% of PRIMECAP Management (Trades, Portfolio)'s portfolio, with the firm holding a 6.27% stake in the traded company.

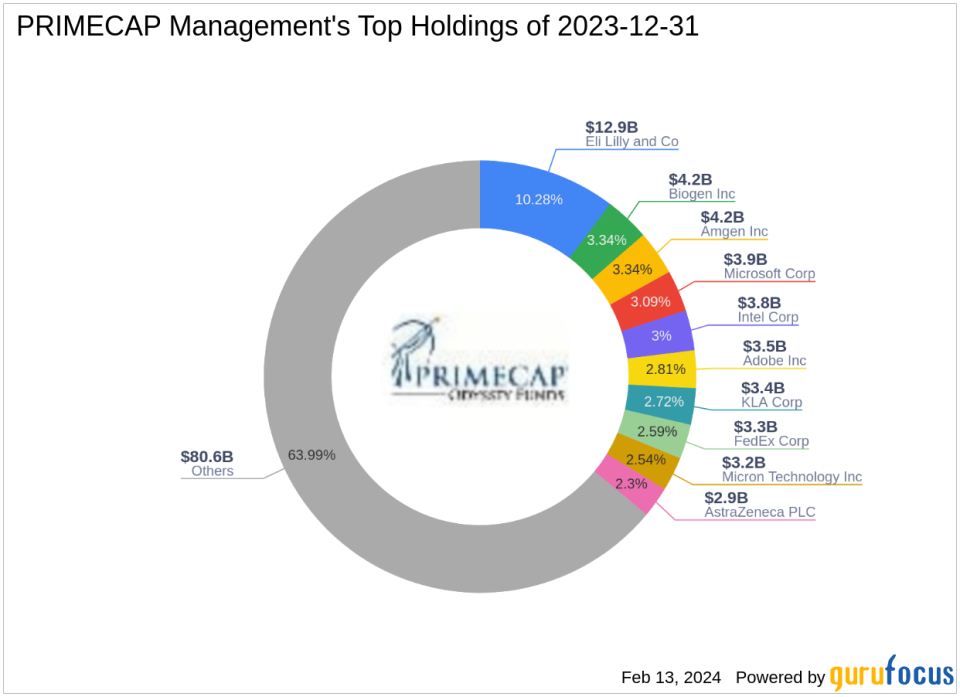

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) has established itself as an independent investment management company based in Pasadena, CA. The firm manages equity portfolios for institutions and mutual funds, primarily within the United States. PRIMECAP Management (Trades, Portfolio) is known for its long-term investment horizon and a focus on value, guided by individual decision-making and a strong commitment to fundamental research. The firm's multi-counselor investment model allows each portfolio manager to independently manage a portion of the fund, ensuring a diverse range of investment strategies under one roof.

Transocean Ltd at a Glance

Transocean Ltd, with the stock symbol RIG, is a Swiss company that went public on May 28, 1993. The company is a leading international provider of offshore contract drilling services for oil and gas wells, specializing in harsh environment and ultra-deepwater floaters. With a market capitalization of $4.19 billion, Transocean plays a pivotal role in the oil and gas industry, despite the current challenges faced by the sector.

Deciphering the Trade's Impact

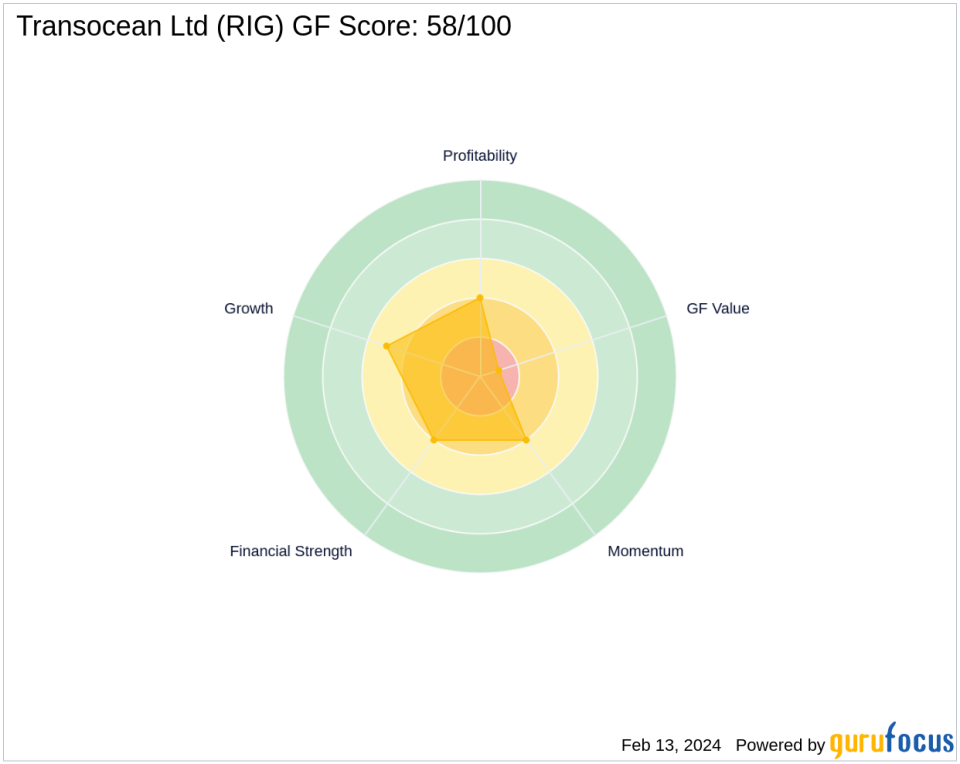

The addition of Transocean shares by PRIMECAP Management (Trades, Portfolio) may signal the firm's confidence in the long-term prospects of the company, despite the stock being significantly overvalued according to the GF Value, with a current GF Value of $3.56 and a price to GF Value ratio of 1.45. Transocean's stock price has seen a decline of 18.5% since the transaction, with a year-to-date drop of 17.2%. The company's financial strength and profitability have been areas of concern, as reflected in its GF Score of 58/100, indicating poor future performance potential.

Transocean's Financial Footing

Transocean's financial metrics present a mixed picture. The company's current stock price stands at $5.175, and with a PE percentage of 0.00, it indicates that the company is not generating profits. The firm's financial strength and Profitability Rank are both at 4/10, while its Growth Rank is slightly higher at 5/10. However, the GF Value Rank is at the lower end of the spectrum at 1/10, and the Momentum Rank is also modest at 4/10.

Market and Sector Dynamics

PRIMECAP Management (Trades, Portfolio)'s top sectors include Technology and Healthcare, with Transocean Ltd fitting into a different category of the firm's diversified portfolio. The oil and gas industry has faced volatility, and Transocean's performance must be viewed within this broader context. The sector's cyclical nature and fluctuating oil prices often impact the performance of companies like Transocean.

Other Major Investors in Transocean

Barrow, Hanley, Mewhinney & Strauss is currently the largest guru shareholder in Transocean Ltd. Other notable investors include Ronald Muhlenkamp (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio), each holding a stake in the company and potentially looking for long-term value.

Concluding Thoughts

PRIMECAP Management (Trades, Portfolio)'s increased stake in Transocean Ltd reflects a strategic investment decision that aligns with the firm's philosophy of identifying undervalued opportunities with a long-term perspective. While the current financial and market performance of Transocean presents challenges, PRIMECAP's move may be based on an anticipation of a future turnaround in the oil and gas sector. Value investors will be watching closely to see if this investment aligns with the firm's history of recognizing value early and achieving superior long-term equity investment results.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.