PRIMECAP Management Bolsters Stake in Xometry Inc

On December 31, 2023, PRIMECAP Management (Trades, Portfolio) executed a notable transaction by increasing its investment in Xometry Inc (NASDAQ:XMTR), a company specializing in AI-enabled manufacturing equipment. The firm added 21,647 shares to its holdings at a trade price of $35.91. This acquisition expanded PRIMECAP Management (Trades, Portfolio)'s total share count in Xometry to 6,652,858, representing a 0.2% position in the firm's portfolio and a 14.66% ownership in the traded stock.

Insight into PRIMECAP Management (Trades, Portfolio)

Founded in 1983, PRIMECAP Management (Trades, Portfolio) Company has established itself as a distinguished investment management firm based in Pasadena, CA. The firm manages equity portfolios with a focus on the US market, serving a select group of institutions and mutual funds. PRIMECAP Management (Trades, Portfolio)'s investment philosophy is grounded in four key principles: individual decision-making, a commitment to fundamental research, a long-term investment horizon, and a focus on value. The firm's multi-counselor investment model allows each portfolio manager to independently oversee a portion of each Fund, ensuring a diverse range of expertise and perspectives.

Understanding Xometry Inc

Xometry Inc operates within the industrial products sector, offering a range of manufacturing processes such as CNC Machining, Injection Molding, and 3D Printing. The company, which went public on June 30, 2021, is divided into two segments: the U.S. and International, with the majority of its revenue stemming from the U.S. market. Despite a challenging market, Xometry's market capitalization stands at $1.5 billion.

Trade Impact and Portfolio Significance

The recent addition of Xometry shares by PRIMECAP Management (Trades, Portfolio) has not had a calculable impact on the firm's portfolio due to the absence of trade impact data. However, the transaction underscores the firm's strategy of identifying and investing in companies with potential for long-term value, even when they may be currently out of favor.

Xometry's Market Performance

Since the trade date, Xometry Inc's stock price has seen a decline, currently trading at $31.20, which is a 13.12% decrease from the trade price. The stock has also experienced a significant drop of 53.44% from its IPO and a year-to-date decrease of 9.98%.

Financial Health and Growth Prospects

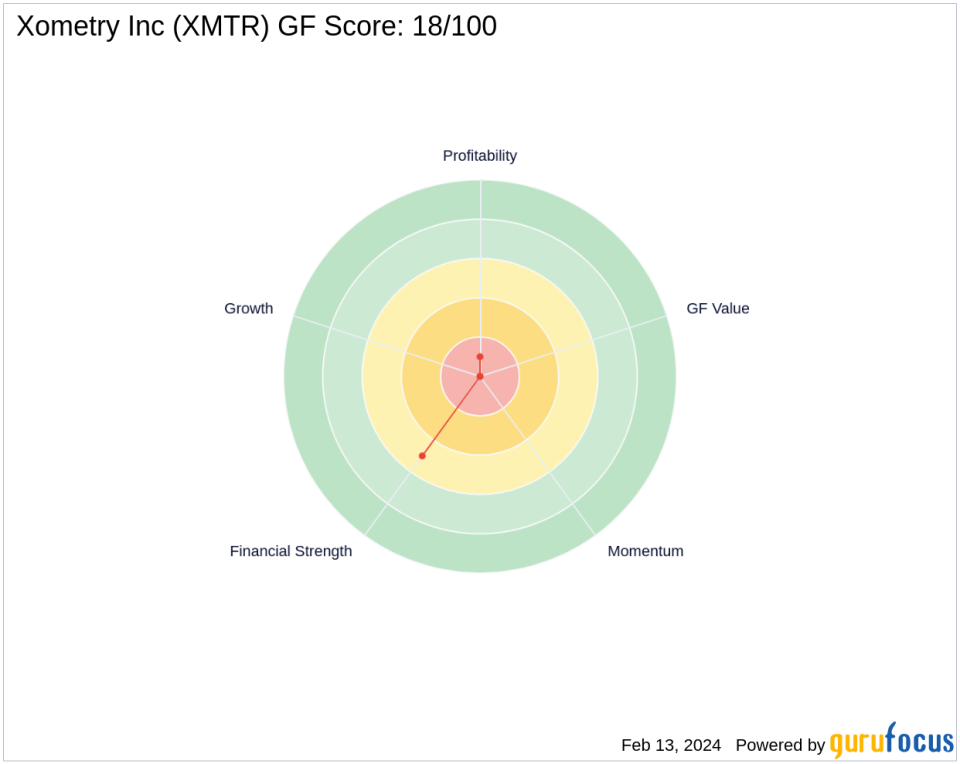

Xometry's financial health and growth metrics present a mixed picture. The company's GF Score is 18 out of 100, indicating potential challenges in future performance. The Financial Strength rank is 5 out of 10, with a Piotroski F-Score of 4, suggesting moderate financial stability. However, the company's Profitability Rank is low at 1 out of 10, and it has a negative Return on Equity (ROE) of -22.55% and Return on Assets (ROA) of -11.22%.

PRIMECAP's Strategic Position in Xometry

Xometry Inc represents a strategic position within PRIMECAP Management (Trades, Portfolio)'s portfolio, aligning with the firm's approach to investing in undervalued companies with long-term growth potential. The firm's holding in Xometry is significant when compared to its other top holdings, which include major players in the technology and healthcare sectors such as Amgen Inc (NASDAQ:AMGN) and Eli Lilly and Co (NYSE:LLY).

Industrial Products Sector and Market Context

PRIMECAP Management (Trades, Portfolio)'s investment in Xometry Inc fits within the broader context of the industrial products industry. The firm's top sectors include technology and healthcare, indicating a diversified investment strategy. The current state of the industrial products industry may have influenced PRIMECAP's decision to invest in Xometry, considering the firm's propensity to seek out undervalued opportunities with a long-term perspective.

Conclusion: Analyzing the Transaction's Influence

The acquisition of additional shares in Xometry Inc by PRIMECAP Management (Trades, Portfolio) is a testament to the firm's confidence in the company's future prospects, despite its current market challenges. While the immediate impact on the portfolio is not quantifiable, the firm's significant stake in Xometry suggests a belief in the company's potential to deliver value over time. Investors will be watching closely to see how this investment aligns with PRIMECAP's history of recognizing and capitalizing on long-term market trends.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.