PRIMECAP Management's Most Significant 3rd-Quarter Portfolio Changes

On Nov. 12, PRIMECAP Management (Trades, Portfolio) released its portfolio update for the third quarter of 2019. As of the quarter's end, the mutual fund has 291 stocks (10 new) in an equity portfolio valued at $125.04 billion. Its most significant portfolio updates include a new holding in ForeScout Technologies Inc. (NASDAQ:FSCT), additions to its Pioneer Natural Resources Co. (NYSE:PXD) holding and complete sellouts of its shares in Altaba Inc. (NASDAQ:AABA) and Airbus SE (XPAR:AIR).

Founded in 1983 in Pasadena, California as an independent investment management company, PRIMECAP Management serves a limited number of institutions and mutual funds. The company's investment philosophy is based on individual assessment of each company's long-term fundamentals and plans for the future, with a focus on developing separate opinions without Wall Street influence. The goal of its investments is long-term capital appreciation, with a primary focus on investing in U.S. companies.

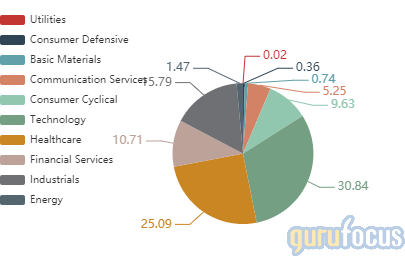

As of the quarter's end, PRIMECAP's top holdings are Eli Lilly and Co. (LLY) at 3.83%, Microsoft Corp. (MSFT) at 3.58% and Adobe Inc. (ADBE) at 3.52%. In terms of sector weighting, the fund is most heavily invested in technology (30.84%), health care (25.09%) and financial services (10.71%).

ForeScout Technologies

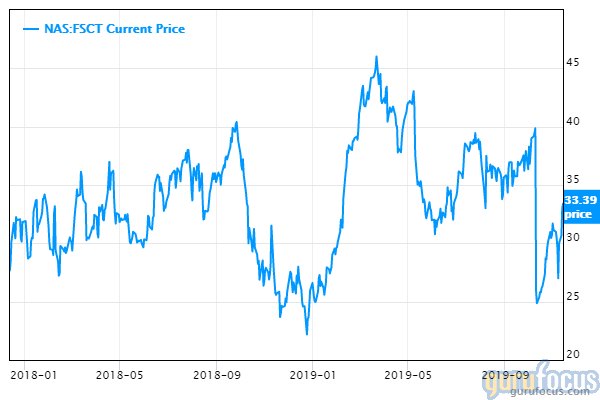

PRIMECAP'S biggest new holding of the quarter is 737,650 shares of ForeScout Technologies, which impacted the equity portfolio by 0.02%. The stock was trading at an average price of $36.52 during the quarter.

ForeScout operates in the device visibility and control market. Its unified security platform allows clients to maintain complete awareness of their device connectivity environment in order to reduce cyber and operational risk. Using agentless, real-time discovery, the platform can detect and classify devices that are connected to or attempting to connect to a system. As of Nov. 14, the stock has a market cap of $15.18 billion and an enterprise value of $15.13 billion.

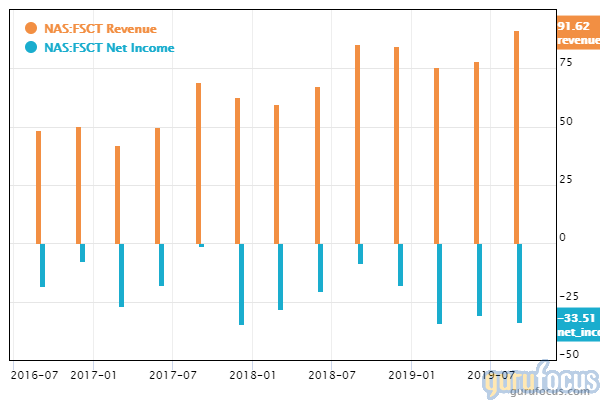

After the end of the third quarter, share prices of ForeScout dropped from $39.86 to $24.87 per share following the company's preliminary third-quarter results. The preliminary results saw the company lowering its revenue expectations from between $98.8 million and $101.8 million to $90.6 million to $91.6 million. The company's final results for the quarter included revenue of $91.62 million and net loss of $33.51 million, slightly beating the lowered expectations and granting some recovery for the stock price.

Originally founded in 2000, the company became publicly traded during the fourth quarter of 2017. It has yet to turn a profit since its listing, though as a technology company in its early stages, this is perhaps to be expected.

GuruFocus has assigned ForeScout a financial strength score of 5.3 out of 10 and a profitability score of 2 out of 10. The company has a cash-debt ratio of 1.93, an Altman Z-score of 1.1 and a three-year Ebitda decline of 29.1%.

Pioneer Natural Resources

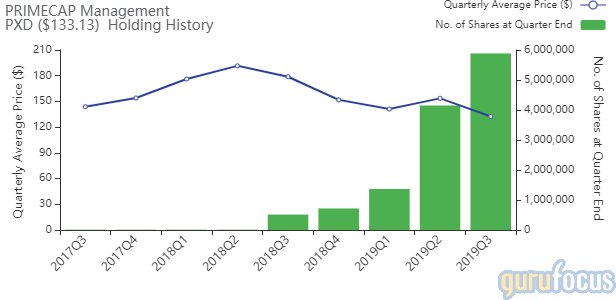

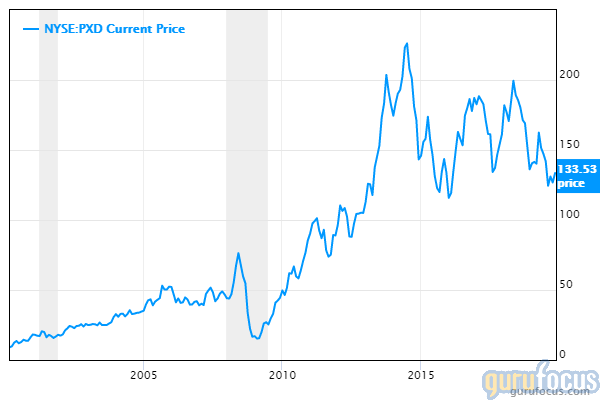

The fund added 1,734,201 shares to its Pioneer Natural Resources stake, impacting the equity portfolio by 0.17%. During the quarter, shares traded at an average price of $132.34.

Pioneer Natural Resources is an independent oil and gas exploration and production company based in Irving, Texas. It is the largest acreage holder in the Permian Basin and is primarily engaged in hydrocarbon fracking. As of Nov. 14, the stock has a market cap of $22.2 billion and an enterprise value of $24.22 billion.

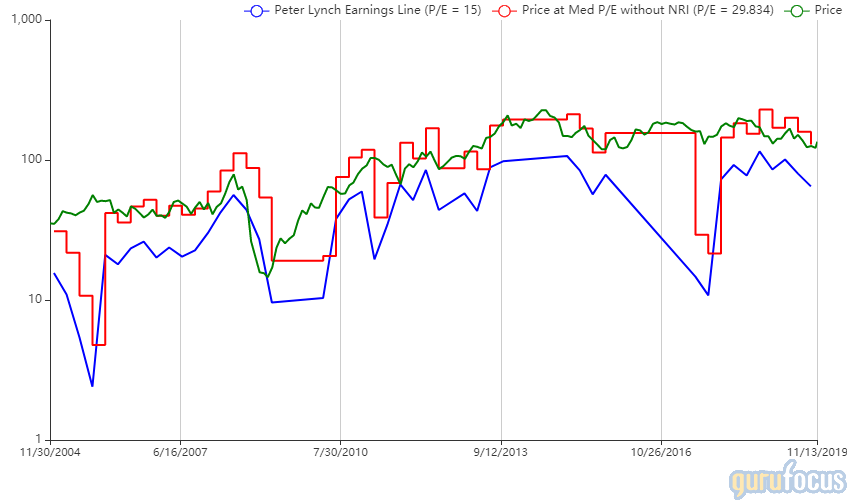

The third quarter saw an average share price decline of 13.8% compared to the previous quarter, during which PRIMECAP bought 2,783,199 shares of Pioneer. Purchasing more shares after a price drop indicates the firm believes this company is an even better deal now. According to the Peter Lynch chart, the company is currently trading at a fair value.

GuruFocus has assigned Pioneer a financial strength score of 6 out of 10 and a profitability score of 7 out of 10. The company has a cash-debt ratio of 0.23 and an Altman-Z score of 3.14, putting it out of the bankruptcy danger zone. Its current price-earnings ratio is 30.95, lower than 86.39% of industry competitors. Since Pioneer is a cyclical, this indicates that the company may be at the bottom of its profit cycle.

Airbus

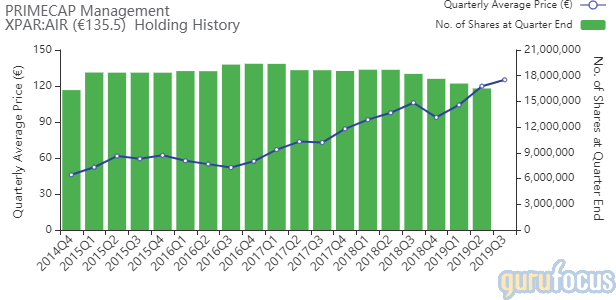

During the quarter, the fund sold all 16,513,798 of its shares of Airbus, impacting the equity portfolio by -1.73%. Shares traded at an average price of 125.17 euros ($137.93) during the quarter.

Airbus is an international aerospace company that primarily designs and manufactures commercial and military aircraft as well as satellites and launch vehicles. After software design errors in Boeing's (NYSE:BA) 737 Max caused more than one deadly crash, many airlines around the world have reduced their orders of the problematic model and switched to Airbus' more expensive wide-body planes, greatly boosting its orders. As of Nov. 14, the company's stock has a market cap of 105.35 billion euros and an enterprise value of 108.65 billion euros.

Airbus shares rose 11.94% following the announcement of the company's third-quarter earnings, which saw revenue of 18.3 billion euros and net income of 1.2 billion euros. The upcoming fourth quarter marks the peak of Airbus' revenue cycle.

Despite Airbus' earnings success and the extra business from Boeing, the stock may be overvalued compared to the company's current production capacity. As of the third quarter's end, the Airbus order book contained order intake of 127 planes year to date versus 7,133 planes on the order book, as well as order intake of 173 helicopters year to date versus 681 helicopters on the order book. Additionally, Boeing plans to acquire 80% of Brazilian planemaker Embraer's (NYSE:ERJ) commercial jets division for $4.2 billion, which may revive its ability to compete against Airbus.

GuruFocus has assigned Airbus a financial strength score of 5 out of 10 and a profitability score of 7 out of 10. It currently has a price-earnings ratio of 28.17, a cash-debt ratio of 0.71, an Altman Z-score of 1.4 and an operating margin of 8.08%.

Altaba

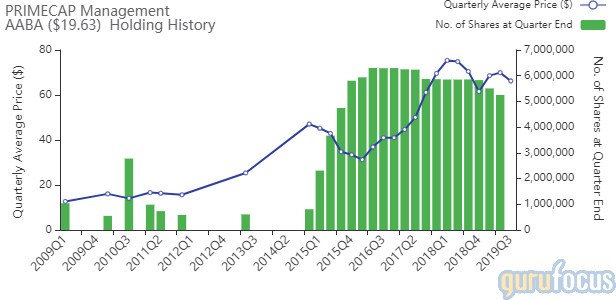

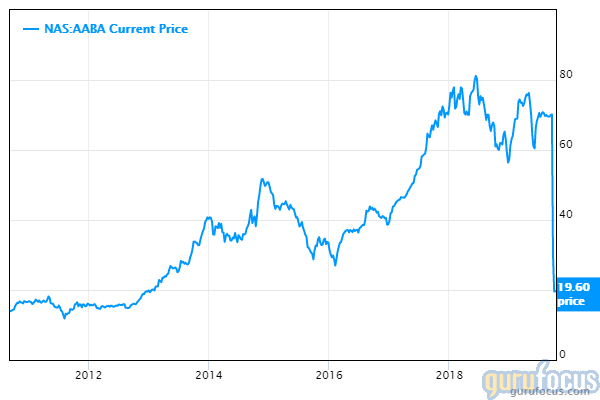

PRIMECAP also sold out of its 5,249,910 shares in Altaba, impacting the equity portfolio by -0.27%. Shares were trading at an average price of $66.23 during the quarter.

Altaba is a bit of a special situation. Officially classified as a non-diversified, closed-end management investment company, Altaba was formed from the remnants of Yahoo Inc. after Verizon (VZ) bought out its internet business in June of 2017. In short, it is a holding company that was operating in liquidation mode until its dissolution on Oct. 4.

Altaba's shares plummeted 71.97% on Sept. 23 following a massive dividend payment of $51.50 per share as the holding company planned to fully dissolve on Oct. 4. The dividend payment marks a crucial step in closing the company's books for good. The only major non-cash asset the holding company still had was some stocks of Chinese internet retailer Alibaba Group Holding Ltd. (NYSE:BABA).

Nasdaq halted trading of the company's shares on Oct. 2. As planned, Altaba filed its certificate of dissolution with the U.S. state of Delaware on Oct. 4.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

Rebounding Prices: 3 Stocks That May Provide False Optimism

Xerox's Bid for HP: Could Consolidation Return Profits to Printing?

Olstein Capital Management's Most Promising 3rd-Quarter Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.