PRIMECAP Management's Strategic Exits and New Positions Highlight Q4 Moves

Seagen Inc. Sale Marks Notable Portfolio Change for PRIMECAP Management (Trades, Portfolio)

PRIMECAP Management (Trades, Portfolio), an esteemed investment firm known for its value-driven approach and long-term investment horizon, has revealed its 13F filings for the fourth quarter of 2023. Founded in 1983 and based in Pasadena, CA, PRIMECAP specializes in managing US equity portfolios for institutions and mutual funds. The firm's investment philosophy is anchored in four key principles: individual decision-making, rigorous fundamental research, a long-term perspective, and a keen focus on value. PRIMECAP's multi-counselor model allows each portfolio manager to independently manage a segment of the fund, fostering a diverse range of investment strategies under one roof. The firm is adept at identifying undervalued stocks, particularly in sectors that are currently out of favor, and patiently waits for the market to align with its valuation assessments.

Summary of New Buys

PRIMECAP Management (Trades, Portfolio) expanded its portfolio with 7 new stock additions, including:

Boeing Co (NYSE:BA), purchasing 299,300 shares, which now comprise 0.06% of the portfolio, valued at $78.02 million.

Broadcom Inc (NASDAQ:AVGO), acquiring 58,371 shares, making up 0.05% of the portfolio, with a total value of $65.16 million.

Gartner Inc (NYSE:IT), adding 35,000 shares, accounting for 0.01% of the portfolio, valued at $15.79 million.

Key Position Increases

PRIMECAP Management (Trades, Portfolio) also bolstered its stakes in 67 stocks, with significant increases in:

Albemarle Corp (NYSE:ALB), adding 1,245,719 shares for a total of 3,476,674 shares, marking a 55.84% increase in share count and a 0.14% impact on the portfolio, valued at $502.31 million.

Bristol-Myers Squibb Co (NYSE:BMY), with an additional 2,998,228 shares, bringing the total to 23,534,378 shares, a 14.6% increase in share count, valued at $1.21 billion.

Summary of Sold Out Positions

Exiting completely from 6 holdings, PRIMECAP Management (Trades, Portfolio) made notable portfolio changes:

Seagen Inc (SGEN): Sold all 6,261,798 shares, impacting the portfolio by -1.12%.

Activision Blizzard Inc (ATVI): Liquidated all 4,618,105 shares, affecting the portfolio by -0.37%.

Key Position Reductions

PRIMECAP Management (Trades, Portfolio) reduced its positions in 189 stocks, with the most significant reductions in:

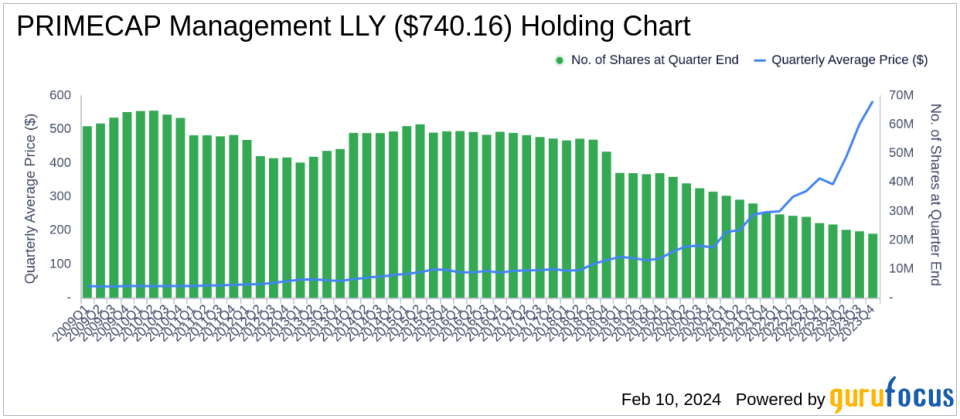

Eli Lilly and Co (NYSE:LLY), cutting back by 863,002 shares, a -3.74% decrease in shares, impacting the portfolio by -0.39%. The stock traded at an average price of $583.7 during the quarter and has seen a 25.40% return over the past 3 months and 26.97% year-to-date.

Novartis AG (NYSE:NVS), reducing by 1,689,455 shares, a -11.58% decrease in shares, affecting the portfolio by -0.14%. The stock traded at an average price of $96.35 during the quarter and has returned 8.37% over the past 3 months and 0.06% year-to-date.

Portfolio Overview

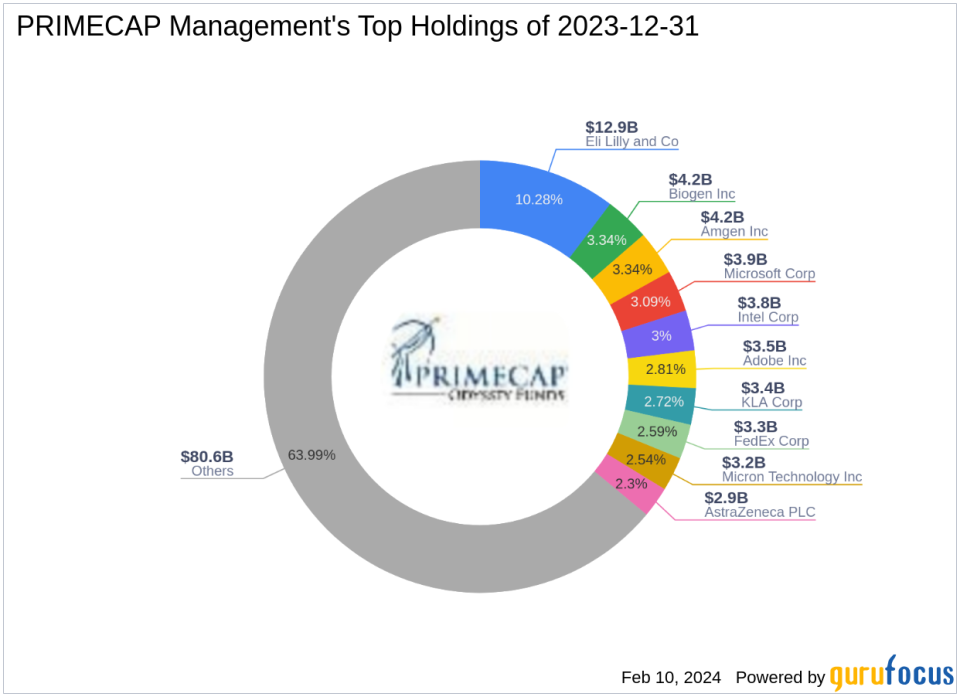

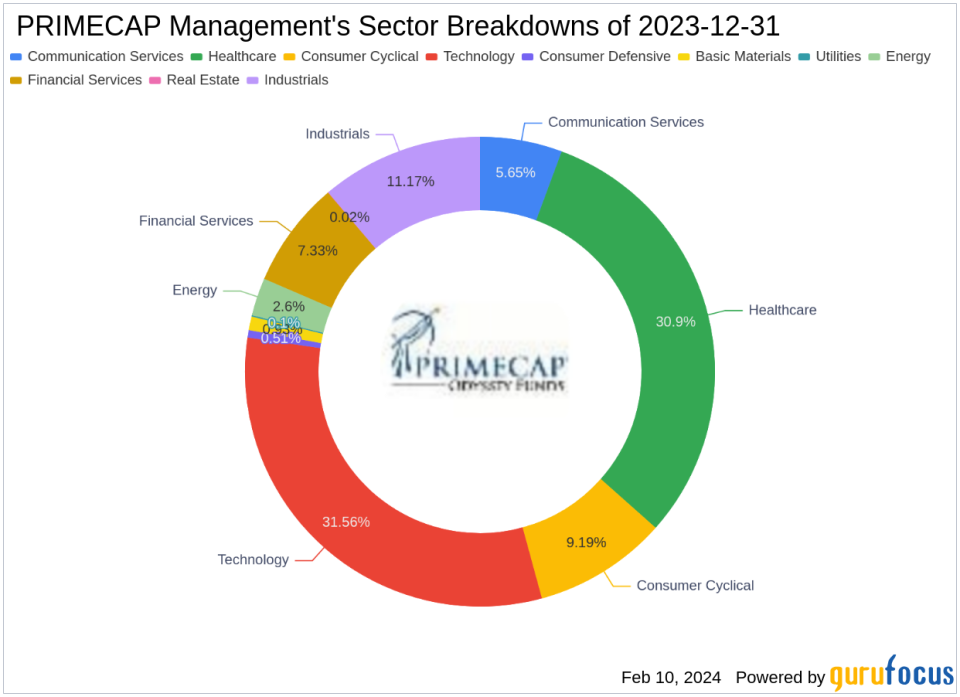

As of the fourth quarter of 2023, PRIMECAP Management (Trades, Portfolio)'s portfolio consisted of 334 stocks. The top holdings were 10.28% in Eli Lilly and Co (NYSE:LLY), 3.34% in Amgen Inc (NASDAQ:AMGN), 3.34% in Biogen Inc (NASDAQ:BIIB), 3.09% in Microsoft Corp (NASDAQ:MSFT), and 3% in Intel Corp (NASDAQ:INTC). The investments span across all 11 industries, with a focus on Technology, Healthcare, Industrials, Consumer Cyclical, Financial Services, Communication Services, Energy, Basic Materials, Consumer Defensive, Utilities, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.