Primerica Inc (PRI) Reports Growth in Q4 Earnings and Sales Force Expansion

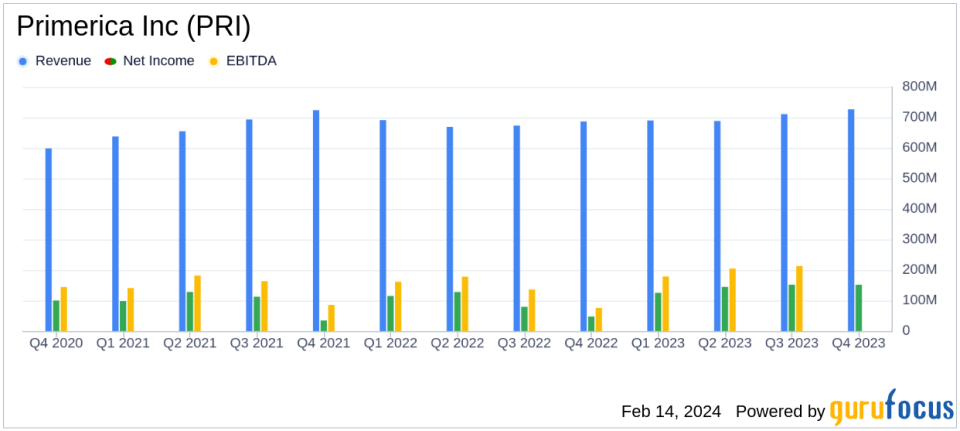

Revenue: Total revenues increased by 6% year-over-year to $726.3 million.

Net Income: Net income rose by 4% to $151.9 million compared to the same quarter last year.

Earnings Per Share (EPS): Diluted EPS grew by 9% to $4.30, reflecting a strong earnings performance.

Life-Licensed Sales Force: A record 141,572 life-licensed representatives, marking a 5% increase year-over-year.

Term Life Policies: Issued policies up by 12% and total face amount issued up by 16%.

Investment and Savings Products (ISP): Sales up by 13% and ending client asset values up by 15%.

Stock Repurchase: Completed a $375 million share repurchase in 2023 and authorized a new $425 million program for 2024.

On February 13, 2024, Primerica Inc (NYSE:PRI) released its 8-K filing, announcing financial results for the fourth quarter ended December 31, 2023. The company, a leading provider of financial services to middle-income households in the United States and Canada, reported a 6% increase in total revenues to $726.3 million and a 4% increase in net income to $151.9 million compared to the fourth quarter of 2022. Diluted EPS increased by 9% to $4.30, and the life-licensed sales force expanded to a record 141,572, a 5% increase year-over-year.

Primerica's robust performance in the fourth quarter is significant as it demonstrates the company's ability to grow its core business segments despite market challenges. The increase in term life policies issued and the growth in investment product sales are particularly important for an insurance company, as these metrics indicate both the company's competitive strength in the market and its ability to generate revenue through its product offerings.

Financial Highlights and Segment Performance

The company's term life insurance segment saw a 4% increase in revenues to $431.3 million and a 6% increase in pre-tax operating income to $140.3 million. The investment and savings products segment also performed well, with a 12% increase in revenues to $221.7 million and an 11% increase in pre-tax operating income to $62.8 million. However, the senior health segment experienced a decline, reflecting lower sales and a pre-tax operating loss of $2.7 million.

Primerica's capital position remains strong, with a statutory risk-based capital (RBC) ratio for Primerica Life Insurance Company estimated at approximately 435% as of December 31, 2023. The company also completed a $375 million share repurchase in 2023 and has authorized a new $425 million share repurchase program through December 31, 2024.

Challenges and Outlook

Despite the positive results, Primerica faced challenges in the senior health segment, resulting in a small loss. Additionally, the company noted pressure from higher living costs contributing to elevated lapse rates in life insurance policies. However, CEO Glenn Williams expressed optimism for 2024, citing the expanding sales force and upcoming biennial convention as opportunities for growth.

For the full year, Primerica recruited nearly 362,000 individuals, leading to a 9% increase in new insurance licenses and an 8% increase in issued term life insurance policies. While investment product sales declined by 8% year-over-year due to volatile equity markets, the overall financial results for the year showed a 23% increase in net income to $576.6 million and a 29% increase in diluted EPS to $15.94.

Primerica's earnings report underscores the company's resilience and ability to navigate a complex financial landscape. The growth in key metrics, such as the life-licensed sales force and investment product sales, coupled with strategic stock repurchases, positions the company well for continued success in serving middle-income families' financial needs.

For more detailed information on Primerica's financial performance, including the full earnings release and financial statements, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Primerica Inc for further details.

This article first appeared on GuruFocus.