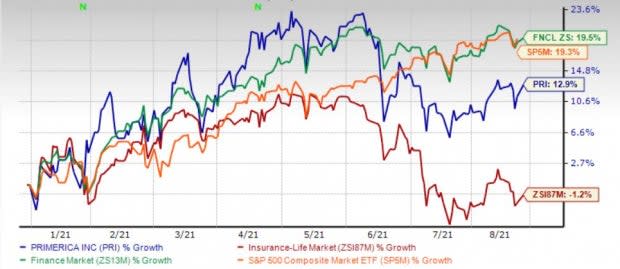

Primerica (PRI) Stock Up 13% YTD: Can it Retain the Momentum?

Shares of Primerica, Inc. PRI have gained 12.9% year to date against the industry’s decrease of 1.2%. The Finance sector and the Zacks S&P 500 composite have rallied 18.7% and 19.3%, respectively. With a market capitalization of about $6 billion, average volume of shares traded in the last three months was 0.1 million.

Image Source: Zacks Investment Research

A compelling portfolio, strong market presence, and sturdy financial position continue to drive Primerica. It has a decent track of beating earnings estimates in the three of last four quarters and missing in one, the average surprise being 7.55%.

Return on equity in the trailing 12 months was 23.3%, better than the industry average of 13.7%, reflecting the company’s efficiency in utilizing shareholders’ fund.

The Zacks Consensus Estimate for 2021 and 2022 earnings has moved up 4.5% and 3.5%, respectively, in the past 30 days, reflecting analysts’ optimism.

Will the Bull Run Continue?

The Zacks Consensus Estimate for 2021 indicates year-over-year improvement of 19.9% on 16.2% higher revenues. The consensus estimate for 2022 indicates year-over-year improvement of 10.3% on 7.2% higher revenues.

The company is well poised for progress, as is evident from its favorable VGM Score of B. Here V stands for Value, G for Growth and M for Momentum, with the score being a weighted combination of all three factors.

The company believes that it is well poised to cater to the middle market's increased demand for financial security on the strength of its business model. With the acquisition of e-TeleQuote, the company added senior health offerings to its financial solutions for middle-income families.

Its U.S. mortgage distribution business is also progressing well and the company remains focused on expanding distribution. The company estimates the mortgage business to deliver about $4 million in pre-tax earnings in the second half of 2021 and about $7 million in 2021.

Primerica boasts being the second largest issuer of term life insurance coverage in North America with solid demand for protection products driving sales growth and policy persistency.

Primerica had $774.5 million in liquidity as on Jun 30, 2021. Primerica Life Insurance Company statutory risk-based capital ratio was about 410%. While its leverage ratio has been improving, times interest earned has increased over the last two years.

This Zacks Rank # 3 (Hold) life insurer has raised dividend 10 times in the last nine years. Total stockholder return has continually outperformed the S&P 500 Index over the last five years.

Stocks to Consider

Some better-ranked stocks from the insurance space include American International Group AIG, CNO Financial Group CNO, and MetLife MET, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AIG delivered an earnings surprise of 27.73% in the last reported quarter.

Cincinnati Financial delivered an earnings surprise of 22.22% in the last reported quarter.

MetLife delivered an earnings surprise of 47.20% in the last reported quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.