Primerica (PRI) Unveils $425 Million Share Buyback Initiative

Primerica, Inc. PRI recently revealed that its board of directors has approved a new $425 million share repurchase program, scheduled to remain in place through Dec 31, 2024. Its solid cash-generating ability, supported by the Term Life business strength, will enable it to continue boosting shareholder value.

Primerica generated an operating cash flow of $451.5 million in the first nine months of 2023. It has made repurchases of $302.5 million during this time. The ongoing $375 million buyback program is set to conclude by this year-end.

The Term Life business, a stalwart for predictable margins and reliable cash flow, witnessed 3% year-over-year growth in adjusted operating revenues in the third quarter, while adjusted operating income before taxes jumped 7%. The business had a face amount in force exceeding $937 billion at the third quarter-end. Rising insurance policy sales are expected to keep driving the unit, contributing to its overall financial stability.

The company's confidence in its financial strength enables it to increase the size of the share buyback program, which will enhance shareholder value and provide an attractive rate of return. The news follows a strong third-quarter result announced last week, where its adjusted operating EPS of $4.28 increased 14% from the year-ago period and beat the Zacks Consensus Estimate by 6.2%.

The company beat earnings estimates in all the last four quarters, with an average surprise of 7.8%. The consensus mark for its 2023 full-year earnings of $16 per share predicts 39.9% year-over-year growth, which has witnessed two upward estimate revisions in the past month. Additionally, the consensus estimate for full-year revenues stands at $2.8 billion, suggesting a 3.2% increase from the previous year.

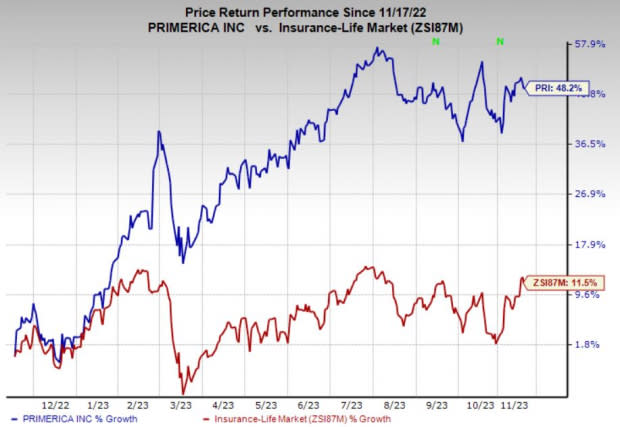

Price Performance

Shares of Primerica have gained 48.2% in the past year compared with the industry’s 11.5% rise.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Primerica currently has a Zacks Rank #2 (Buy). Investors interested in the broader Finance space can consider some other top-ranked companies like Employers Holdings, Inc. EIG, Assurant, Inc. AIZ and Brown & Brown, Inc. BRO, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus mark for Employers Holdings’ current year earnings indicates a 17.8% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 26.5%. Furthermore, the consensus estimate for EIG’s revenues in 2023 suggests 17.5% year-over-year growth.

The Zacks Consensus Estimate for Assurant’s current year earnings indicates a 27.5% year-over-year increase. It beat earnings estimates in each of the past four quarters, with an average surprise of 42.4%. Also, the consensus mark for AIZ’s revenues in 2023 suggests 5.1% year-over-year growth.

The Zacks Consensus Estimate for Brown & Brown’s current year earnings is pegged at $2.75 per share, which indicates 20.6% year-over-year growth. It has witnessed four upward estimate revisions against none in the opposite direction during the past month. It beat earnings estimates in all the past four quarters, with an average surprise of 12.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report