Primis Financial Corp (FRST) Reports Notable Improvement in Q4 2023 Earnings

Net Income: $8.1 million or $0.33 per diluted share for Q4 2023, compared to $3.0 million or $0.12 per diluted share for Q4 2022.

Year-to-Date Earnings: $9.9 million or $0.40 per diluted share, including nonrecurring charges and goodwill impairment.

Investment in Panacea Financial Holdings, Inc.: Acquired approximately 19% of PFH, with an implied fair market value of $20 million.

Quarterly Cash Dividend: Declared at $0.10 per share, marking the forty-ninth consecutive quarterly dividend.

Net Interest Income: Increased by approximately $3.1 million to $30.3 million in Q4 2023.

Loan Portfolio: Loans held for investment increased to $3.21 billion at the end of Q4 2023.

Asset Quality: Nonperforming assets decreased to $7.7 million at the end of Q4 2023.

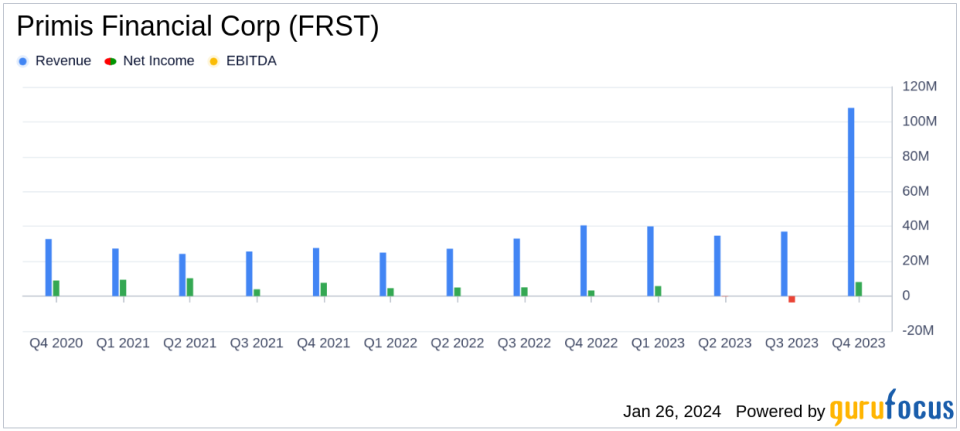

On January 25, 2024, Primis Financial Corp (NASDAQ:FRST) released its 8-K filing, announcing a significant uptick in its fourth-quarter earnings for 2023. The bank holding company for Primis Bank, which offers a wide range of commercial banking services, reported a net income available to common shareholders of $8.1 million, or $0.33 per diluted share, for the quarter ended December 31, 2023. This represents a substantial increase from the $3.0 million, or $0.12 per diluted share, reported for the same quarter in the previous year.

Financial Performance and Challenges

Primis Financial Corp's performance in the fourth quarter shows a material improvement across several fronts, despite a challenging year for the industry. The company's strategic investments and operational adjustments have contributed to its growth in revenue by $14 million or 11%, with a 9.1% increase in loans and a 20.1% increase in deposits. The bank's net interest income saw a significant rise, primarily due to accretion related to a third-party managed portfolio. However, noninterest income decreased slightly due to reduced mortgage banking activity.

The company's investment in Panacea Financial Holdings, Inc. (PFH) is particularly noteworthy. Primis acquired a 19% stake in PFH, with the investment's fair market value estimated at approximately $20 million. This strategic move is expected to enhance Primis Bank's earnings from the relationship with PFH and contribute positively to future operations.

Financial Achievements

Primis Financial Corp's financial achievements in the fourth quarter are crucial for the company and the banking industry. The growth in net interest income and the successful capital raise for its investment in PFH demonstrate the company's ability to navigate a complex financial landscape and capitalize on opportunities. These achievements are important as they reflect the company's financial health and its potential for future growth.

Key Financial Metrics

Primis Financial Corp's key financial metrics for the fourth quarter of 2023 include:

Net interest margin increased to 3.36% from 3.01% in the previous quarter.

Loans held for investment rose to $3.21 billion, marking continued growth in the loan portfolio.

Nonperforming assets decreased significantly to $7.7 million, improving asset quality.

Deposits and funding sources remained robust, with total deposits at $3.27 billion.

Shareholders' equity increased, with book value per common share at $16.09.

These metrics are important as they provide insights into the company's profitability, asset quality, liquidity, and capital adequacy, which are critical for assessing the company's financial stability and performance.

Analysis of Company's Performance

Primis Financial Corp's performance in the fourth quarter reflects a strong recovery and strategic positioning for future growth. The company's focus on loan and deposit growth, coupled with its investment in PFH, positions it well for continued success. The bank's ability to maintain a high-quality loan portfolio and strong capital levels suggests resilience and potential for further expansion.

The declaration of a quarterly cash dividend of $0.10 per share underscores the company's commitment to returning value to shareholders and confidence in its financial stability. As Primis Financial Corp navigates the post-pandemic economic environment, its strategic initiatives and operational efficiencies are expected to drive further improvements in profitability.

For more detailed information and analysis, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Primis Financial Corp for further details.

This article first appeared on GuruFocus.