Primis Financial (NASDAQ:FRST) Is Due To Pay A Dividend Of $0.10

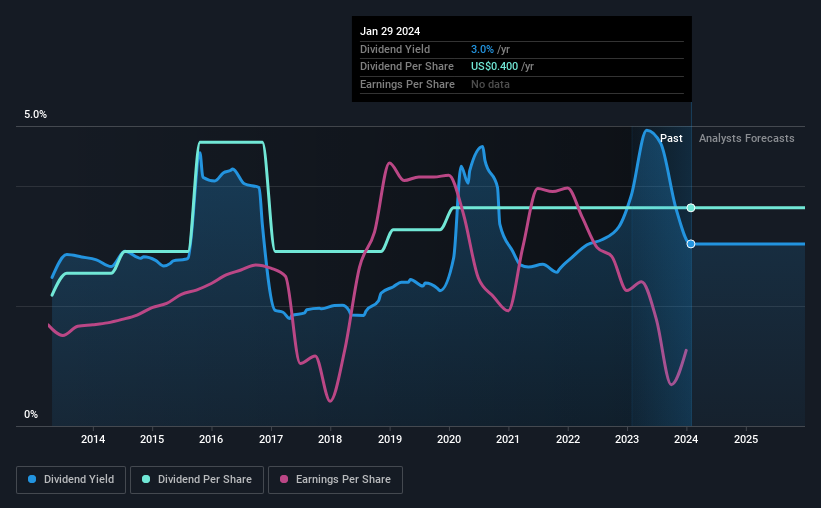

The board of Primis Financial Corp. (NASDAQ:FRST) has announced that it will pay a dividend of $0.10 per share on the 23rd of February. This means that the annual payment will be 3.0% of the current stock price, which is in line with the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Primis Financial's stock price has increased by 41% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Primis Financial

Primis Financial's Payment Expected To Have Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much.

Primis Financial has a long history of paying out dividends, with its current track record at a minimum of 10 years. Although the company has a long history in paying out dividends, Primis Financial's latest earnings report shows a payout ratio of 99%. This may be worrying, as it shows that Primis Financial is barely covering its dividend.

Looking forward, earnings per share is forecast by analysts to rise exponentially over the next 3 years. They also estimate the payout ratio reaching 25% in the same time period, which is fairly sustainable.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was $0.24 in 2014, and the most recent fiscal year payment was $0.40. This means that it has been growing its distributions at 5.2% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Primis Financial might have put its house in order since then, but we remain cautious.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Primis Financial's EPS has fallen by approximately 22% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Primis Financial's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments are bit high to be considered sustainable, and the track record isn't the best. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 3 warning signs for Primis Financial that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.