Primoris Services Corp (PRIM) Reports Record Revenue and Backlog in 2023 Earnings

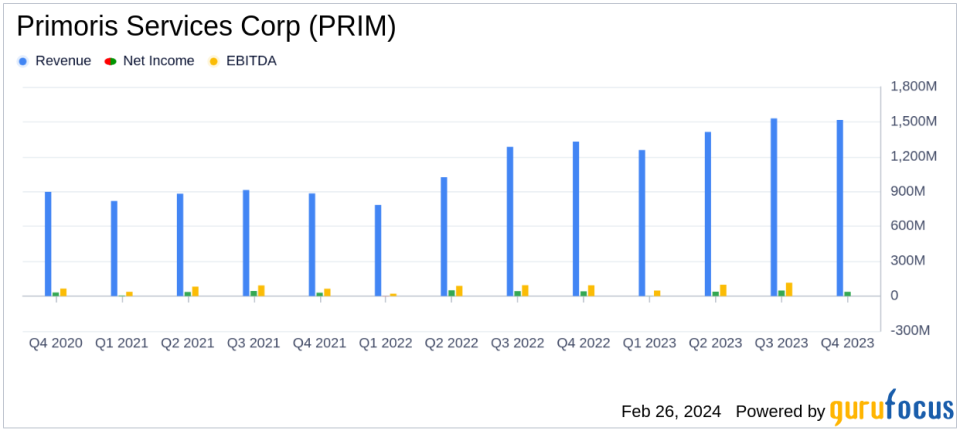

Revenue Growth: PRIM achieved a record $5.7 billion in revenue for 2023, a 29% increase year-over-year.

Backlog Expansion: Total backlog reached a new high of $10.9 billion, up nearly 20% from 2022.

Net Income: Full-year net income decreased by 5.2% to $126.1 million, with EPS at $2.33.

Adjusted EBITDA: Adjusted EBITDA for 2023 increased by 33.9% to $379.5 million.

Capital Allocation: PRIM paid down $120 million of borrowings and declared a $0.06 per share dividend.

2024 Outlook: EPS is expected to be between $2.50 and $2.70, with Adjusted EBITDA forecasted between $395 to $415 million.

On February 26, 2024, Primoris Services Corp (NYSE:PRIM) released its 8-K filing, announcing financial results for the fourth quarter and full year ended December 31, 2023, and providing an initial outlook for 2024. The company, a leading specialty contractor and infrastructure company in the United States, operates through three segments: Utility, Pipeline, and Energy/Renewables, with the latter earning the majority of the revenue.

Financial Performance and Challenges

PRIM's 2023 results marked a record year with revenue reaching $5.7 billion, a significant increase of over 29 percent from the previous year. The total backlog closed at a record $10.9 billion, nearly a 20 percent increase from 2022's record. The strong performance was attributed to a robust close to the year in solar project awards and contributions from acquisitions made in 2022.

Despite the revenue growth, net income for the full year was $126.1 million, or $2.33 per fully diluted share, a decrease of 5.2 percent from the previous year. Adjusted Net Income for the full year was $154.7 million, or $2.85 per fully diluted share, compared to $135.8 million, or $2.53 per fully diluted share, for the same period in 2022. Adjusted EBITDA for 2023 was $379.5 million, a 33.9 percent increase from the previous year.

Segment Performance

The Utilities segment saw a revenue increase of 17.6 percent in 2023 compared to 2022, primarily due to acquisitions and increased activity across power delivery and communications markets. However, gross profit decreased by 1.8 percent due to a decrease in margins. The Energy segment's revenue increased by 39.2 percent, driven by growth across all business lines and contributions from acquisitions. Gross profit in this segment increased by 54.5 percent, primarily due to higher revenue and margins.

Operational Highlights and Outlook

PRIM demonstrated strong cash generation, allowing the company to pay down $120 million of borrowings under its revolving credit facility in the fourth quarter. The company also highlighted its best safety performance in history, emphasizing its commitment to project safety.

Looking ahead to 2024, PRIM is optimistic about continued success across its end markets, focusing on improving margins in the Utilities segment and growing revenue in utility-scale solar construction. The company expects EPS to be between $2.50 and $2.70 per fully diluted share, with Adjusted EPS estimated in the range of $3.05 to $3.25. Adjusted EBITDA for the full year 2024 is expected to range from $395 to $415 million.

PRIM's balance sheet remains solid, with $217.8 million of unrestricted cash and cash equivalents as of December 31, 2023. The company's capital expenditures for the year totaled $103.0 million, including $34.0 million in construction equipment purchases. Additionally, the Board of Directors declared a $0.06 per share cash dividend, payable in April 2024.

Investors and analysts are invited to participate in the conference call and webcast scheduled for February 27, 2024, to discuss the company's results and business outlook further.

For detailed financial tables and reconciliations of non-GAAP financial measures, please refer to the schedules included in the 8-K filing.

Primoris Services Corp (NYSE:PRIM) continues to demonstrate its ability to navigate the complexities of the construction industry, delivering value to its clients, employees, and shareholders. With a strong backlog and focus on cash flow generation, PRIM is well-positioned for sustained growth in the coming year.

Explore the complete 8-K earnings release (here) from Primoris Services Corp for further details.

This article first appeared on GuruFocus.