Princeton Bancorp (BPRN) Announces New Share Buyback Program

Princeton Bancorp, Inc. BPRN recently rewarded its shareholders with enhanced capital-deployment activities by introducing a new share-repurchase program.

The new program allows the company to repurchase up to 5% of its outstanding shares of common stock (314,000 shares as of Aug 10, 2023) for a total cost of not more than $10.7 million. The same can be carried out through open market transactions or privately negotiated transactions per the applicable rules and regulations.

Also, the program does not allow Princeton Bancorp to buy any shares unless the purchase price of each share is lower than the tangible book value per share. Further, the program may be limited, suspended or terminated without prior notice and does not oblige the bank to acquire any particular amount of common stock.

In addition to announcing the share repurchase authorization, Princeton Bancorp recently announced a cash dividend of 30 cents per share on its common stock. The dividend will be paid on Aug 31, 2023, to shareholders on record as of Aug 9, 2023.

The company has regularly paid out dividends to its shareholders. It had last hiked its dividend in January 2023 by 20% to 30 cents per share. Moreover, Princeton Bancorp has increased its dividend five times in the last five years. Based on BPRN’s closing price of $30.49 on Aug 11, 2023, the annualized dividend yield stands at 3.94%, which is quite attractive to income investors.

The company maintains a solid balance sheet with ample liquidity. As of Jun 30, 2023, its total assets aggregated $1.84 billion, benefiting from the Noah Bank acquisition in May 2023. Also, BPRN’s total loan and deposits were $1.5 billion and $1.6 billion, respectively, as of the same date.

Princeton Bancorp recently posted solid second-quarter 2023 results. It reported earnings per share of 72 cents, surpassing the Zacks Consensus Estimate of 30 cents. Moreover, analysts seem bullish regarding the company’s 2023 earnings, with estimates having been revised 15.1% upward over the past month.

Thus, given its robust liquidity position and earnings strength, BPRN is expected to continue with efficient capital deployment activities, thereby enhancing shareholders' value.

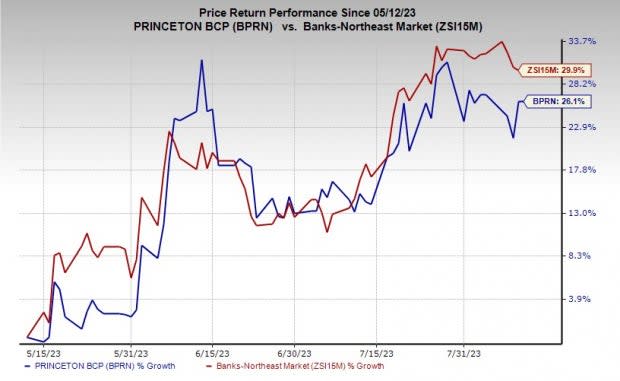

In the past three months, shares of BPRN have rallied 26.1% compared with the industry's rise of 29.9%.

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Taking Similar Steps

Over the past month, Fulton Financial Corporation FULT and Investar Holding Corporation ISTR announced an increase in their quarterly dividend payouts.

Fulton Financial Corporation declared a quarterly cash dividend of 16 cents per share, reflecting a rise of 6.7% from the prior payout. The dividend was paid out on Jul 14, to shareholders of record as of Jul 3.

Prior to the current hike, the company increased its dividend by 7.1% to 15 cents per share in March 2022. FULT raised its quarterly dividend eight times in the last five years. Also, it has a five-year annualized dividend growth of 5.1%. Currently, the company's payout ratio is 34% of earnings.

Investar Holding Corporation announced a quarterly cash dividend of 10 cents per share, reflecting an increase of 5% from the prior payout. The dividend was paid out on Jul 31, to shareholders of record as of Jul 3.

Prior to the present hike, ISTR increased its dividend by 5.6% to 9.5 cents per share in September 2022. It raised its quarterly dividend 13 times in the last five years. Also, it has a five-year annualized dividend growth of 21.1%. Currently, the company's payout ratio is 15% of earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fulton Financial Corporation (FULT) : Free Stock Analysis Report

Investar Holding Corporation (ISTR) : Free Stock Analysis Report

Princeton Bancorp, Inc. (BPRN) : Free Stock Analysis Report