Princeton Bancorp Inc (BPRN) Reports Mixed Results Amidst Economic Headwinds

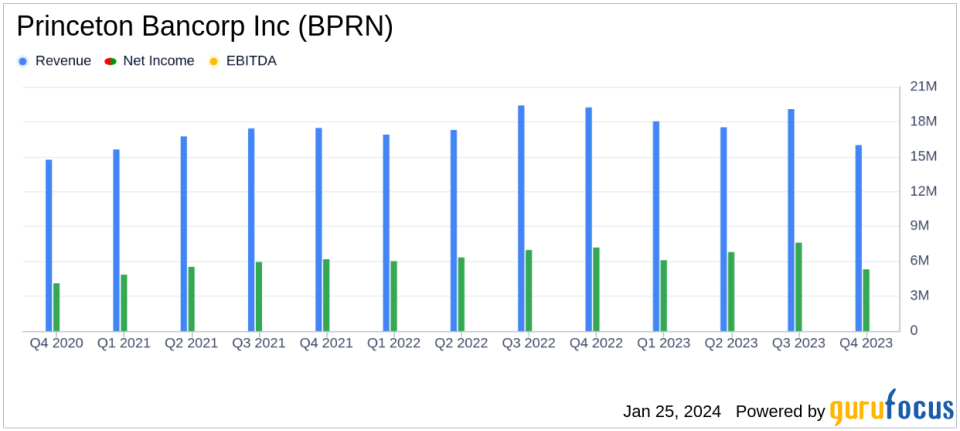

Net Income: Q4 net income fell to $5.3 million from $7.6 million in Q3 2023 and $7.2 million in Q4 2022.

Earnings Per Share: Diluted EPS for Q4 2023 was $0.82, down from $1.19 in Q3 2023 and $1.13 in Q4 2022.

Annual Performance: 2023 annual net income slightly decreased to $25.8 million, or $4.03 per diluted share, compared to $26.5 million, or $4.11 per diluted share in 2022.

Balance Sheet Growth: Total assets grew by 19.7% to $1.92 billion, largely due to the Noah Bank acquisition.

Asset Quality: Non-performing assets increased to $6.7 million, up from $0.3 million at the end of 2022.

Interest Income and Expense: Interest income increased, but was offset by a significant rise in interest expense due to federal funds rate hikes.

On January 25, 2024, Princeton Bancorp Inc (NASDAQ:BPRN) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The banking institution, known for its comprehensive suite of personal and business banking services, faced a challenging economic landscape marked by rising interest rates and industry pressures.

Financial Performance Overview

President and CEO Edward Dietzler expressed pride in the bank's resilience, noting increased loan and deposit balances, strong liquidity, and good credit quality despite the tough environment. The acquisition of Cornerstone Bank in 2024 is expected to enhance the bank's presence in central and south New Jersey.

Princeton Bancorp Inc reported a decrease in net income for Q4 2023, attributed to lower net interest income and non-interest income, alongside higher provisions for credit losses and non-interest expenses. However, the bank's annual net income for 2023 remained strong, albeit slightly lower than the previous year, primarily due to increased non-interest expenses and a decrease in net interest income, offset by a substantial increase in non-interest income and a decrease in income tax expense.

Balance Sheet and Asset Quality

The bank's total assets increased significantly, driven by the acquisition of Noah Bank, which contributed approximately $239.4 million in assets. The bank also saw an increase in net loans, cash and cash equivalents, bank-owned life insurance, and deferred tax assets. Total deposits rose by 21.4%, with a notable increase in certificates of deposit and money market deposits.

Asset quality experienced some deterioration, with non-performing assets totaling $6.7 million at the end of 2023, up from $0.3 million at the end of 2022. This increase was primarily due to a delinquent commercial real estate loan and non-performing loans acquired from Noah Bank.

Income Statement and Tax Considerations

Net interest income for Q4 2023 was $16.0 million, a decrease from both the previous quarter and the same quarter in the previous year. The bank's net interest margin also declined due to rising interest rates, which increased funding costs. Non-interest income for the fourth quarter decreased compared to the third quarter but increased significantly over the previous year's quarter. Non-interest expenses for Q4 2023 rose due to the Noah Bank acquisition and other operational costs.

The bank's effective tax rate for Q4 2023 was 15.9%, lower than the rates for the previous quarter and the same period in 2022. The annual effective tax rate for 2023 also decreased, largely due to the non-taxable bargain purchase gain from the Noah Bank acquisition.

Looking Ahead

Princeton Bancorp Inc remains focused on expanding its footprint and building on its valuable franchise. With the upcoming acquisition of Cornerstone Bank, the bank is poised to strengthen its market position and continue navigating the challenging economic conditions.

For a detailed breakdown of Princeton Bancorp Inc's financials and to stay informed on the latest financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Princeton Bancorp Inc for further details.

This article first appeared on GuruFocus.